* – This article has been archived and is no longer updated by our editorial team –

Sureify is the global life insurance industry’s leading digital acquisition, engagement, retention and consumer behavior analytics platform, digitally transforming the life insurance industry. Below is our recent interview with Dustin Yoder, CEO at Sureify:

Q: Could you provide our readers with a brief introduction to Sureify?

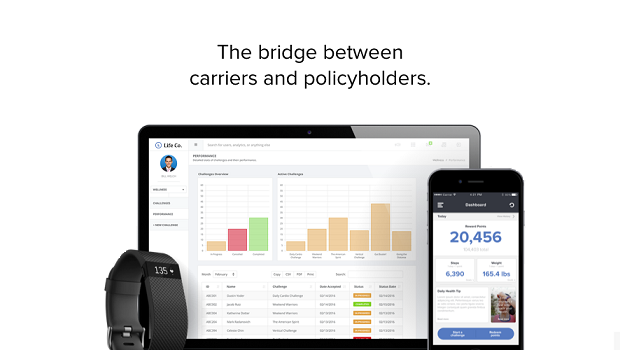

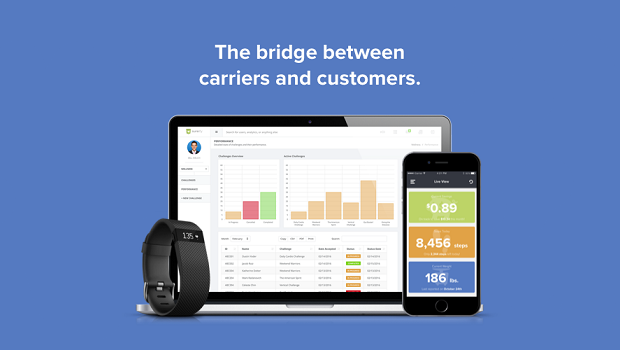

A: We were founded in 2012 with the mission of becoming the life insurance platform of the future helping to digitally bridge the gap between carriers and their customers. Today we work with customers across the globe spanning top 10 to top 500 carriers.

Recommended: OpenWater – Software Platform For Application And Review Program Management

Recommended: OpenWater – Software Platform For Application And Review Program Management

Q: Can you give us insights into your features?

A: Sureify provides our customers with a white labeled electronic application and purchase process solution – our apply and buy product – as well as in-force engagement, and policyholder analytics solutions – our engagement suite and carrier panel products.

These tools help life and annuity carriers transform their paper based application and purchase process into a digital web and mobile based e-app that integrates with insurers automated underwriting and legacy/third party systems integrations. We extend the customer journey from the point of purchase by putting in-force customer engagement tools such as incentives, challenges, rewards, education modules, surveys, polls and personalized content in the hands of the consumer with our customers look and feel.

Life Insurance carriers gain access to vast amounts of policyholder data from users wearables and IoT devices, electronic health and medical records, behavioral and geographic data, surveys, polls, and more. With the Lifetime platforms robust analytics and insight tools, we make that data actionable and meaningful so carriers can engage policyholders with the right message, or right product, at the right time whether that’s on the web or mobile or through push, text, email or other means of communication to meet the consumer where they are today.

Q: You’ve recently announced partnership with Human API; could you tell us something more?

A: We’re very excited about our partnership with Human API and the value this partnership will provide for consumers and Life Insurance carriers. Through the integration of the HumanAPI and Sureify platforms, we can incorporate user permissioned electronic health record data into the underwriting process. This will enable life insurers to further streamline the digital policy quoting, underwriting, and distribution processes to improve the consumer buying experience and speed of purchase. By leveraging this combined solution during the application process, life insurers can make real-time risk decisions and connect the consumer with the right policy at the right time. As a further advancement and emerging opportunity, the real-time electronic medical record data from Human API and Sureify’s in-force policy engagement solution also allows an insurer to engage with policyholders in a more personal way throughout their lifetime post-sale.

Recommended: Anti Hero Capital – One Of The First Investment Funds That Focus Exclusively On Crypto Assets And Digital Currencies

Recommended: Anti Hero Capital – One Of The First Investment Funds That Focus Exclusively On Crypto Assets And Digital Currencies

Q: What makes you stand out from your competition?

A: What really sets us apart from others in this space is that rather than delivering point products, we deliver a platform that takes a holistic approach to solving the problems carriers are currently facing and helping to guide them through their digital transformation. As a platform offering, we provide a wealth of features and functionality carriers can use to improve the customer experience at various points along the customer journey. We also provide the ecosystem that connects these digital tools with their existing legacy systems and tie in connections to vast amounts of disparate third party data source integrations to meet each carriers specific needs.

Q: What are your plans for the future?

A: Our mission has been and continues to be building the life insurance platform of the future. To that end, we will continue to expand upon features that that give carriers the tools and insight they need to make data based business decisions. We’ll also continue to focus on growing our partner ecosystem so that we can connect carriers to the vendors and data sources they need to remain competitive in the quickly changing.

Activate Social Media: