Surgent has become one of the fastest-growing Exam Review course providers. They’ve grown rapidly because of their proprietary adaptive learning technology. To learn more about Surgent, we sat down with their Chief Marketing Officer Lisa Hobart and their Senior Director, Tax & Advisory Content, Nick Spoltore:

Q: Could you provide our readers with a brief introduction to Surgent?

A: A little more than 30 years ago, Jack Surgent, CPA, started Surgent Professional Education with a mission to provide the best continuing professional education (CPE) for accounting and tax professionals. Since that time, Surgent has become the brand trusted most by CPAs to bring them practical, timely, relevant education. We’ve provided more than 6 million CPE credits to tens of thousands of accounting and tax professionals all across the U.S. and abroad, through live seminars and online courses in a variety of convenient formats. More recently, Surgent has become one of the fastest-growing Exam Review course providers. We’ve grown rapidly because our proprietary adaptive learning technology, coupled with our expert instruction, is saving prospective CPAs hundreds of hours of study time while increasing exam pass rates.

Q: The Tax Cuts and Jobs Act that passed at the very end of 2017 was, of course, big news. What aspects of the law are driving the most questions from accountants and tax professionals?

A: Practicing accountants have been asking about the pass-through 20% deduction more than anything else. This new §199A deduction is complex and, unfortunately, regulations have not yet been issued to allow authoritative answers to some of the more complex, nuanced topics being confronted by CPAs. That’s why we’re continually updating our materials to keep our customers apprised of the latest guidance on the pass-through deduction, as well as the other aspects of tax reform that CPAs are asking a lot of questions about, including choice of entity, entertainment expenses (particularly relating to food and beverage), and the new alimony rules.

Recommended: Los Angeles Based Mediasans Reaches 11 Million Users Worldwide Through App Design And Task Management Tools

Recommended: Los Angeles Based Mediasans Reaches 11 Million Users Worldwide Through App Design And Task Management Tools

Q: The tax reform law includes a new section that creates a deduction for Qualified Business Income; what exactly does it mean?

A: In a nutshell, the new deduction is 20% of Qualified Business Income (QBI). QBI is the net amount of items of income, gain, deduction, and loss with respect to a trade or business. Rather detailed income limitations apply. Taxpayers with taxable income over the threshold amount of $157,500 ($315,000 for a joint return) are also subject to limitations based on W-2 wages and unadjusted basis in acquired qualified property. QBI does not include any guaranteed payment or employee compensation and similarly does not take into account investment-related income.

Q: Which business entities allow taxpayers to take advantage of the 20% deduction?

A: The deduction is generally 20% of a taxpayer’s QBI from a partnership, S corporation, or sole proprietorship. Multi-member LLCs treated as partnerships, Schedule E real estate investors, trusts and estates with an interest in a pass-through entity, qualified cooperatives, and real estate investment trusts are also eligible to take advantage of §199A. A C corp is unable to utilize the deduction, but rates for C corps dropped from 35% to 21%.

A qualified trade or business is any trade or business except a specified service trade or business or the business of an employee. A specified service trade or business means any trade or business involving the performance of services in the fields of health; law; engineering; architecture; accounting; actuarial science; performing arts; consulting; athletics; financial services; and brokerage services, including investing and investment management, trading, or dealing in securities, partnership interests, or commodities. Any trade or business where the principal asset is the reputation or skill of one or more of its employees is a specified service trade or business. This distinction for a specified service trade or business is incredibly important. One not so beneficial result is no §199A deduction is allowed for a specified service trade or business where 2018 taxable income is $207,500 ($415,000 for a joint return) or more. (Sorry accountants, lawyers, and doctors!)

Q: What do you think will be the most far-reaching impact of The Tax Cuts and Jobs Act for individuals?

A: At the risk of sounding like a broken record, the §199A deduction will have a pronounced effect on the income taxes of individuals due to its pass-through nature. Its tentacles have already spread. For example, forward thinking investment professionals are discussing strategies with clients involving investing in pass-through businesses in order to take advantage of the deduction. A 20% cut of QBI is long money to anyone.

In addition, the tax reform law created a real incentive for a potential alimony payor to have the divorce or separation agreement executed by the end of 2018. For a divorce or separation agreement executed after December 31, 2018, alimony will not be deductible by the payor or included in the income of the payee. A rush to divorce court (with alimony payor spouse as petitioner) will undoubtedly ensue.

Q: What about for businesses?

A: It is difficult to understate the tax savings to C corps inherent with the rate drop to a flat 21%. There is obvious potential there to redirect former tax payments to investors. That story has not yet unfolded. Speaking of which, the repatriation of accumulated offshore earnings of multinational companies at 15.5% for cash holdings and 8% for non-cash holdings provides additional capital and its attendant potential to these same companies.

Moreover, tax reform increased bonus depreciation to 100% for property placed in service after September 27, 2017 and before January 1, 2023. The law also increased the §179 expense limit to $1 million with the cost of qualifying property phase out threshold set at $2.5 million. These are incredibly generous ‘shots in the arms’ of collective businesses nationwide.

Finally, in an unabashed attempt at formulating public policy, the tax reform law created a new credit for employer-paid family and medical leave. The law allows businesses a general business credit of 12.5% of the amount of wages paid to qualifying employees on family and medical leave if the rate of payment is 50% of the wages normally paid to the employee. The credit is increased by .25 percentage points (not above 25%) for each percentage point by which the rate of payment is over 50%. The change is effective for wages paid in tax years beginning after December 31, 2017 but is not applicable to wages paid in tax years beginning after December 31, 2019.

Recommended: Artificial Intelligence Assistant From Voicera Makes Meetings Awesome

Recommended: Artificial Intelligence Assistant From Voicera Makes Meetings Awesome

Q: Shifting gears toward the exam prep side of your business, what makes your adaptive technology unique in the CPA Review market?

A: Other vendors in the CPA Review market have spent years building more and more content to study—which makes sense because the CPA Exam now covers so much material. But what doesn’t make sense is that these CPA Exam prep vendors don’t help students actually get through their mountains of material in a manageable way, which we think explains why national pass rates for the CPA Exam are under 50%.

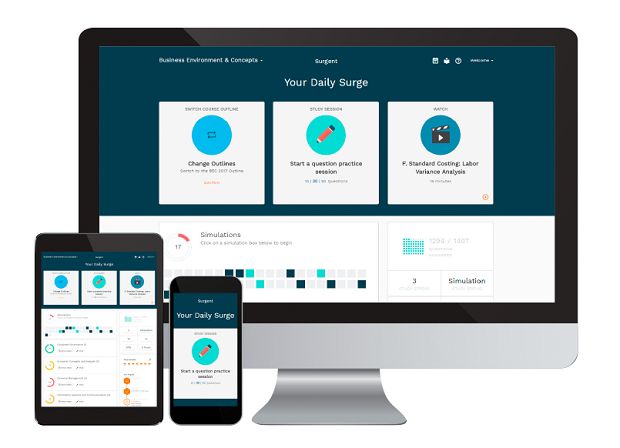

That statistic is why Surgent took a completely different approach when we designed our course. We wanted to help students study more efficiently rather than just study more. Our A.S.A.P. Technology, whose acronym stands for Adaptive Study and Accelerated Performance, is an advanced, proprietary adaptive learning system that continually personalizes and guides each student’s study experience based on their demonstrated knowledge.

In a nutshell, our course figures out what you already know and what you don’t. It then focuses your study time on your weak areas—guiding you to our short, focused video lectures and relevant questions. This helps you dramatically improve your understanding, while actually studying less. In fact, Surgent CPA Review can save students as much as 400 hours of study time, while our average pass rate is nearly two times better than the national average! That’s a big reason why Surgent CPA Review Premier Pass was just recognized by Accounting Today as the best new professional education product for 2018.

Q: What are your plans for 2018?

A: We know that The Tax Cuts and Jobs Act is going to continue to create questions for CPAs, tax professionals, financial planners, attorneys, bookkeepers, and their clients. That’s why, in addition to the six new tax reform courses currently airing, we are already producing another nine new courses on various aspects of tax reform, as well as dozens more new courses on other tax, accounting, technology, and other topics. We will continue to provide the courses that help our customers get the education they truly need to support their clients and their careers.

In addition, we’re excited to be expanding our reach into other areas of exam prep. In fact, we just launched exam prep courses featuring our A.S.A.P. Technology for the Enrolled Agent (EA) exam, the Certified Management Accountant (CMA) exam, the Certified Internal Auditor (CIA) exam, and the Certified Systems Information Auditor (CSIA) exam. We’re excited to bring the same efficient, effective learning to even more exams in the near future.

Activate Social Media: