Luxoft Holding was founded in 2000. Today, the company is over 10,000 people big with 30 offices in 16 countries and it’s looking to get in access of $640MM in revenue for the year ending 3/2016. Below is our interview with Alina Plaia, VP of Global Communications at Luxoft:

Q: Alina, tell us something more about Luxoft Holding and your history?

A: Luxoft Holding was founded in the year 2000, IBM and Boeing (both are still happily with us among the top clients) being our first customers. The Company has been profitable and growing from day one, including the recessionary periods of 2008-2009 and 2012-2013. Our legacy, and the reasons for our continued growth have been completely different than those of the Indian providers.

While the underlying concept of labor arbitrage gave birth to Luxoft, the type of talent and the tasks that that talent have been hired to support are much more complex and focused on particular business domains. Historically, and to present times, focused on complex greenfield software development for six verticals, two of which became of utmost importance over the past several years – financial services and automotive.

The types of engagements on which Luxoft chooses to focus are mission critical in nature and non-discretionary – engagements that must support our clients’ goals to be on the competitive edge, regulatory compliant, etc.

Due to the nature of these engagements that we are after, the quality of staff has always been very high: 85% of the employees have advanced degrees and about the same percentage of the employees have at least 5 years of experience in the IT sector, in most cases with industry backgrounds. We pride ourselves not only on possessing deep domain expertise, but also on the impeccable quality of work that we deliver to our clients. These are the very reasons why we are not diluting our labor force with more junior personnel for the sake of lower cost of sold goods (COGS) / margin expansion.

Since 2013, Luxoft has grown primarily by referrals and word of mouth within each of the industry segments we focus on. Several years ago, we began building quite focused solution-based teams, which were, and continue to be managed by senior executives within given business domains. In present times, some business development is brought (anchored) by these sales teams, but still, the majority of new business is still via referral. I think it is also important to mention, Luxoft has very low (practically non-existent) client turnover; 97-98% of our annual sales come from the existing clients and only 2-3% comes from new business. Our P&L dynamic is as follows: revenue growth at least 20% per annum, GM above 40%, and adjusted EBITDA 17-19%. That has been the historical picture for nearly a decade, and that is how we guide the market today. We hope that we will cross $1Bn in sales by the end of our financial year 2018 (in three years, I.e. 3/31/2018).

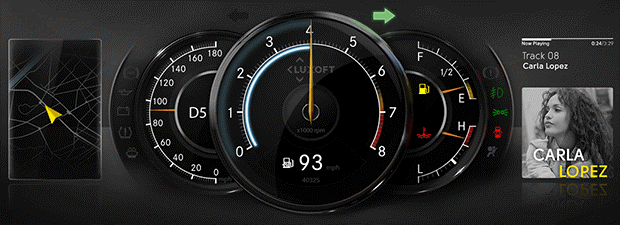

Throughout our 15 year history, Luxoft’s business model has evolved several times. We moved from the initial labor arbitrage premise in the first several years of Luxoft’s life, to become vertical specialists offering solutions for key domains of focus, such as financial services, automotive and telecommunications. Currently, we are very well positioned as a next generation provider of end-to-end IT services and solutions; that is the new era of Luxoft’s development trajectory. Today, Luxoft’s engineering expertise coupled with our products / platforms cover the entire spectrum of pain points that exist in our sectors of focus. For instance, regulatory reporting, governance and compliance for the financial sector; Human Machine Interface (HMI), autonomous driving for automotive, Software Defined Networking (SDN) / Network Function Virtualization (NFV) for telecommunications. We are also building centers of excellence around Internet of Things (IoT) / Big Data and User Experience / User Interface (UX/UI). Each CoE reinforces our current vertical offerings and help shape the future of the offerings. We prefer to manage engagements, some of which entail managing entire business domains of our clients, on the shared outcome / managed delivery basis and most of our contracts at this time are fixed price (60%).”

Luxoft often plays a leadership role with our clients given the seniority of the team and the trust earned from the client.

Today our company is over 10,000 people, 30 offices in 16 countries. We are looking to earn in excess of $640MM in revenue for the year ending 3/31/16. Our customer list consists of over 170 clients, over 30 of which are high potential accounts (next UBS, Boeing, Harman etc.)

Recommended: MarketInvoice Raises 10 Million To Change Invoice Finance

Recommended: MarketInvoice Raises 10 Million To Change Invoice Finance

Q: What is your core competence?

A: We view ourselves as specialists is several domains: financial services, automotive, and telecom. We are also focused on growing our horizontal practices to reinforce offerings in our key verticals of focus (such as IoT / Big Data, UI/UX, etc.). Our domain knowledge of regulatory topics, of financial products, intricacies of the automotive industry, etc., positions us well to be the go-to brand for certain complex engineering tasks. We prefer to be the main provider in the smaller, but growing markets rather than competing with providers of the similar or bigger size than us in the commodity marketplace.

Q: How does Luxoft Holding differ from its competition?

A: We focus on provisioning end-to-end services that include our consulting expertise, solutions, and actual IT execution by our quality engineers. We prefer managed delivery types of engagements where we take the responsibility to bear primary decision making with respect to day-to-day tasks, rather than engage into simple staff augmentation arrangements. We go after engagements of high complexity that are anchored within or directly supporting the front office (revenue generation units) of our customers, where the cost of failure is extremely high. That is why we have been able to grow our revenue per billable employee to $75,000 as of September 30, 2015, which represents historical growth of 6-8% per year for the past several years since we launched solution / end-to-end service provision approach.

Thus, we are different from our competition on:

– managed delivery engagement style

– depth of domain expertise

– quality of engineering work

– degree of agility

– Attrition levels (9-11% hist)

– The way we service our clients – dedicated global distributed delivery model (we are not servicing one client out of one or even two geographies – the bigger the client, the most distributed the delivery team is supporting that client)

Recommended: Tricentis – Automated Enterprise End-To-End Software Testing Solutions

Recommended: Tricentis – Automated Enterprise End-To-End Software Testing Solutions

Q: Who is your ideal customer and why?

A: We have been focusing on anchoring and developing relationships with what we call High Potential Accounts (HPAs). These are the clients that we believe will generate at least $5MM in annual recurring revenues by the time the account is 3 years old. We are working to cultivate the next Deutsche Bank, UBS, Boeing, Harman, etc. Our ideal client is the one whose success depends on the degree of technological advancement (i.e. substantial ongoing need for domain savvy IT talent) and who has ample IT budget to support its IT needs. We enjoy working with clients that provide recurring growth and steadily increasing level of work allotted to us each year. Ideally, we do not participate in RFI/RFP process with our existing clients in the areas in which we have previously worked for this client. We participate in the bidding process to advance into new departments or in case if our existing clients are going through a vendor consolidation process. As a rule we have multi-year MSAs (Master Services Agreement) with our clients and are labeled as their Change the Business (CTB) vendor.

Recommended: Creative House – Personalized Video Technology For Every Stage Of The Customer Journey

Q: What are your plans for the first half of 2016?

A: To continue pursuing our end-to-end provider strategy, focusing on a few domains where we have strategic advantages vs the competition and ensure impeccable execution on all engagements that we are currently working on. We also are focused on expanding organically our geographic presence, adding execution capabilities in Asia. Lastly, we are always running the radar over all emerging markets to scoop out talented seasoned candidates to staff our incoming engagements.

Activate Social Media: