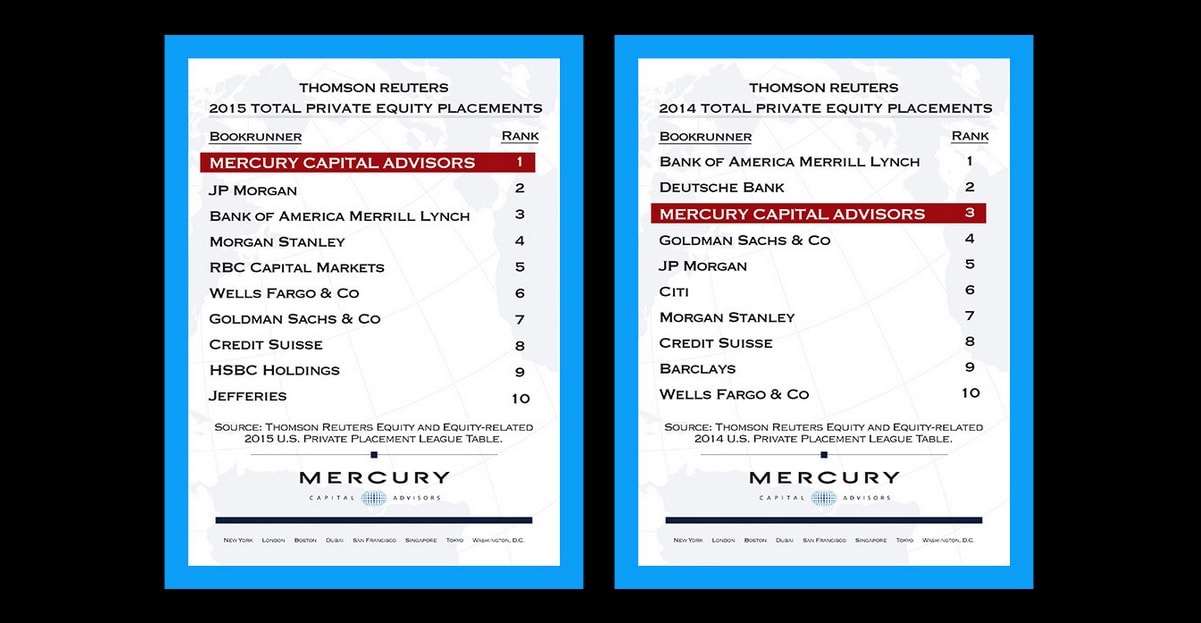

Mercury Capital Advisors, is one of the world’s elite institutional capital raising enterprises, specializing in alternative investments. They have recently launched a state of the art, end-to-end, digital platform for alternative offerings through its Mercury iFunds Platform – Mercury iFunds™. Mercury has executed well over 100 capital raising mandates mandates totaling close to $160bn. Mercury was ranked #1 placement agent by Private Equity International in the North America category for 2015 and has global reach which extends to Europe, the Middle East, and Asia. We sat down with George Lucaci, Partner and Senior Advisor at Mercury Capital Advisors, to learn more about the company and its plans:

Q: What is unique about Mercury iFunds and how does it stand out from competition?

A: Mercury is the only digital platform operated by a leading global capital raising firm having existing relationships with over 2500 of the largest and most sophisticated institutions in the world. Mercury’s state of the art technology evolved from its historical institutional success. No other digital platform for alternatives manifests that uniqueness or history.

Q: Can you give us more insights into your platform?

A: Other than providing the independent RIA community with institutional pricing,

approved clients of Mercury iFunds™ may invest with as many managers as they select from the sixteen vertical offering menu. In addition, investors will employ a single, simple subscription document for multiple funds, ultimately resulting in a single, aggregated K1 worksheet with integration through DTCC for seamless connectivity into the largest custodians in the world.

Recommended: IIBA Announces New Opportunities And Connecting With Organizations To Help Businesses Achieve Better Outcomes

Recommended: IIBA Announces New Opportunities And Connecting With Organizations To Help Businesses Achieve Better Outcomes

Q: What new technologies are disrupting the institutional capital industry right now?

A: Technology that powers more efficient marketing practices and that reduces heretofore overpriced distribution. Technology that accelerates the extinction of outdated information. In short, immediate and efficient delivery of information in all of the highly regulated sectors of the financial world – banking, insurance, wealth management, including, of course the market for alternatives.

Recommended: b8ta Raises $7 Million To Help People Discover The Latest Technology Products

Recommended: b8ta Raises $7 Million To Help People Discover The Latest Technology Products

Q: What are your plans for keeping Mercury Capital Advisors on the forefront of technology innovation?

A: It is critical that technology innovation be accompanied by what we call a ground game. That is, staying close to our investors, as well as our funds, and to continue to understand how they are evolving, thus providing both new technology and innovative, unique products, accompanied by analytics, to meet their changing demands and growth. Mercury is aggressively pursuing that ground game in the US and in the third quarter of 2017 we will be pursuing that ground game on a global scale.

Activate Social Media: