* – This article has been archived and is no longer updated by our editorial team –

Below is our recent interview with Jaime Hale, CEO and Co-Founder of Ladder:

Q: Could you provide our readers with a brief introduction to Ladder?

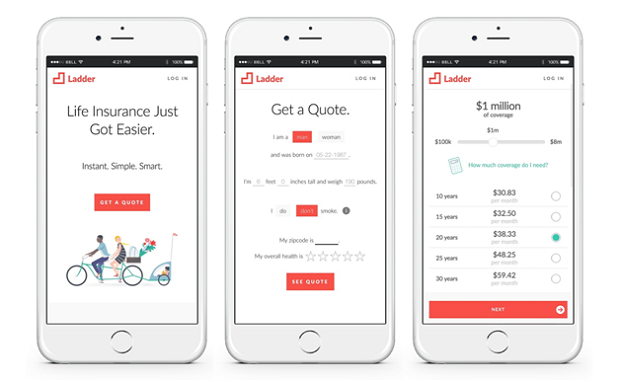

A: Ladder makes getting term life insurance instant, simple and smart. We have taken an antiquated life insurance process and used technology and customer-focused design to streamline the experience. Consumers have found the traditional process complex and cumbersome – paperwork, meetings and lab work can make the process drag on for weeks. With Ladder, someone can get a quote, do their application online and get an instant decision on life insurance in a matter of minutes, with no commissioned agents or policy fees. This direct-to-consumer approach allows today’s consumers to purchase term policies when it is convenient for them, and gives them the opportunity to get basic coverage in place, which they can adjust later if their needs change.

Life insurance changes lives. My father passed away when I was 11. The basic policy he had in place ensured my mother, brother and I were able to stay in our community, in a supportive environment, and I was able to get an education and go to graduate school. At Ladder, we want to make getting life insurance easier so more families can rest easy, knowing their people are protected.

Q: What type of life insurance does Ladder offer?

A: We offer all cause, fully underwritten, individual term life insurance for 10-30 year terms, with coverage from $100,000 to $8,000,000 from a top insurer, Fidelity Security Life Insurance Company.

Q: What does life insurance cover?

A: Insurance was first created centuries ago as a way for a communities to have each others’ backs. For a small contribution, each individual could make sure the people they cared about would be covered, if the unthinkable happened. Ladder is making this service easily accessible for more people. From a practical standpoint, life insurance payouts can replace future lost income, if you pass away unexpectedly. This may enable families to offset existing debt from loans, such as student loans or mortgages; pay for the cost of living associated with raising children (including education expenses); cover basic living expenses and support other obligations such as caring for aging parents or friends in need.

Recommended: Thexyz – Delivers Powerful Email Application For Both Business And Personal Users

Recommended: Thexyz – Delivers Powerful Email Application For Both Business And Personal Users

Q: What makes you stand out from your competition?

A: Ladder takes a comprehensive approach that spans all touch points for a customer from consideration and acquisition through underwriting and servicing. We simplify things, so someone can get insurance figured out in minutes, not weeks. We didn’t just slap a pretty interface on a legacy system, we built full stack technology, from the ground up, and have focused on user research and fast iterations to create a truly delightful user experience. Consumers that are self-directed can find information that is easy to understand and do their application whenever or wherever it is convenient for them, in minutes. Last fall, our data indicated that more than 60% of our transactions occurred outside of normal business hours (not something a busy parent could achieve in an agent meeting-driven process) and more than 66% of our policies were being purchased on mobile devices. Cutting through the complexity to help people get to the finish line is what makes Ladder a winning option for today’s time-starved customer.

Additionally, we launched an easy way to ladder your policy online, enabling customers to have the right coverage in place at the right time. Laddering can save customers thousands of dollars over the course of their policy term.

Q: What are your plans for the future?

A: We were excited to introduce the Ladder API in January, enabling investment platforms, lending companies, benefits managers, health and wellness innovators and more to seamlessly integrate with Ladder. This gives their customers the ability to quote, apply manage their life insurance in a convenient fashion. Partnering with companies like these, that have complementary offerings, is just one way we’re looking to bring ease and convenience to customers.

As we move forward, we will continue to relentlessly hone our user experience, learn from our customers and partners, collaborate with regulators and evaluate how we can continually improve. We are in this for the long term and our platform is a foundation for tremendous innovation to come. We are proud that we have leveraged technology and human-centered design to empower customers to buy and manage insurance quickly and easily, so they can rest easy and focus on everything life has to offer.

Activate Social Media: