* – This article has been archived and is no longer updated by our editorial team –

Below is our recent interview with Scott Roberts, Vice President at The 6ix Capital Group:

Q: Could you provide our readers with a brief introduction to The 6ix Capital Group?

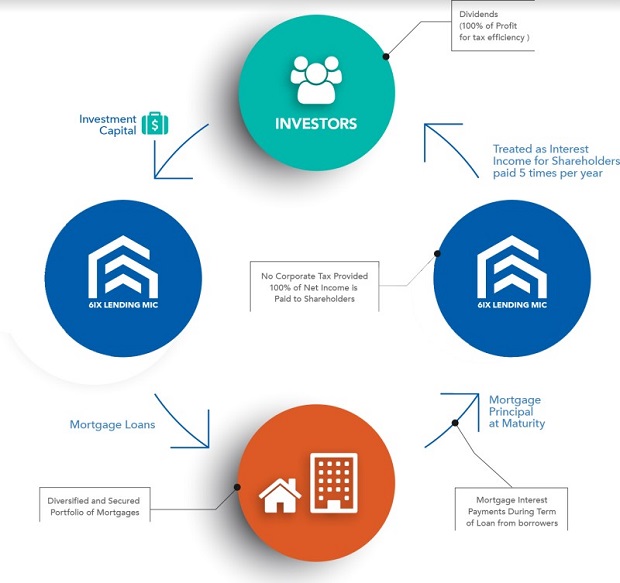

A: The 6ix Capital Group Corporation manages 6ix Lending MIC, a private Canadian non-bank lender that invests in a diversified portfolio of quality real estate loans on houses in the Greater Toronto Area. Our investment objective is to preserve the capital we invest and grow a diversified portfolio of real estate secured loans with an aim to maximize dividends via effective management. Audited financial statements for the fiscal year ended June 30, 2018 indicate an annual yield of 9.18% to shareholders and investors. The 6ix Capital Group is headquartered in downtown Toronto, Ontario. The 6ix Capital Group has capitalized over $13.0M in residential mortgages located exclusively in the GTA.

Recommended: Meet Indextra – A Subscription Based Medical Library App Made For Medical Students And Health Care Professionals

Recommended: Meet Indextra – A Subscription Based Medical Library App Made For Medical Students And Health Care Professionals

Q: You’ve recently announced 2 dividend payments to shareholders for month end October 2018; could you tell us more?

A: Sure, we pay regular distributions every quarter equivalent to 7% annual interest. At the end of the fiscal year (June 30) we have our results audited by BDO. Those year end results come back to us in October. This past year, we earned 9.18% for our shareholders. Thus, we make a 5th dividend payment for the year. That payment is a “sweep” payment that encompasses the difference between the 7% that shareholders had already been paid and the 9.18% that the corporation earned them. Thus, this past October, in addition to our regular 7% interest payment, we paid an additional 2.2% to investors.

Q: What is a Mortgage Investment Corporation?

A: Created in 1973 through the Income Tax Act, MIC’s (Mortgage Investment Corporation) allow multiple investors to pool their funds to be lent as private mortgages on residential properties. MIC’s typically target 7-9% annual returns all while providing the expertise required to underwrite the loans.

Q: Why would you recommend investing with The 6ix Capital Group?

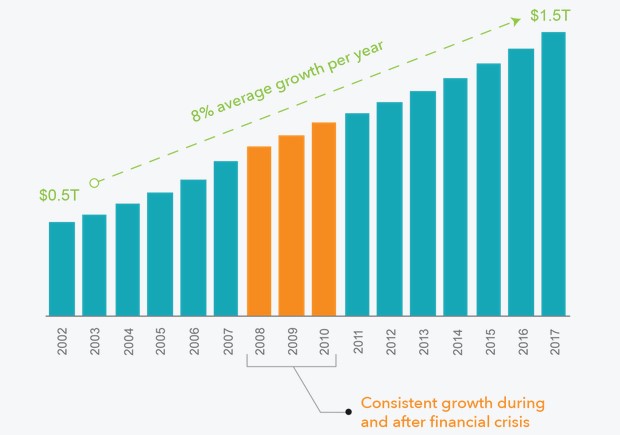

A: The parameters we follow for lending make us a conservative choice for investing your funds. We consider the location, economy and possible market downturn as we set our lending guidelines. We focus on financing homes in the GTA with Loan terms up to 1 year with a maximum 75% loan-to-value. Thus, as an investor in our MIC, you will be investing in short term debt on assets that are located in the most robust real estate market in the country. As an example, if a home is worth $1,000,000, our MIC will only lend the owner of that home up to a maximum of $750,000. And it must be a home (not a condo) and it must be located in the GTA. Thus, in order for the MIC to take a loss on that loan, the home would need to drop more than 25% in 1 year AND the borrower would need to default on his/her mortgage payments. Considering the default rate in the GTA is 0.1%, the likelihood is minimal.

Recommended: Softomotive Raises $25M In Series A Funding Round Invested By Grafton Capital

Recommended: Softomotive Raises $25M In Series A Funding Round Invested By Grafton Capital

Q: How do you help borrowers achieve their real estate financing needs?

A: Borrowers generally find us through their respective mortgage broker. Our rates and terms are competitive with all other alternative lenders.

Q: What are your plans for the future?

A: We plan to continue on the exact same path that we currently are following. Investors first. Making short term, low leverage loans on homes in the GTA. We will continue to prioritize investors by making conservative mortgage loan choices with them in mind.

Activate Social Media: