Below is our recent interview with Chandler Hansen, Marketing Operations Specialist at Divvy:

Q: For those who haven’t heard of it, what is the best way to describe Divvy?

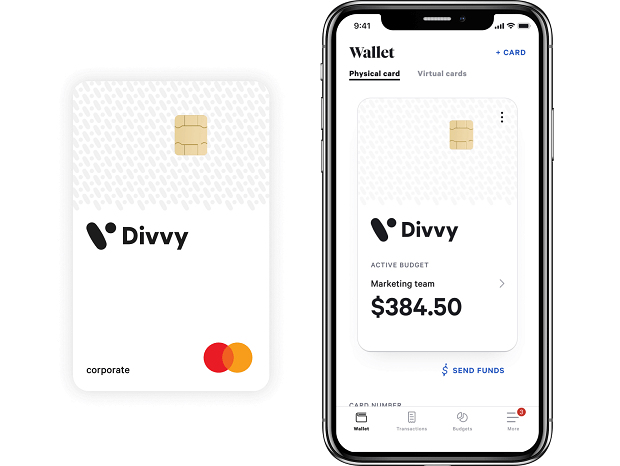

A: Divvy is the leading spend and expense management platform for business. We’ve fused the best in financial software with the leading credit card to make the perfect spending solution for every business.

So many businesses operate on a spend first, ask later mentality. This leads to out-of-policy spending, employee fraud, and dangerous overspend. There are tools to track every business process imaginable—and they’re getting better all the time. Salesforce tracks a lead and opportunity lifecycle in real time. Jira tracks engineering processes and Intercom tracks customer support metrics. Why haven’t we seen innovation in the tools that track the lifeblood of a company—money?

Divvy’s expense management software tracks every business expense in real-time and offers powerful budgeting tools, best-in-class business travel partnerships, and invoice payment solutions to help every business spend smarter.

Q: Divvy recently released a Bill Pay tool. Why did you decide to build it and what business upside will it provide Divvy?

A: Divvy Bill Pay is the next step in Divvy’s quest to become the financial nervous center for businesses. While Divvy has already revolutionized the expense tracking process—eliminating manual expense reports and providing real-time visibility into budgets—not all business spending can be confined to a credit card. In fact, most business spending comes from ACH payments from invoices.

By integrating a bill payment solution directly into Divvy, finance professionals can set, track, and evaluate more complete budgets with all of their business’ expenses, not just the ones done on a credit card.

Bill Pay increases product stickiness and increases daily customer interactions with Divvy. From a revenue standpoint, Bill Pay unlocks another area of customer spend and the associated interchange fees—which is how Divvy keeps the lights on.

Q: Can you give us insights into your pricing plans?

A: Divvy has only one pricing plan: free.

We make money the same way Visa and Mastercard make money—interchange fees. Every time a card is swiped, a small portion of the money from that transaction goes to the financial parties involved (including The Point of Sale processor, the credit card issuer, and the bank).

According to this model, Divvy gets a small percentage of every transaction that occurs on a Divvy card. That lets us continue to build a world class product, completely free of charge to our customers.

Q: Your Quickbooks Online integration is launching soon? How will that help Divvy customers? Do you foresee any other integrations in the future?

A: Divvy’s Quickbooks Online integration is the best in the business. In a few clicks, customers can connect to their QBO instance and map Divvy custom fields directly to their Quickbooks categories. All transactions and transaction details will sync automatically with QBO, letting accountants monitor their bottom line at all times and helping them close their books as fast as possible.

In the future, Divvy hopes to integrate with every major accounting software. In the meantime, customers can easily export a CSV of transactions from Divvy and import it into their chosen accounting system.

Q: What are your plans for the future?

A: We’ve seen tremendous growth over the past two years. From launching our product in January 2018 to raising over $250M in capital since then, Divvy has made waves in the fintech world. And with new product features like Bill Pay and the QBO integration, we are just getting started.

In the coming months and years, Divvy will continue to make financial planning, decision-making, and reporting easier than ever while enabling businesses to spend smarter. We will continue to expand into every major expense process as we look to become the financial nervous center for business.

Activate Social Media:

Recommended:

Recommended:  Recommended:

Recommended: