Below is our recent interview with Bolun Li from Zogo:

Q: For those who haven’t heard of it, what is the best way to describe Zogo?

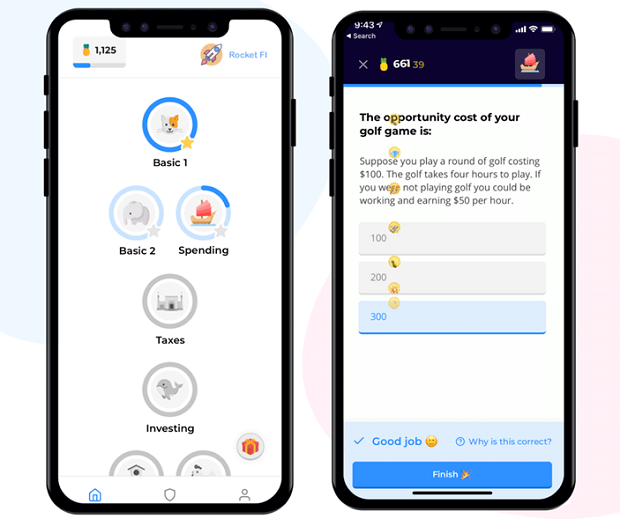

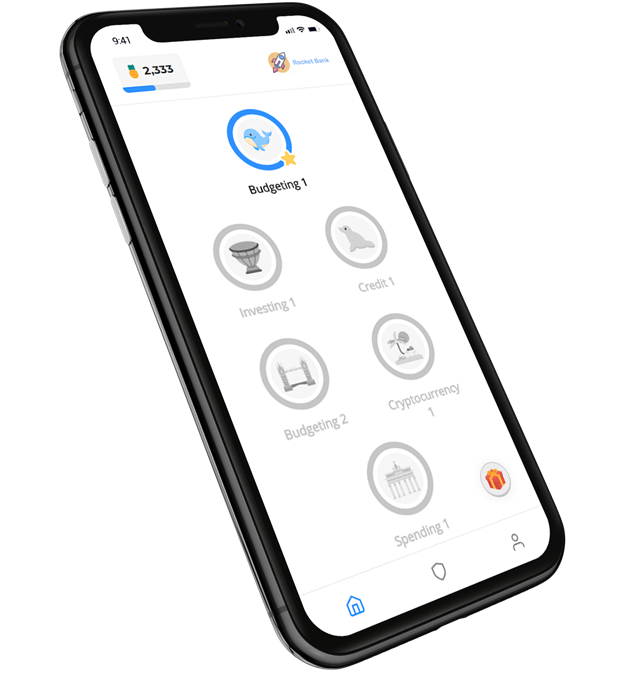

A: Zogo is a financial literacy app that is co-branded with its partner financial institution and comes complete with some 300 bite-sized learning modules on a variety of different topics, starting with budgeting but growing more complex as teenagers advance through the app.

Users start each module by learning five concepts before taking a five-question quiz. Completing each module earns users points. Accumulate enough points and users win a $5 gift card to the store of their choice.

Q: Can you tell us something more about your history? How did you start?

A: We started Zogo when we were 18 years old to try to solve our own personal finance problems. Growing up, no one taught us anything about financial literacy. Our parents didn’t really talk to us about 401k accounts or credit scores at home. Our team all took some form of financial literacy classes in high school, but the classes felt too much like a lecture and were too boring to be effective.

When we learned that a lot of big corporations, especially banks and credit unions, spent millions of marketing dollars sponsoring financial literacy classes, we were shocked! These corporations were trying to put their brands in front of GenZ, but these classes weren’t teaching financial literacy or spreading their brand.

So we got to work trying to teach our generation financial literacy. We started developing Zogo to make financial literacy learning fun and also help our corporate partners better reach GenZ

Q: You have won numerous industry accolades, Why are financial institutions jumping on this?

A: Financial institutions want to make a real impact on their community and at the same time attract and engage the GenZ. There’s no solution right now that helps them do both at the same time.

Q: How financial institutions use Zogo?

A: A lot of financial institutions sponsor classes in local. schools. Zogo can be a great leave-behind after these classes so their brand persists on the teenagers’ phone even after the short hours-long classes.

Some financial institutions also use Zogo to complement their teen checking account offerings. It’s a great added benefit that can be attractive for parents.

In terms of the technology itself, there’s only one Zogo app on the app store. Each Zogo partner will receive an institution-specific access code to the app that they can distribute to their customers. By entering the code during onboarding, the Zogo app becomes co-branded with the partner’s logo.

Q: What type of customer would benefit the most from your service?

A: We work with financial institutions of all sizes, from $100M AUM all the way up to $500B. Our partners all have a strong vision & strategy for engaging the next generation, and we’re a tool that complement their strategy.

Recommended: An Interview With Tjeerd Bosklopper, CEO At Netherlands A.I. NN Group

Recommended: An Interview With Tjeerd Bosklopper, CEO At Netherlands A.I. NN Group

Q: What are the company’s plans and goals for the future?

A: In terms of the product, the next step for us is to integrate with bank accounts and provide experiential learning through real transactions. In terms of the business, we want to reach 150 financial institution partners by the end of next year.

Activate Social Media:

Recommended:

Recommended: