Pefin is the world’s first Artificial Intelligence (AI) financial advisor and provides comprehensive, tailored, fiduciary planning and advice at a fraction of the cost of a traditional financial advisor. To find out more about their AI-driven financial solutions we sat down with Catherine Flax, CEO of Pefin:

Q: Catherine, what is Pefin?

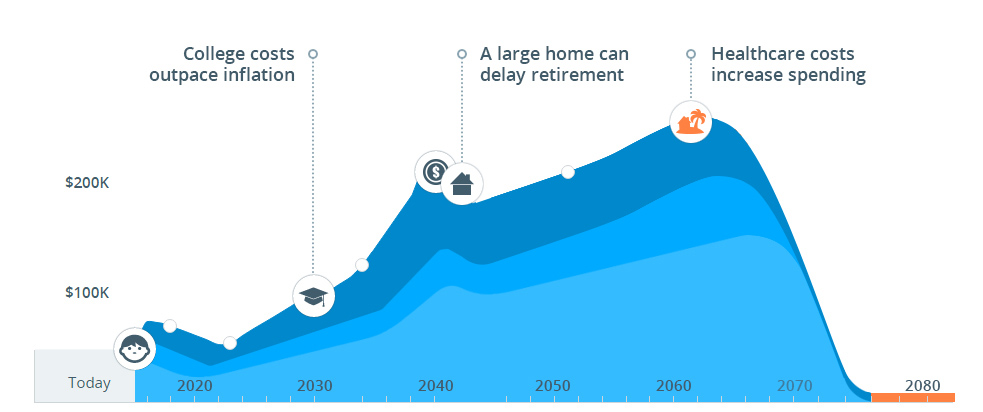

A: Pefin understands a user’s complete financial situation, including their current spending patterns, their debt and investments and their goals. An interactive chat experience helps users plan for life events that matter to them- like buying a home, having kids, sending them to college, and retiring in comfort. Pefin then incorporates the economy, markets, social security rules, federal and state taxes and much more to craft a thorough financial plan tailored to each user, showing the affordability of their plans. It provides ongoing advice on how they can save to achieve their plans, when they should repay debt, and whether investing is appropriate. If it is, Pefin also offers investment advice and portfolio management services through its SEC regulated subsidiary, Pefin Advisors. Pefin does not require that users invest through its platform, but if they choose to do so, it tailors each portfolio to help users achieve their plans.

Over time, Pefin learns from the user’s unique spending behavior and personal preferences and automatically adapts, updating the user’s financial plans and advice real-time. Pefin takes a different approach to planning personal finances by focusing on the user’s best interest and offering personalized, fiduciary and affordable financial planning and advice.

Recommended: Accelo Raises $9M Series A Funding To Help Small Businesses Be More Profitable By Automating Service Operations

Recommended: Accelo Raises $9M Series A Funding To Help Small Businesses Be More Profitable By Automating Service Operations

Q: You were recently welcomed as Chief Executive Officer; could you tell us something more?

A: Why move from Wall Street to a Fintech startup? I have seen for some time that the world of banking and finance has been poised for significant disruption, as a result of technological, regulatory and social changes. I have been fortunate to have been involved in these changes as a board member of Digital Assets, a leading blockchain company, a board member of the Securities Industry and Financial Markets Association (SIFMA) board, being a leader in Innovation initiatives at BNP Paribas and as an advisor to Pefin. What’s exciting about Pefin, and what inspired me to make the move to being CEO, is that I believe Pefin is uniquely positioned to radically transform the way individuals around the globe think about, manage and plan their finances. Historically, only a very small percentage of the population has had access to high quality financial planning and advice. We know that in general, there is a crisis of financial illiteracy which results in suboptimal decision making around savings, debt management and investment. Because of the scalability that AI affords, almost everyone can now afford top quality financial planning and advice – this makes Pefin a true game changer. Once people understand how much stress can be reduced in their lives by having a handle on their finances today and well into the future, Pefin will be a household name. I have been working in the world of finance for a very long time and I can confidently say that there is nothing else like this on the market.

Q: Who are the primary users of Pefin and what are some of the key challenges you are helping them solve?

A: Financial planning is one of the most overlooked aspects of most people’s lives. The typical human advisor charges between $2,000 – $,5000 for a one-time financial plan and being static, it is obsolete moments after it is created. Robo-Advisors, while affordable, are unable to offer a comprehensive financial plan, instead focusing on recommending a generic portfolio (one of 10 or so static investment portfolios), primarily based on a risk level the user picks. This advice doesn’t take into account important factors like the level of savings, debt, or other investments the user has, nor does it incorporate the interrelatedness of their personal financial goals (things like how sending your children to an expensive college may impact your retirement, or taking time off from work may impact the size of the home you can afford). Here is where Pefin comes in. Pefin’s AI stays on top of 2-5 million data points per user and updates plans real-time, ensuring the advice users receive is current and anything but generic. And Pefin does all this, for $10 a month. As for investments, Pefin requires no minimum investment size, and fees are 0.25% of assets under management, with the first $5,000 managed for free.

Pefin views life as a complete journey- and therefore it is useful and applicable to any adult at any stage of life. We have found that there are many users who have never used financial planning services, embracing Pefin when they begin to plan for certain life events. This could be a couple planning for a child, someone planning to retire, someone buying a home or sending their kids to college, or a fresh out of school graduate, facing big financial decisions for the first time. It could also be someone who wants to fund all these ventures, but isn’t a savvy investor. By creating transparency around their current financial situation, keeping on top of all the financial variables that impact them, and helping them plan financially for these life events, Pefin helps users achieve their goals, simply and easily.

Recommended: Techimon – Enterprise Class Managed IT Services For The SMB Market

Recommended: Techimon – Enterprise Class Managed IT Services For The SMB Market

Q: Can you give us more insights into your Artificial Intelligence powered solution?

A: Pefin’s AI is fiduciary by design and always acts in the user’s best interests. At the core of Pefin is its AI brain, which is a feed-forward neural network. The best way to picture this network is like a web, which captures the relationships among the many variables describing a user’s financial life and their environment at one point in time. The neural network understands these financial rules and relationships, and propagates them forward in time, up to 80 years depending on the age of the client. The network starts with a user’s current finances and projects how they change over time with market conditions, inflation, taxes, government rules, and their plans. Among all these factors, the network makes hundreds of connections. For example, if the user has a child, are they eligible for a tax credit going forward? If they take time off from work today, how does that change their Social Security benefits when they retire? Any time the data input to the network changes (such as market conditions, tax rules, a user’s account balances, or their monthly spending,) the financial projections and plans are automatically updated to reflect the most current and accurate information. For any given user, the network evaluates anywhere from 2-5 million data points, depending on the complexity of their financial situation and financial plans are available 24/7.

Reinforcement Learning is an additional layer added in the Pefin Artificial Intelligence methods to truly provide individualistic advice to each user. Rooted in behavioral psychology, this aspect of machine learning is very important in moving away from generic advice and into more complex problem solving with unique outcomes. Reinforcement learning takes the details of an individual’s financial behavior and feeds that into learning algorithms – creating a growing insight into the objectives of that individual user. These tools are also able to consider things like short term vs. long term tradeoffs, which are inherent in financial decision making.

Leveraging this technology enables Pefin to provide comprehensive, tailored advice at an affordable price. That’s the power of AI.

Q: What are your plans for the future?

A: Right now, we’re anticipating the imminent launch of Pefin in the US market. In the near future, consumers will see additional features such as Individual Retirement Accounts and 529 plans. We have also begun our international expansion through B2B partnerships in Europe and Asia. Our ultimate goal is to bring Pefin’s world-class financial planning, financial advice and investment advice to everyone across the globe.

Activate Social Media: