Below is our recent interview with Marco Margiotta, CEO of Payfare Inc.:

Q: Could you provide our readers with a brief introduction to your company?

A: Payfare facilitates on-demand and instant access to earnings for gig workers. Our mission is to ensure that every worker in the gig economy can become an empowered entrepreneur with dignity and financial security.

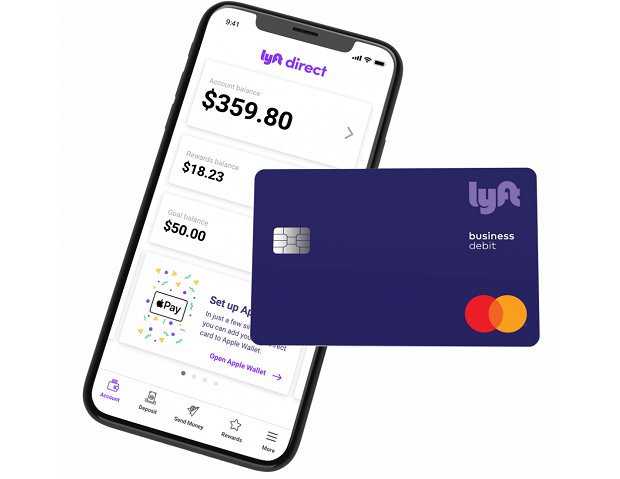

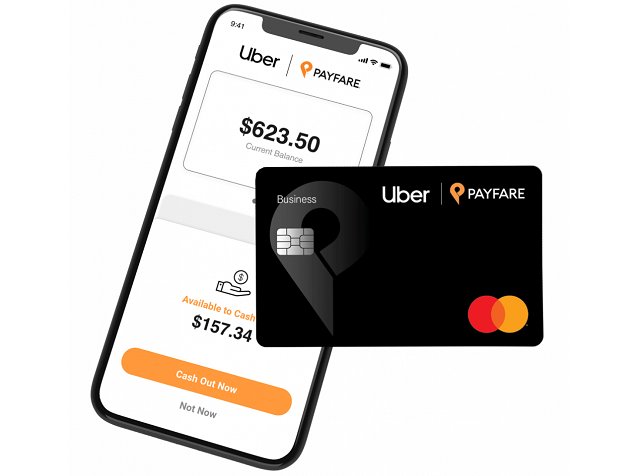

We created a simple API integration for gig economy platforms like Uber, Lyft and DoorDash so that workers get instant access to their pay through a free digital bank account, as well as rewards and discounts on things like fuel for Lyft and Uber drivers. By using Payfare, workers also have access to free in-network ATM withdrawals, online bill payments, fund transfers and more, with no minimum account balance requirements or costly monthly service fees like you get with some traditional banks. For more information, visit our website.

Recommended: Meet Kalkine Group – Leading Equity Research Firm, Media House And An Investor Relations Group

Recommended: Meet Kalkine Group – Leading Equity Research Firm, Media House And An Investor Relations Group

Q: Any highlights on your recent announcement?

A: Yes, of course. The pandemic has accelerated the demand for food delivery, and now the recovery is driving a resurgence of ridesharing across the U.S.. As an example, we have seen our DasherDirect program with DoorDash continue to build momentum, with active users climbing a further 21 percent in April 2021 from the end of Q1 2021.

The inherent need for workers to have instant access to their earnings, combined with our recent IPO (TSX:PAY) have provided strong catalysts for growth across our business including key new hires, product development and user acquisition.

Q: Can you give us more insights into your offering?

A: We developed Payfare in the back of ride shares, talking to drivers. They would either get their earnings earlier through a third-party payment processor with fees or they would use traditional bank accounts that had slow transfers. Bank accounts can also be costly for low-balance clients, leading them to turn to predatory check cashers and payday lenders to fill the gaps. Our clients save money, and their workers get more financial security.

Further, if we’ve learned anything in the last year, it’s that many gig workers are essential workers. They complete necessary tasks like restaurant, grocery and even pharmaceutical delivery; providing transport to other essential workers; and more. Solutions like ours that give gig workers their pay automatically ensure a low gas tank, flat tire or other unexpected expense doesn’t derail them — or simply make it impossible to do their work.

Q: What can we expect from your company in next 6 months? What are your plans?

A: There is lots for us to be excited about, and we look forward to sharing the news with you. The entire payments industry has witnessed a seismic shift in the last year to mass adoption of digital banking, payments and financial services. We see a future where any independent worker has the option to get paid instantly. The simplicity of our API integration will allow our services to be adapted to additional industry segments, including trucking, and other independent workers and entrepreneurs that might be working with smaller gig platforms. We also look forward to strategic new hires to support our ongoing product and technology development.

Recommended: The Q&A With Plastic Bank Co-Founder And CEO, David Katz

Recommended: The Q&A With Plastic Bank Co-Founder And CEO, David Katz

Q: What is the best thing about your company that people might not know about?

A: Our goal is to support financial inclusion for all. Though work is changing, one thing remains the same: People gain connection, purpose, and dignity from their jobs. We are disrupting the traditional banking industry to better serve the gig economy – who have become essential amidst the global pandemic. As more people turn to contract work, it is expected that gig workers could make up more than half of the workforce by 2023.

We are also proud to be a Canadian-born business, and we kicked off with our very first legacy partner in Canada. Headquartered in Toronto, it has been thrilling to see the city transform into a true global tech hub and stay close to technology trends developing at our doorstep.

Last Updated on September 26, 2021

Activate Social Media: