Dynacor is a Canadian based profitable gold company active since 1996 with its mining properties located in Peru. Currently the company is actively pursuing the exploration of the Manto Dorado vein structure where they discovered very high gold grades in 2013.

Below is our interview with Dale Nejmeldeen – Director, Investor Relations of Dynacor:

Q: Tell us something more about Dynacor Gold Mines and your history?

A: Dynacor is a Canadian based gold ore processing and exploration company. The Company’s activities consist of the production of gold and silver from the processing of purchased ore and the exploration of its mining properties located in Peru. Dynacor produced 68,000 ounces of gold last year from the ore processing division.

The Company has a share count of 38.4 million. It is tightly held by a sophisticated group of retail and institutional shareholders. Dynacor has been in construction/expansion mode over the last year and is close to the opening of a brand new and larger scale ore processing mill located in southern Peru. As a result, the Company is expecting a significant increase in gold production together with substantial earnings growth. Dynacor is one of the few gold companies generating consistent profits…with a streak of twenty consecutive quarters.

The profit picture is exciting to say the least. An Ore-Processing Financial Calculator enables users to input their own estimates to see future results:

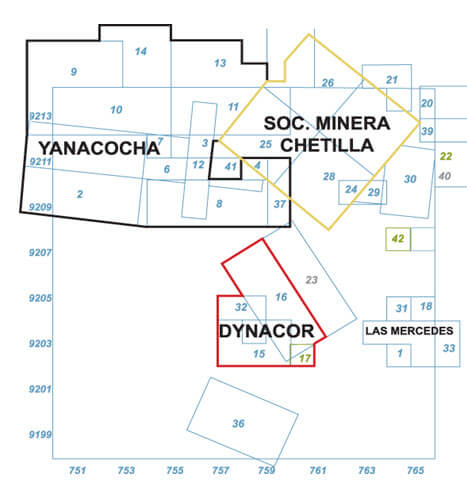

Currently the Company purchases its ore from ore producers from various regions of Peru and then processes it at its Metalex Huanca milling facility (the Metalex Plant) to produce gold and silver. The Company also owns rights on over three gold properties, which are in the exploration-stage, including its flagship exploration gold, copper and silver prospect, the Tumipampa property, and the Anta property, which is a silver/gold exploration prospect with approximately five concessions covering an area of over 3,800 hectares. The Tumipampa property will have its first NI 43-101 resource calculation this fall. The property covers an area of approximately 4,870 hectares.

Recommended: EPC Technologies Launches Oracle Cloud Services To Help Organizations Drive Innovation And Business Conversion

Recommended: EPC Technologies Launches Oracle Cloud Services To Help Organizations Drive Innovation And Business Conversion

Q: You’ve recently announced the issuance of 950,000 common shares; tell us something more?

A: On June 17, 2016, Dynacor issued from treasury 950,000 common shares of the Corporation following the exercise of 950,000 warrants at a price of $1.83 CAD per common share for total proceeds of $1,738,500. The warrants which included an acceleration clause had been issued in January 2016, as part of the transaction for a $10.0 M USD credit facility (see press release dated January 15, 2016).

Q: Dynacor received conformity certification from Peruvian Ministry of Mines and Energy for the Veta Dorada plant. When you expect to begin operating the plant?

A: Dynacor has applied for its water usage permit from the Ministry of Agricultural and Irrigation (MINAGRI). The MINAGRI is well aware of our new Veta Dorada plant as we have been building a relationship over the last month. Lastly, we need to receive the final operation permit from the Ministry Energy Mines and the same rules apply taking about another fifteen business days. Looking at the big picture, the brand new plant should be in full commercial production by late July or early August. We are planning to hold the official ribbon cutting ceremony in late September or early October.

Recommended: Sphinx Resources Announces The Generation Of A Project With Les Ressources Tectonic

Q: What have been some major milestones over the last 12 months?

A: A major accomplishment is that we have not missed a quarter reporting a profit. The Company has reported profits for twenty quarters in a row and counting.

Received its conformity certificate in June, 2016, from the Ministry of Energy and Mines for the Veta Dorada plant;

Completed construction of the new Veta Dorada ore processing plant in May, 2016;

Received its construction permit in March, 2015, from the Ministry of Energy and Mines for the Veta Dorada plant

Produced 67,604 gold ounces in 2015;

Sales of US $78.9-million in 2015;

Produced a record monthly production of 7,602 ounces in December, 2015.

In October, 2015, the Company entered into a strategic partnership with Precinox, a privately owned Swiss refinery;

Recommended: One Of The Fastest-Growing European Fintech Startups Creamfinance Launches In Scandinavia

Recommended: One Of The Fastest-Growing European Fintech Startups Creamfinance Launches In Scandinavia

Q: What milestones can investors expect in the future?

A: We feel as though in the last year Dynacor and its stock price is akin to taxiing up to the runway in preparation for takeoff. As I mentioned earlier, during the past year we have been in the development and construction phase. Historically this phase has been proven to be a time when a company’s stock price builds a floor in anticipation of the growth coming from the new development once in operation. It’s no different for Dynacor…the floor is building.

Q: What are the catalysts to takeoff?

A: · Open a brand new cost efficient mill

· Increase profit margin by at least 25%

· Drive earnings power by at least 2 times;

· Publish first NI 43-101 resource calculation;

· Establish new dividend policy.

Activate Social Media: