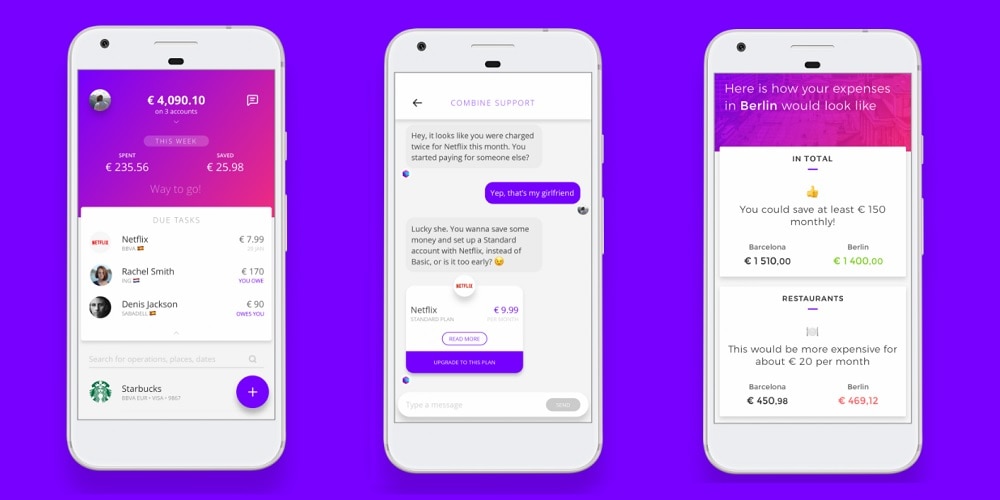

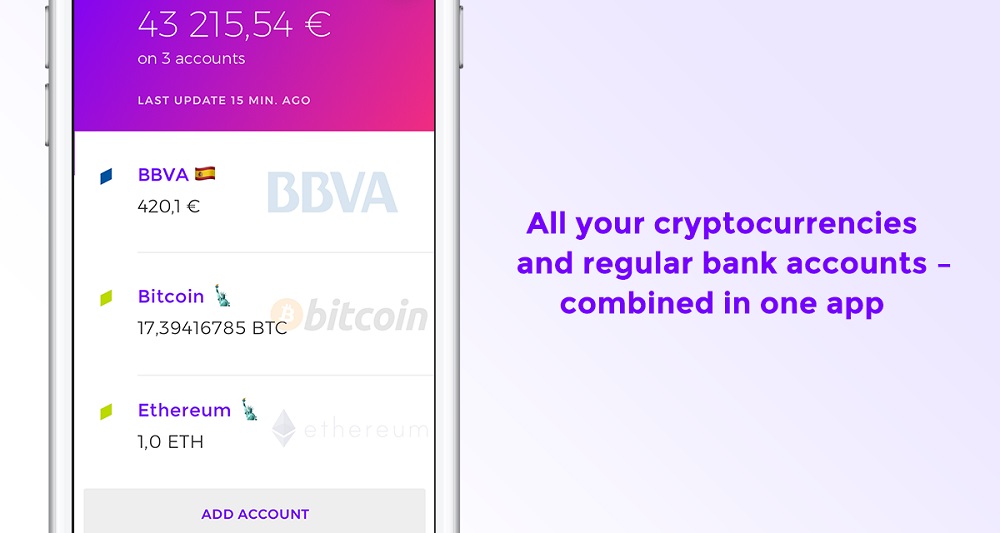

Combine lets users see aggregated balance from all their bank accounts and existing Bitcoin and Ethereum wallets, with a unified feed of transactions and analytics on their spendings. Users can also sign up for partner services inside the application. To find out more about their application we sat down with Irakli Agladze, CEO and Co-founder of Combine:

Q: You’ve recently announced your Angel funding round; could you tell us something more?

A: Sure. After our demo day at Startupbootcamp, we had quite a few discussions with potential investors, but Ilya (CEO of Aitarget) and his partners were the most confident and provided something more than just the money – Aitarget’s expertise in customer acquisition and strategy. With their guidance we will be able to significantly improve our customer acquisition costs, staying as cost-effective as it’s possible. We see this partnership as a way to gain experience and provide our users with even better insights on their financials.

Q: What is Combine’s story, how did you start?

A: It’s quite long. We began in 2014 in Russia as a product-outsourcing consultancy, helping major banks and retailers be innovative both by training their staff and providing them with manpower. When we started to realise that our initiatives sometimes are being buried deep into our clients’ backlogs – we decided to create a product of our own.

We then tried to applicate our experience in building a mobile banking app and selling it as a white label. But we realised that a company with zero credibility on the European market will need quite a lot of effort – so eventually we decided to pivot to a standalone application.

We visited a couple of startup conferences, pitched some investors and accelerators, and finally, we were accepted to Startupbootcamp’s branch in Barcelona, where we started to work on the product 24/7.

Recommended: Rainbird AI Raises $2.89M Seed Funding To Provide A Cognitive Reasoning Platform For Automating Complex Decisions

Recommended: Rainbird AI Raises $2.89M Seed Funding To Provide A Cognitive Reasoning Platform For Automating Complex Decisions

Q: Why is now the time for a technology solution like Combine?

A: Well, with PSD2 coming to Europe it’s the perfect time for an app like ours. People will get used to providing their financial data to third parties eventually. And right now – millions of Europeans change their country of living every year, and they still need to open a bank account in the new place most of the times. And then they find themselves having multiple bank accounts across countries, and each needs their attention from time to time. That’s where we come in and let them control all their accounts across borders in one, easy to use app.

Another thing – switching to a challenger bank is still too expensive regarding trust and time involved, even if we talk about the best challengers, like N26. So people stay with their old and reliable banks, but at the same time they want their mobile experience to be as good as possible, and again – that’s where we can help. Because even without moving around people sometimes have more than just one bank account, and we can connect everything inside Combine.

Recommended: MC360 Platform Helps Its Users Build, Manage And Customize Professional Resumes

Recommended: MC360 Platform Helps Its Users Build, Manage And Customize Professional Resumes

Q: What are your plans for the future?

A: In the short term, we’re planning to spend the investment on expanding to other markets as well as adding more companies to the list of partners providing their services within the app. We are happy to connect both with the small startups like ourselves, and with the larger companies if they see they could profit from such partnership. But still, the focus is on the users’ happiness, so we’ll start from something our users need but don’t have. We will create an alternative banking application that lets people control their regular and crypto- currencies in the same app. Watch, transfer and who knows what else.

And then we will go for the rest of the financial assets a person can have. Maybe the ones he or she doesn’t count as an asset yet. We’re going to fix that. This vision will not be easy to bring to life, but we’re looking into possible solutions already. It may involve getting a license as a financial institution — a thing we didn’t want before. But if it’s indispensable — we’ll probably have to go that way.

To obtain a firm stance in the market, we’ll need additional funds. I will be working hard to raise as little as possible so that we don’t turn into a bubble. We’re thinking €2M, aiming to close the round by the 15th of December.

Activate Social Media: