* – This article has been archived and is no longer updated by our editorial team –

Apruve is a B2B credit network built to improve the process in which companies buy from each other. Below is our recent interview with Matthew Osborn, Senior Marketing Manager at Apruve:

Q: Could you provide our readers with a brief introduction to Apruve?

A: If you look at any B2B company’s balance sheet, you will most likely find a large portion of their assets in Accounts Receivable. These assets are sales revenues that have yet to be collected from their customers. In order to generate more sales, companies allow their buyers to pay for their purchases at a later time (typically net 30, 60, etc). This process of buying is favorable for the buyer, but it exposes the supplier to cash flow issues, paper and mailing expenses, large employee overhead to manage credit checks and collections, and default payments.

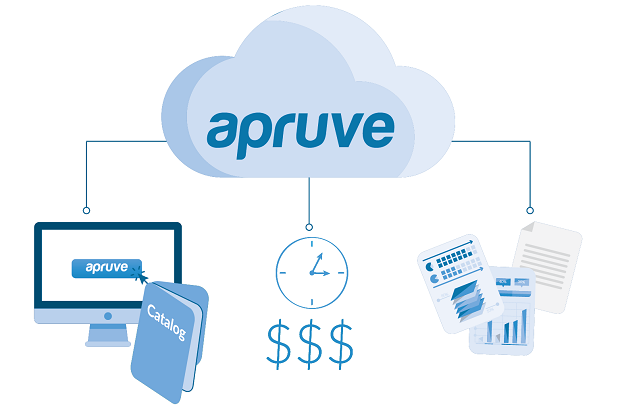

Apruve streamlines the credit process by automating credit approvals, invoicing, and collections, while paying the supplier within 24 hours with no financial risk–allowing businesses to increase working capital while minimizing expenses and unnecessary overhead.

Recommended: Zoobdoo, An All-In-One Online Property Management System For Property Managers, Landlords & Tenants

Recommended: Zoobdoo, An All-In-One Online Property Management System For Property Managers, Landlords & Tenants

Q: How exactly does it work?

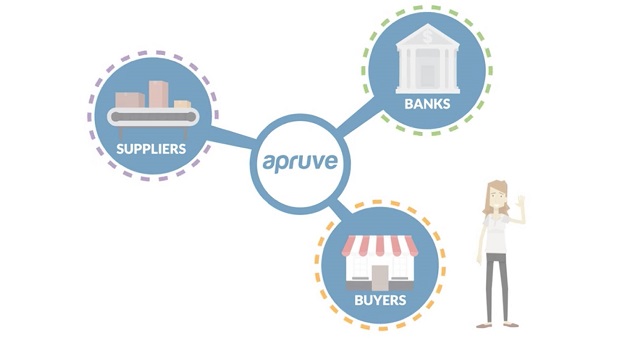

A: Apruve’s network connects suppliers, buyers, and financial institutions. Similarly to a credit card, Apruve underwrites the buyer and pays the supplier within 24 hours of invoicing.

After the purchase is made, Apruve will send a digital invoice to the buyer along with payment reminders under the supplier’s branding. When payment is due, customers can login to Apruve to make a payment, or if they wish, initiate the AutoPay feature to have the invoice amount automatically debited from their bank account.

Applying for a line of credit

Buyers can quickly get a line of credit with their preferred supplier through Apruve’s online credit application, which can be completed in 3-4 minutes. The buyer will receive an email notification after completion regarding their approval and the size of their line of credit.

Integration

Apruve integrates directly with a supplier’s ERP, eCommerce, or accounting software to eliminate the need for extra data entry. All invoices are automatically generated and funded when Apruve is selected as the payment method.

All approved buyers can purchase against their line of credit through eCommerce channels at check out or as an offline order made directly through their sales rep. For more information, click here.

Q: How will automation change the B2B credit decision process?

A: In the past, businesses have not had a lot of data available to them about a company’s history, buying behavior, or general financial health. This lack of data led to very labor intensive processes, looking through multiple databases to find more financial information and to protect themselves from fraudulent orders. Sadly, many of these databases get their data only from the select few companies that share their business data. These gaps in data along with the data being spread across multiple databases, leads to a lot of man hours without fully mitigating risk.

Today, we are seeing that more and more purchases between businesses are moving through digital channels. This allows for cloud based databases to instantaneously update their information on a business’s buying behaviour. Additionally, we are finding that business data is more accessible through multiple channels such as as Google, social media platforms, and online public records.

In the very near future, and we are seeing it already today, businesses are using cloud based software to automatically pull datasets from each database and automating the process of finding the creditworthiness of a customer. This automation will mitigate financial risk and lead to quicker credit approvals with far less associated expenses.

Recommended: Fluzcoin – Intelligent Retail Cryptocurrency That Ensures Fast Transaction Speeds With Zero Transaction Costs

Recommended: Fluzcoin – Intelligent Retail Cryptocurrency That Ensures Fast Transaction Speeds With Zero Transaction Costs

Q: How important is data visualization in eCommerce marketing Strategies?

A: In every department, not just in marketing, businesses are taking in an extraordinary amount of data. It has been proven that big data can offer a wide variety of insights for businesses to help them in their decision making processes. But if, you look at a giant spreadsheet with thousands of rows and hundreds of columns, what insights are you immediately able to digest? Most likely nothing.

Visualization is a necessity to show how the data is changing and to predict how it might act in the future. It also has great benefits to convey performance.

Q: What are your plans for the future?

A: Apruve was created by listening to customers, understanding their pain points, and building a solution specific to their needs. We plan to continue viewing customers as our top priority to help us expand and improve our offering. Each day we get more and more insight as to how to improve and we look forward to seeing where that takes us in the future.

Activate Social Media: