Suretly has developed an international crowdvouching platform. Suretly’s business model revolves around diversified risk among the lenders and vouchers making this a unique investment opportunity with minimal money-loss risk. Below is our interview with Eugene Lobachev, CEO of Suretly:

Q: What is Suretly and how does it work?

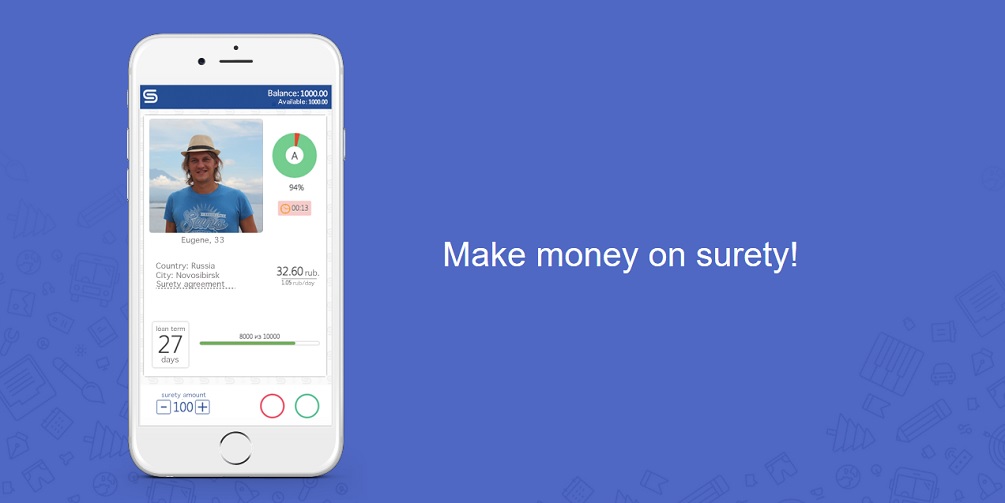

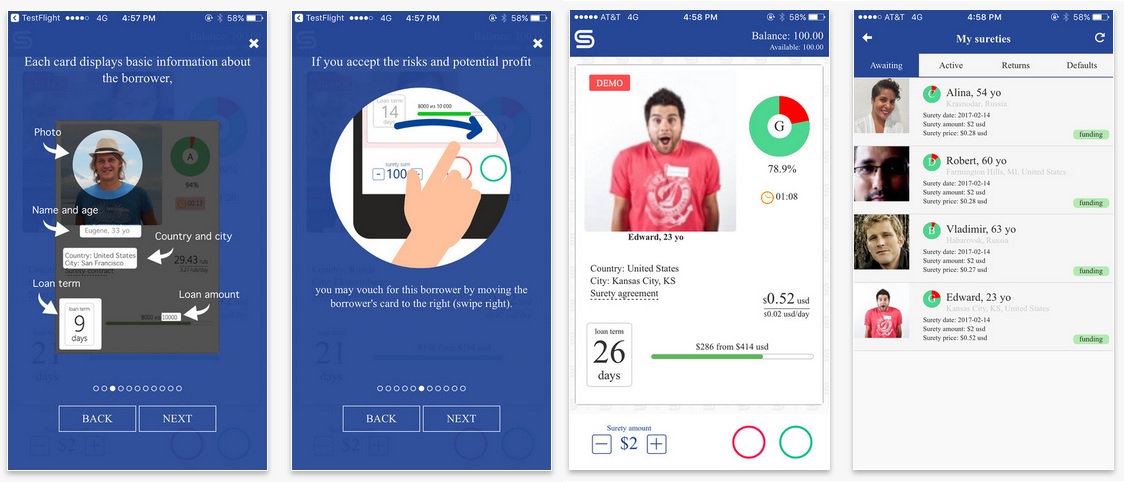

A: SURETLY offers an absolutely new kind of investment alternative – “crowdvouching”, the practice of financially securing a loan repayment by vouching monetary contributions from a large number of people. Unlike P2P lending, SURETLY users do not lend money directly to the borrowers but guarantee to repay the loan to the lender in case of borrower’s default. Vouchers act as a collective mind in order to determine whether to approve loans or not. Each voucher approval serves like an insurance of the loan capped at $10 USD per borrower. In order for the loan to be approved, the entire loan amount should be guaranteed by the big pool of vouchers.

Q: What makes Suretly a good choice?

A: SURETLY connects lenders, borrowers and vouchers providing the following benefits:

1. eliminating default risk for lenders while expanding the loan portfolio due to higher loan approval.

2. decreasing the loan interest rate for borrowers.

3. providing an investment opportunity for a market segment that was unable to invest before.

Recommended: YEAY Plans To Redefine Shopping On Smartphones Through Short-Form Videos

Recommended: YEAY Plans To Redefine Shopping On Smartphones Through Short-Form Videos

Q: What’s your startup story? How did Suretly start?

A: Suretly’s project was launched in June 2016 thanks to the Russian National Research University “Higher School of Economics” business incubator’s support. It also became its first investor. In the fall of 2016, the project team was selected for “Generation S,” which is the largest business accelerator in Europe. It became a Financial & Banks Technologies track finalist. Suretly began working on US market penetration in February 2017, and entered Starta Accelerator in New York. Suretly was nominated for the Benzinga Global Fintech Award in the “Best Lending Platform, Tool or App” category in April 2017. It is one of the most prestigious fintech international awards.

Q: You are currently testing your crowdvouching technology for short-term loans; tell us something more?

A: We’ve already tested our business model in Eastern Europe – first crowd-vouched loan was issued 4 months ago, and statistics show that 76% of our customers have a good income. We have about 15-20 loan loan applications per day from our first piloting partner and we hope to raise this number to 800-1000 applications per month in the end of 3Q 2017

Recommended: Get Set And Get Smart: 7 Questions Before Moving Enterprise Workloads To The Cloud

Recommended: Get Set And Get Smart: 7 Questions Before Moving Enterprise Workloads To The Cloud

Q: Can you give us more insights into your future plans?

A: Our business model has been successfully tested in Eastern Europe and in the next few months we are expanding on the Kazakhstan market. To boost our business we decide to raise money with an ICO. It will starts on July, 11 and we have plans to raise up to $10 million dollars.

It will allow us to successfully prepare to launch in the U.S. market in 4Q 2017. After successfully entering the US market, we will start expanding into various countries in Latin America, Europe, and Asia.

Activate Social Media: