Aingel provides AI-driven analytics tools for venture capitalists and startups. Using patent-pending technologies, they analyze and score both startups and VCs for optimal matchmaking.

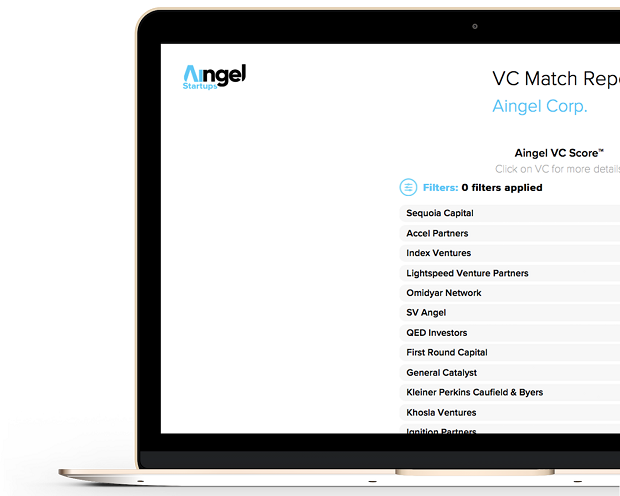

They scan the complete venture capital community and their portfolio companies to generate a contextual understanding of a startup’s ideal VC “matches.” Through an interactive dashboard and VC Matching Report, startups can review the list of VCs who are most likely to add value and be interested in their space.

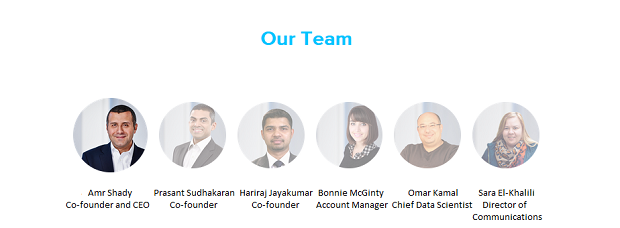

Below is our intervew with Amr Shady, co-founder and CEO of Aingel:

Q: Who are the primary users of Aingel and what are some of the key challenges you are helping them solve?

A: Our work adds value to both VCs and startups. With very few data points available at a startup’s inception, making an investment decision can become quite a challenging task. Many investors resort to making high-level decisions based on qualitative criteria such as startups’ pitches, presentations, ideas, etc. This is where Aingel comes in. Investors use our AI-based platform to gain data driven investment insights, which helps them filter through many companies efficiently and invest in the next game-changing startups while reducing investor bias by identifying companies they would have typically missed. Our custom bias analysis helps VCs spot any personal or professional preferences that are creeping into their selection process.

The number of angel and seed deals declined to approximately 53% since the second quarter of 2015, making the fundraising environment more difficult for early stage startups. Like investors, startup founders also waste time on fundraising so much so that they don’t spend enough time on product or sales development. Startups need data and structure in their fundraising process, and Aingel provides both. We help speed up the fundraising research process by generating a list of potential investors that are most likely to add value and be interested in the startup’s idea or space.

Recommended: Pienso Aims To Help All Non-Programmers Interact With The Machine Learning Algorithms Directly

Recommended: Pienso Aims To Help All Non-Programmers Interact With The Machine Learning Algorithms Directly

Q: Can you give us more insights into your Data-driven fundraising using AI and analytics?

A: Our AI platform analyzes several multi-dimensional attributes derived from founders’ digital footprint, including their career background, entrepreneurial experience, education, and personality to generate the Inception Score™. We scan the complete VC community and their portfolio companies to generate ideal matches that are most likely to add value and be interested in a startup’s stage and space.

Q: Could you explain the most prominent advantages of your Inception Score?

A: With extensive research conducted at NYU, we have developed a patent-pending machine learning algorithm that predicts the success of founders and their ability to execute. The output of our algorithm is the Inception Score™. Think of it as the credit score of startups; the likelihood that this team will be able to execute on their idea and navigate through market and business model changes early in the life of the startup. The Inception Score helps VCs make data-driven decisions in potential unicorns that maximize investment returns.

Recommended: Midex Builds Infrastructure To Help Us Operate With Cryptocurrency As Usual With Fiat Money

Recommended: Midex Builds Infrastructure To Help Us Operate With Cryptocurrency As Usual With Fiat Money

Q: What are your plans for 2018?

A: We plan to extend our services, in 2018, by providing alerts on new prospective VCs, identifying the ideal partners who founders should connect with, and facilitating introductions with investors to further help startups fundraise faster.

Activate Social Media: