Below is our recent interview with Darren Shaffer, CTO & Vice President at Cherry Creek Mortgage:

Q: How has technology at Cherry Creek Mortgage evolved over the past few years?

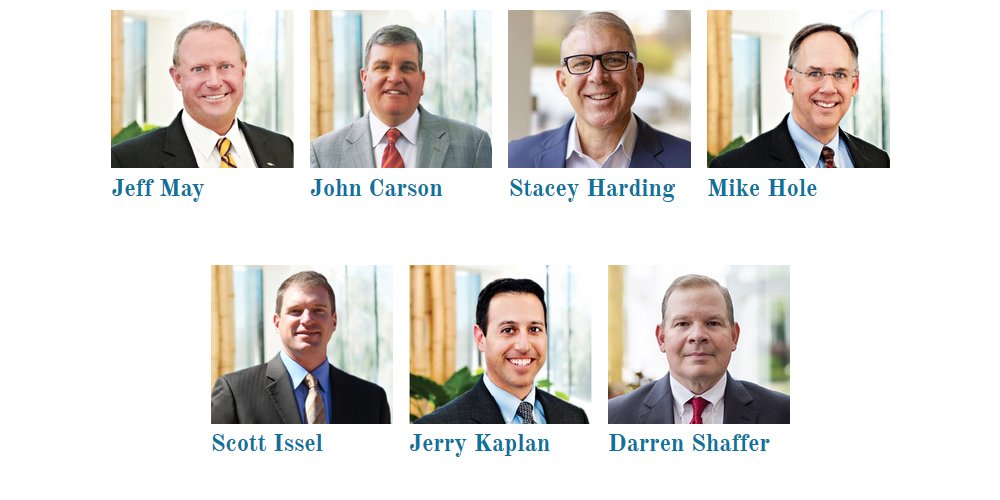

A: Our CEO Jeff May had the vision of controlling this company’s technology destiny over a decade ago. Instead of being in the same boat as other lenders using a handful of loan origination systems, he decided to do something that was viewed as cavalier and highly risky – Jeff brought in a team of senior technology professionals from outside the mortgage industry to rebuild Cherry Creek’s technology from the ground up. My Advanced Technology Team was formed in 2015, and since then we have built an enterprise suite of new applications called Cherry Creek Connect. This suite of digital solutions includes a full multi-channel loan origination system, point of sale, native mobile applications, 34 integrations supporting the digital mortgage process, and user experiences crafted for each stakeholder in the transaction.

We’ve run over 36,000 loans through the new Connect technology and our costs per loan are on par with or beat our peers who depend on third-party systems.

Most importantly, our time to implement change is measured in hours or days – we ship over

220 enhancements/new features to our loan officers each month thanks to our team of 16 senior technology professionals.

Recommended: LE-AP: An AI-driven Learning Experience Platform Set To Enhance Corporate Training

Recommended: LE-AP: An AI-driven Learning Experience Platform Set To Enhance Corporate Training

Q: What inspired the Connections app?

A: Relationships with real estate agents and builder partners are critical to today’s lending industry. As I was learning this industry, it occurred to me that there are 17 possible stakeholders involved in the loan origination and fulfillment process, and only a handful have any real-time visibility into the loan transaction. Collaboration between all these stakeholders happens mostly via email and phone calls. Jeff and I wanted to equip our valued real estate agents and builder partners with tools that give them transparent access into the status of their loans, while also enabling instant digital collaboration (without emails and phone calls) on things like key dates, milestones, appraisals, approvals, and other workflow tasks. Our internal Advanced Technology Team went from vision to field testing on the Connections app in about six months.

Q: What are the main benefits of Connections?

A: Connections equips our partners with a native mobile app that puts them inside the loan as a key teammate in the loan process, which builds confidence and loyalty. Empowering our partners with this technology also helps speed the transaction and get across the finish line to a closed loan!

Q: How will this app make transactions easier for real estate agents and builders?

A: Connections provides real-time pipeline and loan status information, instant communication via push notifications, SMS, email, and voice within the application, the ability to request and re-issue loan pre-approvals, loan and affordability calculators, and access to live pricing available from our loan officers. And we are just getting started! We continually listen to our referral partners for feedback on how to improve the user experience and eliminate friction during the loan process. We ship updates to our mobile apps on a quarterly basis and there is no end to the project – it is ongoing and adaptive.

Q: Where do you see Cherry Creek Mortgage’s technology going in the future?

A: My team has three customers – borrowers, our loan officers, and the other stakeholders in the loan. My primary motivation in serving these customers is surpassing their expectation of what the loan process should be. The mortgage industry has been around for many decades, but has mostly been resistant to innovation and rapid change. We are also currently cutting our teeth in the consumer-direct industry with our Blue Spot Home Loans channel, and there is a ripe field of opportunity for technology innovation in that space.

Mortgage lending is a complex business. Unlike other companies I’ve worked for, the focus here is on user experience and speed of transaction over process simplification. The complexity and rate of change in this industry is a given, and removing those from the experience of borrowers, loan officers, and referral partners is our goal right now.

Recommended: ZenythGroup Offers A Deep Expertise In ADA Website Accessibility And WCAG Compliance For Web And Mobile Applications

Recommended: ZenythGroup Offers A Deep Expertise In ADA Website Accessibility And WCAG Compliance For Web And Mobile Applications

Q: How has technology changed the mortgage industry?

A: I’m about 30 years into a technology leadership career that started as a U.S. Army Signal Officer with stops at Wal-Mart Information Systems, JD Edwards, Microsoft, etc. and I’ve architected over 115 enterprise software projects to date. While I’ve been in residential mortgage lending for a relatively short period of time – about six years now – I would tell you that this industry is in its adolescence when it comes to technology adoption and innovation.

What must come next is new people with new thinking and higher expectation levels across the board. Challenge every traditional constraint and focus intently on delighting your borrowers, your loan officers, and your referral partners! My experience over three decades has been that business doesn’t somehow improve by introducing better technology – rather – better people and better business processes demand continuous innovation made possible by applying new technology!

Activate Social Media: