Gappify is an exciting Bay Area-based tech and services start-up that just launched its new accounting bot, Alan. Being accountants themselves, they understand the daily struggles and risks associated with manual tasks – its harder to calculate transactions accurately and takes longer to produce financial statements, which ultimately causes people to work extremely long hours at month-end. Gappify’s goal is to leverage technology to automate accounting tasks, and they believe that RPA (robotics process automation) and bot technology like Alan is a revolutionary way of helping their community attack this stubborn issue. Below is our interview with Vanessa Kramer, Community Director at Gappify:

Q: You’ve recently announced the launch of Gappify Alan; could you tell us something more?

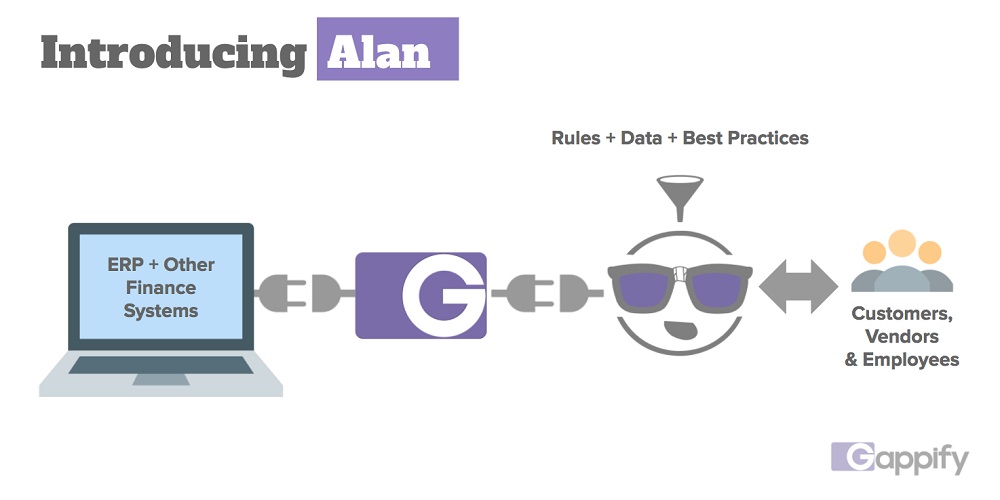

A: Alan brings a piece of RPA to the corporate accounting world. Alan is a bot that resides in Gappify’s cloud-based accounting platform. Business rules, best practices and specific assignments are loaded into Alan, and from there he’s able to perform hundreds of accounting tasks on his own. Behind the scenes, Alan is running Gappify-curated orchestration schemes, which include a combination of gathering data from multiple systems, reading scanned documents, requesting data from internal and external parties, calculations, and of course good old fashioned debits and credits as called for by US GAAP (United States Generally Accepted Accounting Principles). As examples, this approach enables Alan to autonomously ask customers for estimated payment dates as invoices become overdue, audit and report anomalies in employee expense reports, and ask vendors to report unbilled expenses and accruals on a predetermined frequency.

Recommended: Premier Payments Technology Provider Merchant Consulting Group Announces Partnership With Parkloco

Recommended: Premier Payments Technology Provider Merchant Consulting Group Announces Partnership With Parkloco

Q: What advantage does Gappify have over its competitors?

A: Alan is the first multifunctional accounting bot of its kind! In terms of how we are different from other accounting automation software currently in the market – our solution is fundamentally unique in its intent and design. Today’s applications are now great at automating calculations and specific processes, but they are still reliant on human-based users to initiate and facilitate such transactions. Our mentality is different: we believe in fully autonomous end-to-end transactions, with human accountants on standby when needed to approve and/or review higher-risk transactions.

We are also different from many RPA solutions in the market today. Our philosophy is that all manual tasks require automation – whether they are processes that handle thousands of transactions per day, or even ones that are just performed a few times per year. Gappify is committed to full automation, and with that in mind we built Alan to be flexible, economical and easy-to-deploy.

Recommended: Civic Action Network Launches A Service That Calls Congress On Your Behalf And Helps You Stay Engaged In Democracy

Recommended: Civic Action Network Launches A Service That Calls Congress On Your Behalf And Helps You Stay Engaged In Democracy

Q: How would you convince the reader to start using Gappify Alan?

A: Alan is the future! If you’re an accountant bored of processing routine tasks and would rather spend more time on challenging and complicated areas, Alan can help. If you’re a financial executive looking for effective ways to reduce cost, improve efficiencies in your accounting department, and/or to improve the speed of your financial reporting close timeline, Alan is your guy as well.

We encourage everyone who is serious about accounting automation to evaluate Alan and his capabilities. We’re happy to demo Alan if you are interested in meeting him =)

Activate Social Media: