Below is our recent interview with Martijn De Wever, CEO at Floww:

Q: For those who have never heard of it, how would you describe Floww?

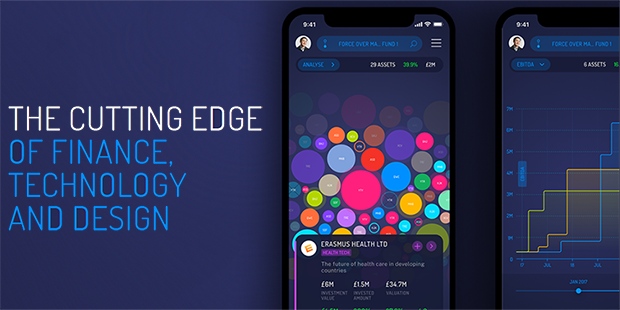

A: Floww is a data-driven marketplace and ecosystem for startups, VCs and investors. The platform is designed to allow Founders to pitch investors, with the whole investment relationship managed online, while also giving investors the metrics they need to source the best deals.

Q: Can you explain the benefits of using Floww?

A: Floww showcases startups based on merit, allowing founders to raise capital by providing investors with data and transparency. Startups are given a suite of tools and materials to get started, from cap table templates to “How To” guides. Founders can then “drag and drop” their investor documents in any format. Floww’s team of accountants then cross-check the data and processes key performance metrics. A startup’s digital profile includes dynamic charts and tables, allowing prospective investors to see the company’s business potential. Investors can now source and engage with the best deals using metrics, not bias.

Recommended: Nancy Etz Scholarship And Ten Other Scholarships For Aspiring Actors

Recommended: Nancy Etz Scholarship And Ten Other Scholarships For Aspiring Actors

Q: You’ve recently raised $5,000,000 in Seed; can you tell us something more?

A: Investors include family offices, angels including Pip Baker, Head of Google Fintech UK, and Floww’s Founder and CEO, Martijn De Wever who also Founded British Venture Capital firm Force Over Mass.

Q: Who would be your ideal user and why?

A: Startup Founders who are in the process of raising capital benefit from being able to reach the right investors on Floww, without the warm introductions that Founders normally need to get on an investor’s radar. Instead, Founders can engage with investors via Floww’s ecosystem of angels, venture capitalists and accelerators. Startups attract capital based on detailed metrics, including milestones hit, team diversity, and traction. Founders who have already raised can manage their investors updates with ease. Venture capital firms, angels and accelerators finally have their own bespoke, data-rich platform to find and assess the best deals and teams. Portfolio management has never been more visual, or more accurate.

Recommended: Lunchbox Raises $20M Series A Funding To Deliver Next-Gen Enterprise Online Ordering

Recommended: Lunchbox Raises $20M Series A Funding To Deliver Next-Gen Enterprise Online Ordering

Q: What can we expect from Floww in the next six months? What are your plans?

A: Having officially launched last week, with over 3,000 startups and 500 investors onboarded already, Floww’s continued plans center around growing the marketplace of startups and investors. When asked if they would consider also moving from venture capital into private equity, the company suggested they had already been approached by PE shops looking to manage their data and deals effectively. As sophisticated SaaS, Floww can be applied holistically across the private market, and has ambitions to service multiple verticals. Over the next 6 months, Floww will focus on user friendly product updates, adding new datasets and metrics for investors, and continued distribution and growth.

Last Updated on December 31, 2020

Activate Social Media: