* – This article has been archived and is no longer updated by our editorial team –

Below is our recent interview with Robert Lonsdorfer, the Founder and CEO at BetterTradeOff:

Q: Robert, what is your mission? Tell us something more about the company?

A: Our mission is to bring personalized and relevant life planning to everyone.

BetterTradeOff – a Singapore-based start-up developed a one-of-a-kind life-planning solution, ‘Aardviser’, powered by advanced statistical models and AI, to reflect the unique lifestyle of everyone removing complicated financial jargon and shifting discussions from product centric to lifestyle centric. It offers a fully transparent, collaborative, easy to use, yet holistic solution to a new generation of advisers and customers in need of trust and belief for the future.

Q: Tell us more about Aardviser. How exactly does it work?

A: Every person’s life is complex and dynamic – “Aardviser” captures every detail of it: salary, expenses, education costs, job progression, retirement, wedding, property, investments, insurance, and more into a digital collaboration space where agents and their customers can plan together and more importantly, customers are able to plan and play in the intimacy of their home towards making dreams a reality.

Being a dream-focused solution, advisers can eliminate any guesswork and directly provide solutions or match relevant products to their clients to help achieve their dreams. This flexible, modular, white-label, multi-language and currency solution can efficiently and quickly capture a customer’s financial situation to immediately engage him or her in relevant and exciting life solutions. We do this by detailing the customer’s future financial life-events and priorities (which we call their “Dreams”) and then through specialized algorithms and machine learning, agents can apply products and strategies to achieve those Dreams over their customer’s lifetime.

We propose the “Trust Continuum” (a transaction of information-for-relevancy between the customer and the Adviser) as a framework to help the customers to overcome their distrust and fear, so that customers can discover their true future needs and thereby understand how financial products fit into their lives. This powerful display of relevancy to each individual’s unique life is what makes the key difference.

Q: Can you give us insights into your features?

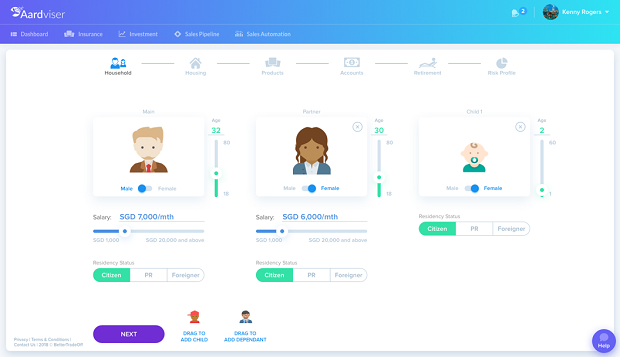

A: Onboarding

We are shifting the onboarding from 45 minutes of data capturing to just 5 minutes, thus enabling more life-based conversations

Recommended: Staker Group – The Fastest Growing Multinational Manufacturer And Importer In The Home & Garden Sector

Recommended: Staker Group – The Fastest Growing Multinational Manufacturer And Importer In The Home & Garden Sector

We quickly capture the basics of: age, income, residency, spouse, dependants, housing, existing products, existing assets, retirement assumptions, and risk appetite. Smoothly blending this with country-specific statistical models allows us to immediately present a “likely” (90% accuracy) financial model for the customer. It’s enough to get a highly-relevant conversation started, and generally they will divulge if pressed for information. However, since information disrupts the Trust Continuum, we bootstrap past any blockers with our statistical models to correct at a later stage in the collaborative journey.

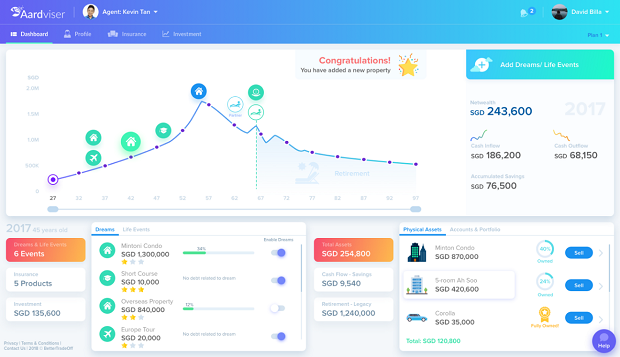

Client Dashboard

The one-stop-shop to plan your life by employing a simple drag and drop mechanism and no financial jargon

Recommended: InvolveSoft Raises $2.5M In New Funding For Its Employee Community & Volunteering Platform

Recommended: InvolveSoft Raises $2.5M In New Funding For Its Employee Community & Volunteering Platform

On our interactive and dynamic dashboard, we can see that customers can add their dreams and life events, and immediately see if a cashflow problem occurs in the customer’s future. We also show that there is usually a netwealth capacity to upsize their life (the area under the curve). Planning has never been so easy and intuitive for both dreams and life events such as death or unemployment. The powerful engine powered by AI calculates your unique situation at real time.

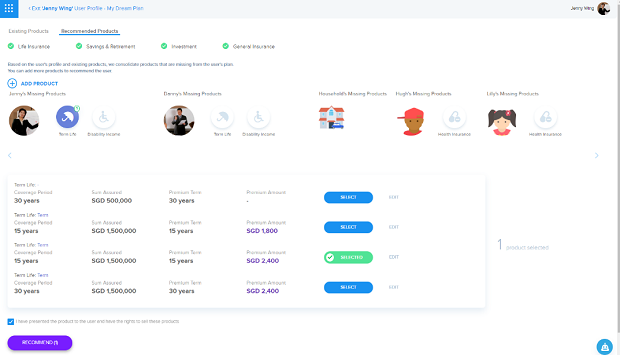

Product Gap Analysis

Recommended: EnergyFunders – The First Equity Crowdfunding Platform Dedicated To The Energy Industry

Recommended: EnergyFunders – The First Equity Crowdfunding Platform Dedicated To The Energy Industry

While you plan and play, our customizable business logic determines the most suitable products to achieve all your customer’s dreams in the unique context of the plan. In the figure above, we can see that the target household already has medical insurance, but their life plan requires a Term Life Insurance in case of the sad event of the main owner passing away. The adviser-recommendation is confirmed by a required “acknowledgement of suitability” for compliance audit.

Q: What was the inspiration for creating Aardviser?

A: Being a planner by nature, I was interested in engaging a financial adviser to map out my finances. The meeting was not very fruitful – in the sense that the adviser was recommending me products without fully understanding my goals in life.

That was when it dawned on me that something was amiss in the financial advisory industry. I wanted to find a way to build something for people to build a plan and understand the financial implications of that plan from the comfort of their homes – that is exactly how BetterTradeOff was born.

We even conducted a survey to understand Singaporeans. In Singapore, 56% of the market is anxious about retirement (pronounced between ages 35-49), especially for women (62%), but they are unlikely to seek financial advice this year (82% of people) because they don’t want to feel pressured by the “hard-sell” techniques they face. Also, none of them believe that robo-led investment will improve their situation.

It just all came together that we had to build something to bring these two groups of people (advisers and customers) together in a way that is beneficial to both parties. And that is what we did.

It has been an incredible journey, building an amazing team and solution and get global recognition from the industry. We won the DIAmond award for most innovative start-up in the Insurance space and we’re one of the selected finalists for the FinTech Lab Accenture in Hong Kong as well.

Recommended: Vestorly Leverages Artificial Intelligence To Curate Content From The Web On Behalf Of Marketers

Recommended: Vestorly Leverages Artificial Intelligence To Curate Content From The Web On Behalf Of Marketers

Q: What can we expect from BetterTradeOff in the future?

A: The aim is rather simple – never rest until we have achieved our ultimate goal to provide our clients and partners with a life planning solution that helps them delight their customers by selling the right products at the right time for the right purpose and comply with ever increasing regulations.

Activate Social Media: