All businesses and individuals need to comply with tax laws. When taxes are not filed properly, businesses and individuals may open themselves up to serious fines and penalties. In extreme situations, they may be subject to criminal prosecution. Properly filing your business taxes, including sales tax filing, will reduce the liability that you will be audited or found non-compliant.

The types of taxes that your business is required to file vary greatly. Variations may include state and local income taxes, excise taxes, payroll taxes, and sales taxes. All of these taxes must be accounted for in your business plan.

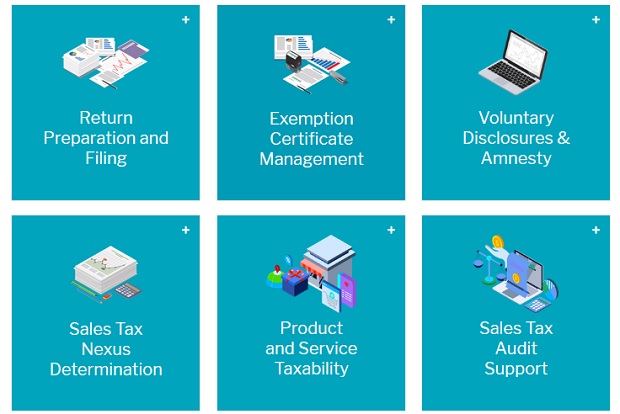

Here are six ways to properly file your taxes, pointing out some of the difficulties that may occur and offering solutions.

Collect Your Records

The first step in properly filing taxes is collecting all of your financial records. It is best to stay organized and to keep on top of this information, but if you have been neglecting this duty, make a serious effort to do so. Here are some of the records you will need:

• Last Year’s Tax Return for Your Business

• Your Taxpayer Identification Number

• Accounting Records

• Bank and Credit Card Statements

• Sales and Revenue Records

Calculate Deductions

You will want to take advantage of all legal deductions on your state and federal income taxes. These deductions can save your business a great deal of money. Working with an accountant or another qualified tax professional, you will be able to determine ways to save money on deductions. Having professional help will bring you greater deductions.

Some businesses that have not kept up with changes in tax law may be surprised by the new deductions that are available. The CARES act has made it possible to adjust the amount of income deducted on business interest. It has also allowed companies to adjust their tax treatment of net operating losses and active losses of pass-through entities.

Calculate Payroll and Employment Taxes

You will owe federal and state payroll and employment taxes. You will need to withhold these taxes from your employees’ wages. Employers and employees both have to pay into the FICA or Federal Insurance Contributions Act system. This provides funding for Social Security and Medicare at the federal level.

Businesses need to be careful to deduct the correct amount of taxes for their employees. Many times, employees will put in requests to have different amounts of tax withheld. If businesses do not withhold enough taxes, they could be subject to penalties.

File State and Local Income Taxes

While a few states such as New Hampshire and Texas do not have state income taxes, most states do levy these taxes. You will need to understand how your state income tax system works and find any additional deductions that you can use to lower your tax liability.

Businesses that operate in more than one state must pay income taxes to both. This follows the same rule as individual taxpayers. This nexus must be calculated by a business owner or a competent tax professional.

One of the issues that business owners need to be aware of is that state income taxes do not necessarily change at the same time as state income taxes. In 2008, the federal government enacted “bonus depreciation.” This allowed businesses to deduct more capital investment in the first year the investment was made. Many states did not alter their income tax provisions to match.

Track Unemployment Taxes

In nearly all states, unemployment taxes are not withheld from an employee’s paycheck. They must be paid by the employer. The Federal Employment Tax Act (FUTA) determines your responsibility for these taxes.

Determine Sales Tax Nexus

One of the most complicated aspects of sales tax filing is determining your economic nexus. If a business is selling products or services to residents of another state, they need to know whether they are subject to state sales taxes in that area. Sales tax nexus can be a pitfall for unwary businesses, and the rules in this area are frequently changing. Having a sales tax consultant is extremely helpful for making sure that you are paying taxes in the correct amount and to the right states.

Staying On Top of Tax Laws

Business owners need to make sure that they stay current with all tax laws. If they cannot devote enough time and attention to a full understanding of tax laws and procedures, they should hire a professional tax consultant or accountant to help them with their returns. Many unwary businesses have had to pay penalties or undergo legal action. TaxConnex reminds business owners that paying taxes is one of the most important duties a company can undertake to keep itself on track.

Activate Social Media: