Below is our recent interview with Jeremy Wood, CEO and Founder of Legerity:

Q: Could you provide our readers with a brief introduction to both your background and Legerity?

A: Legerity is a UK headquartered software solutions provider.

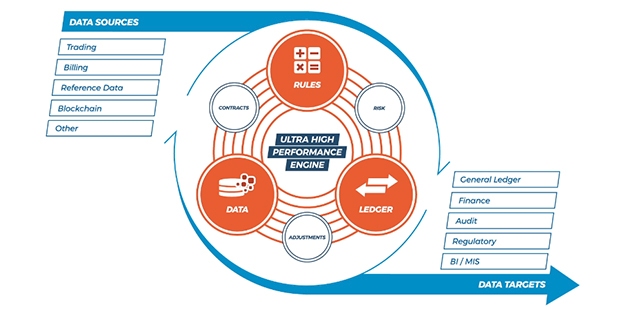

25 years ago, I oversaw the design of a systems based approach to event driven accounting. The concept led to the development of our first best of breed Accounting Rules Engine in 1998, delivering transparency, a strong audit trail and accuracy of financial impact.

Wind the clock forward 20 years, and Accounting Change is at an all-time high, with firms facing a significant challenge in meeting the new IFRS standards.

Legerity’s 3rd generation accounting rules platform, Legerity FastPost, enables Finance and Risk functions to address the regulatory and business challenges resulting from historic under-investment in Back Office systems.

We are currently working closely with the Insurance industry, helping firms comply with the new IFRS 17 standard by January 2022.

Q: Could you explain how IFRS 17 is transforming the insurance industry?

A: IFRS 17 implements a common set of new accounting standards for insurance contracts. The impact will be different for Life, General, Specialist and Reinsurance firms. The new accounting standard demands close collaboration between Actuarial and Finance functions, and will also extend beyond these departments, impacting back-office data, systems and processes.

Further factors including geographical location, legacy systems and technology refresh cycles, and business strategy, will also influence the level of change.

Meeting the new IFRS 17 standard will be a significant challenge for many firms. With deadline’s growing tighter every day, Insurers will likely have decided whether to use a tactical approach to compliance or strive for digital transformation in their Back Office.

Simply adhering to each individual regulation as it comes layers complexity and creates unnecessary expense. At the other end of the spectrum, aiming for full digital transformation can be an unrealistic, and sometimes an unachievable goal.

Legerity’s FastPost platform enables firms to go beyond base level compliance, whilst avoiding the risk and expense of complete transformation. This middle ground offers a practical, robust approach to IFRS 17 compliance.

Insurers have the chance to invest in and update their Back Office technology to deliver both business and operational benefits. Insurers who take advantage of this opportunity will gain the competitive advantage, having transformed their legacy systems and technology estates to deliver real business benefits, sustainable growth, and the agility to compete.

Recommended: Commence CRM Making Waves In The Small To Mid-Size Business Sector

Q: What emerging technologies could Insurers utilise in their digital transformation programmes?

A: Enterprise Cloud has developed significantly in recent years – growing into a secure, resilient and highly-scalable alternative to expensive and ‘clunky’ legacy approaches.

A Cloud based IFRS 17 solution replaces costly hardware, infrastructure and data centres. The Cloud provides frictionless software updates, helping to future-proof your business and increase efficiency.

Based on cutting edge application design with massive scalability and on demand processing Legerity FastPost helps support innovation across the Insurance industry. Innovation will see increasing numbers of complex products with sophisticated, granular risk models being delivered via multiple sales channels, it will include a new wave of mass market instant issue offerings and new technology adoption – Internet of Things (IoT), Blockchain and Crypto Currencies.

Q: You recently opened a new office in Hong Kong. Why has the IFRS 17 global standard brought you to Hong Kong?

A: IFRS 17 affects 40 jurisdictions worldwide, with over 450 listed insurers needing to meet the standards by January 2022. A lot of those firms are based in Asia, whether local firms, regional insurers or part of larger global firms, making Asia a high growth area in the insurance sector. We’ve been working with a number of clients in Hong Kong over the last 12 months.

We are pleased to announce that we have recently opened a Legerity office in Hong Kong, with our newly appointed Head of Asia-Pacific business, Peter Haslebacher. As a significantly experienced industry executive, Peter established and introduced a leading actuarial system into the region. He brings an extensive network of client partnerships making Legerity well placed to serve the APAC region.

Q: How has the adoption for IFRS 17 gained traction in the APAC region?

A: This market is typified by a number of large global insurers – European and US firms, alongside the many local regional firms. Global firms tend to start earlier with their programmes than smaller regional firms but the implementation of IFRS 17 is still at an early stage.

Currently, no firm is 100% live with the standard, most are targeting the move into transition in early 2021.

On the whole there is no significantly different traction in this region than what we see in the European market. The DACH region aside which is probably the most advanced on IFRS 17.

A few of the larger firms that were the earliest movers are starting to struggle with their programs due to internal build or vendor issues and are now starting to revisit their IFRS 17 compliance architecture. Those firms starting implementations now are well placed to capitalise on the knowledge and experience that has been built in the market.

As we enter the second half of 2019, the market is seeing a major increase in implementation activity, placing a huge demand on internal and external resources.

Q: Could you share with us some of your clients and what challenges you’re helping them solve?

A: We are delighted to have entered into an agreement to be a key solution provider to Aegon UK’s future IFRS 17 financial reporting. Aegon is a forward-looking firm committed to market innovation and a digital future. It is great testament to our technology, team and achievements to have been selected by Aegon.

We are also working with a number of leading insurance firms covering Life, General and Reinsurance.

Recommended: Epson WorkForce Pro WF-C869R Competitive Comparison

Recommended: Epson WorkForce Pro WF-C869R Competitive Comparison

Q: How else has Legerity been supporting the insurance industry as a whole?

A: We run a regular series of well-attended webinars, that each take a deeper look into the various challenges of the IFRS 17 change programme. We invite viewers to answers polls, and ask questions that Legerity are uniquely placed to answer, given our expertise in this area.

Our next webinar is on September 10th 2019 and will tackle the challenges of delivering IFRS17 under the PAA. We will discuss some of the potential pitfalls and how to avoid them and examine the key design considerations for delivering a best-practice IFRS17 cloud-based solution.

Q: Are there any thoughts you would like to leave with our readers?

A: Although IFRS 17 was originally focused on ensuring compliance, it is much more than this. It is now a ‘once in a generation’ opportunity to modernise and digitise – to develop sophisticated, efficient systems and data processing that will be sustainable.

Modern cloud-based solutions offer massive scalability and combined with open source infrastructure can reduce the Total Cost of Ownership (TCO) significantly. IFRS 17 systems will be with us for the next 20+ years so having a strong road map and taking a future proofed approach is essential.

Activate Social Media: