AlphaFlow is an online real estate investment management platform. San Francisco-based AlphaFlow simplifies real estate debt investing through automated services such as re-balancing, institutional-quality data analytics and professional management. Below is our interview with AdaPia d’Errico, Chief Operating Officer at AlphaFlow:

Q: What’s the best thing about AlphaFlow that people might not know about?

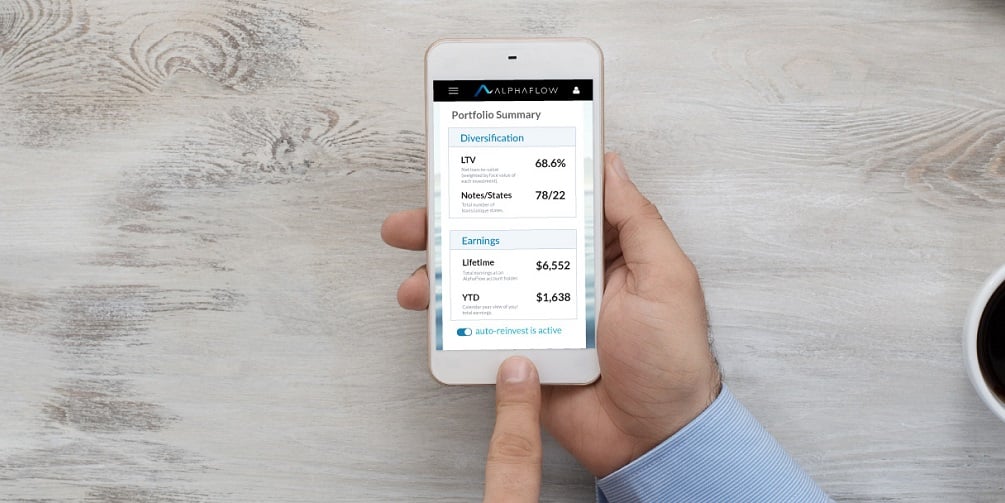

A: What people may not know about AlphaFlow is that we are combining elements of robo-investing with very active, professional investment management, and applying the best of both to real estate investing. You could say we’re the first real-estate robo-investing service, with an expert human foundation. When it comes to investing successfully in real estate, experience and expertise are incredibly important in selecting investments from the right partners, understanding markets and economic and housing cycles. To the investor placing money under our management, they can expect a simple and straightforward process, which produces passive earnings, and no active management on their part. Meanwhile, we are actively managing and building portfolios for our investors using institutional level analytics and automations like rebalancing, which produce our AlphaFlow Optimized Portfolios.

Recommended: Simplaex Is Leading The Next Mobile Wave In Transforming Data Into Insights And Insights Into Action

Recommended: Simplaex Is Leading The Next Mobile Wave In Transforming Data Into Insights And Insights Into Action

Q: How would you describe AlphaFlow in your words?

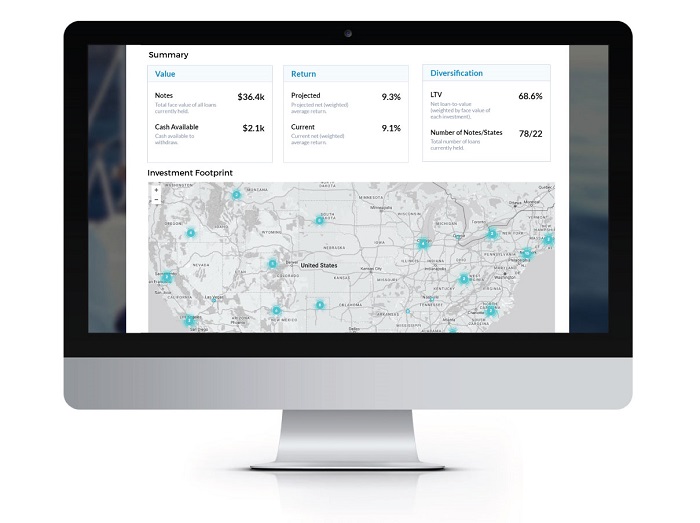

A: AlphaFlow brings to online real estate investing what ETFs brought to stock trading. With a low minimum of $10,000, an investor’s money gets diversified across 75-100 short-term real estate loans in at least 15 states. That level of diversification for such a low minimum, in this asset class, is unprecedented and therein lies the opportunity to attract more investors.

As we discussed, AlphaFlow’s core product — AlphaFlow Optimized Portfolios, broadly diversify across 75-100 loans, with no burden of analysis or loan selection to the investor, and with a low minimum investment amount. I’m excited about the potential for the portfolios to become the investor’s go-to when it comes to the short-term real estate loan asset class. The reason for this, which I believe is worth explaining, is that until real estate crowdfunding hit the scene in 2013-2014, an investor could not even begin to invest in the asset class for less than six figures. Then, real estate crowdfunding made it possible to do it, loan-by-loan for $5,000, or even as low as $1,000 per loan. We do all the analysis, vetting, portfolio building and management for the investor, and provide them with an up to 8-10% return with a maximum loan-to-value of 75%.

Q: You’ve recently joined AlphaFlow as Chief Operating Officer; could you tell us something more about your plans to scale the investor platform and expand AlphaFlow’s channels?

A: You can probably tell how excited I am about AlphaFlow! I’ve been in the online investment industry, via crowdfunding and online lending, since late 2013. I was the CMO of one of the early and leading platforms and the CEO of AlphaFlow, Ray Sturm, co-founded another leading real estate crowdfunding platform. For years, we have both worked to bring awareness of real estate crowdfunding to the mainstream, and to provide access to investors who previously did not have a simple, transparent way to invest in real estate. I get to leverage my experience and apply my passion for fintech and real estate through AlphaFlow. The Optimized Portfolios are designed for the investor who wants the benefits of investing in the kinds of loans that the real estate platforms are offering, and have their funds professionally managed for them. In fact, we work with many of the leading platforms as an institutional buyer of their loans. We’ll be building upon our base of individual clients, as well as expanding our endowment, pension fund, and family office clientele.

Recommended: Gilmour Space Technologies Raises $3.75M Series A Round To Provide Low Cost Access To Space

Recommended: Gilmour Space Technologies Raises $3.75M Series A Round To Provide Low Cost Access To Space

Q: More generally, how do you see the online real estate investing landscape developing, and where do you place yourself in the industry?

A: It may be cliche, and I’ve said this many times over the years, but I still believe we are in the early stages of this industry’s growth. I see the word ‘online’ soon removed from the phraseology of real estate investing, the same way that it has long since been removed from similar phrasing around purchasing other securities like stocks, bonds, ETFs, etc. One day, soon, it will simply be called real estate investing.

Within the industry, we are proud to be a key player in the ecosystem of fintech and online lending. We partner with many of the leading platforms and contribute to the growth of the category. We are creating another way for investors to access what platforms are producing, and structuring the investment product in a way that simply makes a lot of sense to the investor and his or her needs. As a registered investment adviser, we are bound by regulations and very stringent codes of conduct toward the investor. Despite the restrictions on things like marketing and advertising, our fiduciary duty means we are more closely aligned with our investors’ goals and needs. We can provide a level of service, and of advice, that gives us an opportunity to have holistic conversations about asset allocation and financial needs, and how the Optimized Portfolios could be a part of someone’s financial plan.

Q: What is the motto that guides your decisions?

A: Our company is driven by a desire to be of service, and to provide the utmost in client experience. Ours is a culture of credit over volume, of quality over quantity, and of service over vanity metrics. We believe in serving our clients, building relationships, continuously learning, thoughtfully evolving and making a meaningful contribution to the fintech industry.

Activate Social Media: