Dovly is the first fully automated consumer credit improvement platform. With just a few points and clicks, users can dispute inaccuracies that are hurting their credit scores. Everything happens effortlessly online, and you can see unprecedented results. Below is our recent interview with Nirit Rubenstein, CEO and Co-Founder of Dovly:

Q: Why do you want to change the game in credit improvement?

A: Over 40 million Americans have material errors on their credit reports. These errors are weighing down their scores and blocking them from getting access to basic products and services they need – everything from renting an apartment, to getting a credit card with a reasonable interest rate. To make matters worse, current credit repair companies charge people hundreds, if not thousands of dollars, and rarely deliver on their promises.

Recommended: Engage People Helps Businesses Engage Participants In A More Meaningful And Personally Relevant Way

Recommended: Engage People Helps Businesses Engage Participants In A More Meaningful And Personally Relevant Way

Q: How does Dovly’s process work?

A: All you have to do is enroll online by answering a few questions. We instantly and securely pull your credit report and score (using a “soft pull” that doesn’t hurt your credit) and highlight the negative items. You select which ones you want to dispute and click a button to submit your request. Dovly does the rest. Our algorithm determines which items to dispute at any given time, how to pair the items together, and how frequently to dispute the items in order to optimize your results. We send electronic disputes to all the three bureaus and update you daily with alerts about any changes to your credit profile.

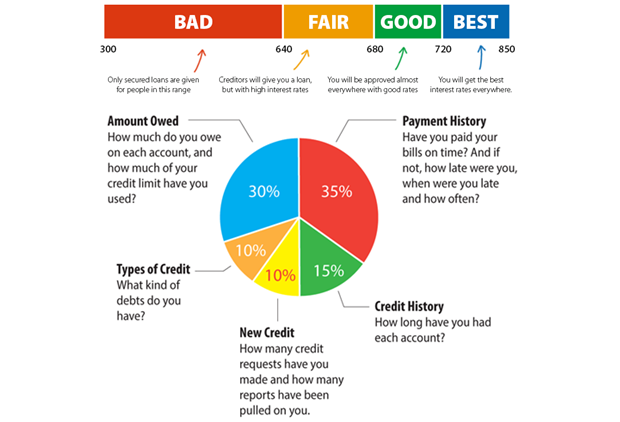

Q: What kind of issues really hurt a credit score?

A: The single biggest factor in most credit scores is the consumer’s payment history. When reports have payment history errors, it can be devastating to the credit score. We see this issue a lot with medical bills. When insurance companies are debating who owes what, unpaid bills go into collection and drag down a customer’s credit score. Often times, even after items get resolved by insurance, they stay on the consumer’s credit report and credit scores get hammered through no fault of the consumer.

Q: How does Dovly make a difference?

A: Dovly uses technology to solve a major consumer issue. We operate automatically and electronically from end to end with no human intervention at any step of the process. But beyond automation, Dovly uses a scientific algorithm and machine learning to score and queue the trade line disputes in a way that optimizes the speed and likelihood of deletion. In other words, Dovly is an intelligent platform that is getting better with time.

Q: Why is that a big deal?

A: The DIY process to complain to credit bureaus is hard to navigate, and consumers typically get stumped. The bureaus have little incentive and often don’t know how to fix the problem. Credit repair companies are no better – they charge a lot of money and regularly disappoint their customers. That’s why many of these companies are getting into trouble with government regulators. Consumers are left holding the bag. They suffer and need someone to advocate for them. That’s where Dovly comes in – we are transparent, easy to use, affordable, and extremely effective.

Q: Where do you want to go with this idea?

A: Credit repair is part of a larger undertaking to help people get smarter about credit. Even as we help fix errors on credit reports, we plan to keep customers engaged with continuous credit monitoring and credit education, so they don’t fall into the same traps again. Ultimately, we hope to drive the cost of our credit repair service to zero, funding the business instead by offering beneficial products and services that help sustain customer credit health. This way consumers don’t have to pay to fix mistakes on their credit reports and they can have true financial freedom.

Activate Social Media:

Recommended:

Recommended: