Below is our recent interview with Jason Lee, Co-Founder and CEO of DailyPay:

Q: Could you provide our readers with a brief introduction to DailyPay?

A: In 2015, I realized there was a big problem for anyone who received a paycheck. Payroll technology was controlling how families live and pay their bills, instead of the workers determining how and when they access the money they worked so hard to make. There had to be a better way. Despite living in an era of incredible technological advances, I realized there was still this profound need for working Americans to have access to their earned pay that would give them financial flexibility and empowerment over their money. So I took an in-depth look at how people were paid in this country. I saw an opportunity for change — and DailyPay was born. My first thought was to build completely from the ground up, to truly start from scratch.

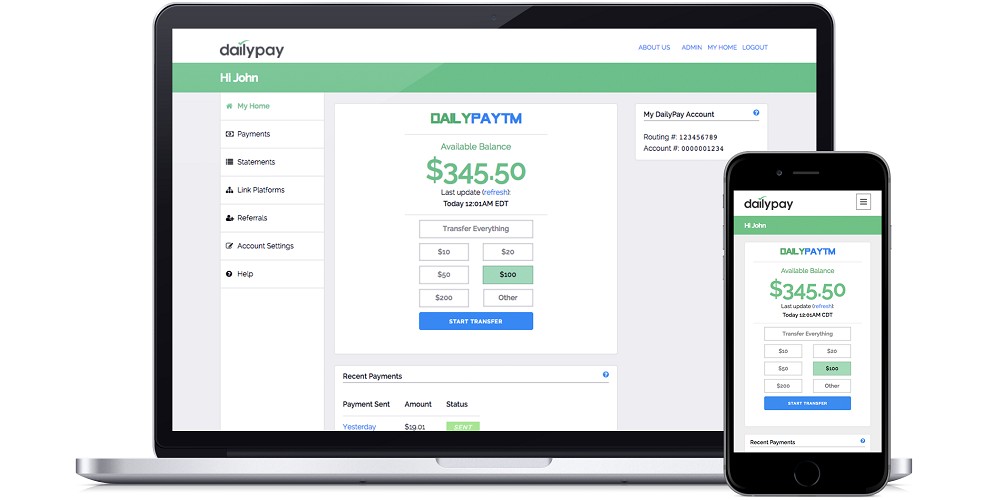

By creating DailyPay, that’s exactly what we did. In 2016, we designed an unrivaled ecosystem (we call PayExTM) featuring a unique “pay experience” that benefits the employee and the employer. DailyPay offers employees choice and control over when and how they receive their earned pay. Unlike other providers, we support every aspect of the employee’s pay experience from payroll processing to pay access and even call center support. Our ecosystem unlocks the abilities for employers and employees to enjoy control and choice over their earned income.

In just a few years DailyPay was recognized as the gold standard in the industry with over 80% of Fortune 100 companies that offer an on-demand pay benefit using DailyPay as their provider.

Recommended: An Interview With Michael Majeed, Toronto Research And Development Consultant

Recommended: An Interview With Michael Majeed, Toronto Research And Development Consultant

Q: What are the key benefits of using PayEx?

A: The benefits of The PayEx platform can literally be life changing. Our products provide employees with a benefit so powerful it can break the vicious cycle of debt that plagues so many Americans, saving them on average $1205 per year because they no longer rely on late fees, overdraft fees and loans.

PayEx currently features four innovative products designed to provide frictionless, digital and rewarding experiences at every stage of the employee lifecycle (recruitment through offboarding):

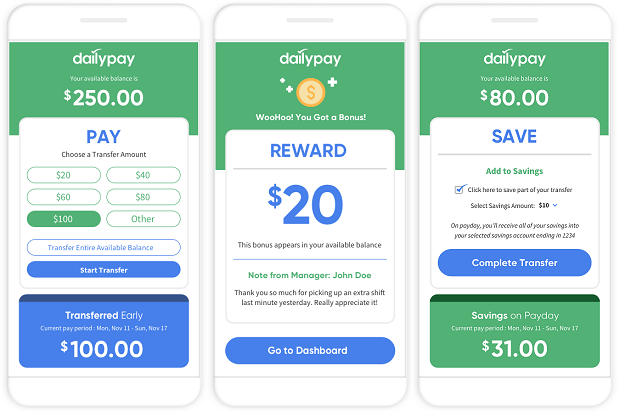

• PAY: Employees can control how and when they get paid with instant access to earned income, transparent fees and 24/7/365 access to 100% of their earned income

• SAVE: Employees can save their pay in three different ways — scheduled automatically, based on pay period earnings and/or at the time of an instant pay transfer

• REWARD: Employers can reward their employees in an on-the-spot, compliant way (i.e., for taking on an extra shift when a coworker calls out)

• CYCLE: Employers can easily and immediately process off-cycle payments (ex. missed shifts/termination pay)

The secret behind our success with PayEx is the finely thought out methodology in terms of both our product and the entire customer journey, from start to finish. We are a full service on-demand pay provider – a major differentiator with other providers. We take pride in delivering the “gold standard” of service to our partners and is the reason we are the top choice for Fortune 500 companies.

Q: Who is your ideal user and why?

A: Every working American benefits from using DailyPay. Who doesn’t want their money to work harder for them?

That said, the type of user whom DailyPay is most popular with is what we call a “MAGGIE.”

MAGGIEs are Millennial And Gen Z who Get Instant Everything and who expect to have instant, easy access to their pay. These generations have grown up with “instant everything,” from one-day package deliveries to immediate money transfers. Millennials and Gen Z want control over their money and financial independence, so having access to their earned pay is important to them. With DailyPay’s PayEx Platform, they can obtain the financial independence that they desire.

Q: What can we expect from DailyPay in the next 4 months?

A: Major innovation, growth and continued support of the American worker.

COVID-19 catapulted on-demand pay from important to essential. Americans finally saw the need for flexible pay as hourly and essential workers struggled during the long-term, unprecedented emergency in our country.

Public demand has reached an inflection point with a just released Harris poll finding 45% of Americans would use on-demand pay to have more control over their finances this holiday season. And the marketplace is responding as two more of the world’s largest retailers are launching DailyPay this fall as more and more forward-thinking companies continue to realize the need to offer the zero-cost benefit that their employees love.

Employees with a DailyPay benefit will have the flexibility to shop and save when they choose this holiday season, not having to wait for traditional payday.

Q: What’s the best thing about DailyPay that people might not know about?

A: DailyPay could be the most powerful, efficient and cost-friendly solution in your techstack. The ecosystem we have created is unrivaled in the industry featuring a dynamic, safe product that is easy to use and supported by the highest-rated customer service team in the business. We have saved our hundreds of partners, many of them blue-chip Fortune 500 companies, millions of dollars each year while not costing them a penny. The research shows a DailyPay benefit boosts productivity and morale, increasing employee engagement by an average of 64%, while reducing turnover by at least 41% and employee financial stress by 70%. By offering employees DailyPay, you give them the power of choice and control over their finances. Employees become more motivated to go to work, translating into lower absenteeism and higher productivity. In fact, 56% of DailyPay users surveyed were more motivated to pick up additional shifts because of an on-demand pay benefit. A motivated employee who feels valued will work harder, helping to drive revenue in a time businesses need it most.

Recommended: An Interview With Michael Majeed, Toronto Research And Development Consultant

Recommended: An Interview With Michael Majeed, Toronto Research And Development Consultant

Q: What differentiates a full-service provider such as DailyPay and a self-service provider?

A: DailyPay takes pride in being the award-winning, recognized gold standard full-service provider for the hundreds of companies we partner with and millions of users nationwide.

Full-service includes everything from hands-on integration into any payroll system to funding payments to 24-hour customer service. Other platforms tend to follow a self-service model for their on-demand pay benefits, meaning that they rely upon the existing payroll infrastructure to make the benefit possible. This can be more taxing on payroll teams in terms of time punch approvals, funding reconciliation, and manual processing, as opposed to the full service model which outsources the main functions of funding, risk management and reconciliation to the third party vendor.

Q: How challenging is customer support with over 2 million users?

A: Someone once said, “If it’s not hard, it’s not worth doing.”We are committed to providing premium white glove support to every one of our clients and their entire employee base. This means we need to have a product that is intuitive and easy to use in order to reduce the need to ask questions. We also need to have a support infrastructure and communications platform that drives delight and not confusion.

For employees who do have questions, we have built a multi-level support infrastructure that is second to none and saves our clients hundreds of thousands of dollars a year. This is a major pillar of our full service commitment to our partners. Because for us, the experience with our platform must be perfect every time.

Activate Social Media: