The Floow is a leading innovator of telematics solutions that allow insurers to price policies more accurately, help drivers improve their safety performance, and enable auto manufacturers and policy makers to design vehicles and road systems that respond to drivers’ evolving needs. Below is our recent interview with Nathan George, Director of Business Development for The Floow, North America:

Q: Can you tell us something more about your platform?

A: Our device agnostic platform has been future-proofed to accept data from virtually any mobility sensor and to assess risk in real-time. Like an oil refinery receives crude oil at one end and generates a range of derivatives such as gasoline, lubricants etc. at the other end, The Floow processes and transforms raw mobility data into derivatives like scores, analytics and a variety of services consumed by auto insurance professionals and policyholders.

At the heart of what we do, our company’s mission is to make mobility safer and smarter for all drivers on the road.

Q: How exactly do you make mobility safer and smarter?

A: The Floow combines data science and behavioral science with highly advanced technology to accurately monitor an individual driver’s performance. Each driver is assigned a safety score based on data our telematics sensor records for each trip.

Unlike other providers in our market, we take this data, and using behavioral science, help improve driving behavior and assist drivers with developing safer driving habits by providing drivers with feedback and incentives to change unsafe behaviors and adopt safer ones. For drivers with the lowest safety scores, we can work directly with participating drivers to teach new behaviors that tangibly improve their safety performance.

Recommended: Canada’s Health System A Perfect Fit For Savience Technology

Recommended: Canada’s Health System A Perfect Fit For Savience Technology

Q: Can you give us insights into your products?

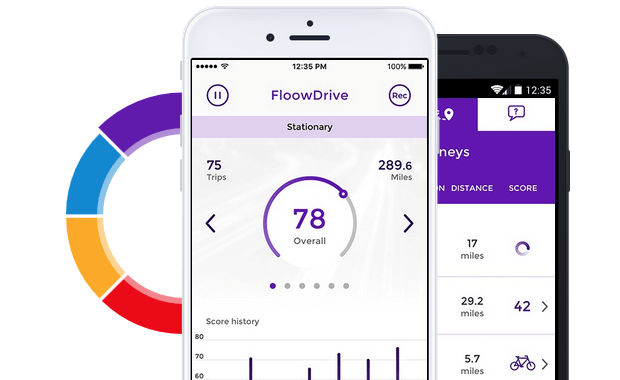

A: FloowDrive

Our core product is FloowDrive, an advanced automotive telematics platform that uses a smartphone as a mobility sensor. Unlike most telematics solutions, FloowDrive can be up and running in minutes. It also offers an easy-to-launch white-labeled rewards module to provide incentives to drivers for proven safety performance.

For insurance companies, FloowDrive offers the following benefits:

• A reliable, best-in-class scoring and analytics engine

• A user-friendly portal for visibility of scores and driver engagement

• Easy customization to meet specific branding requirements

• Supports different language localization needs

• Easy-to-integrate additional modules including our rewards and driver- coaching program, FloowCoach, to improve driver behavior and create greater engagement with safety scores

• A strong product roadmap to introduce new features over time

For drivers, the platform offers:

• An intuitive smartphone app interface with easy registration and a clear scoring dashboard

• In-app notifications and advice to help drivers make behavioral improvements

• An incentives module to reward sustained improvements or continually good safety via a range of easy-to-maintain vouchers to choose from

FloowFleet

Our commercial product, FloowFleet, gives commercial lines insurers the ability to offer fleet customers the ability to manage risk more effectively by tracking their vehicles and drivers. At present, FloowFleet is specifically designed to support insurers that provide policies for fleets of 25 or less light-duty vehicles.

Benefits of FloowFleet for insurers include:

• A reliable scoring and analytics engine that helps identify and manage risk

• Data can be scored via a range of devices, including easy-to-use OBD port devices and fitted devices

• Production-ready and highly scalable for cost-effective deployments

• Customizable so insurers can deliver a specially branded portal

• Access to a range of value-added driver improvement modules to help promote safe driving practices

Fleet managers have access to:

• Easy onboarding for quick implementation

• A powerful scoring engine producing trip and real-time vehicle-level information

• Scores presented via a robust management information accessible via mobile devices, tablets or desktops

• An intuitive and actionable portal to remove the guesswork from managing risk.

• A geofence feature, helping fleet managers to monitor and protect their assets with event-trigger notifications for each vehicle

• Access to additional driver-improvement programs as determined by the insurer

In addition, we are continuing to expand our portfolio of products, capabilities and services for both individual drivers as well as a variety of commercial applications.

Q: How close are we to living in a world driven by thinking machines? Should we be concerned?

A: In my opinion, we’re a few decades away from a world where fully autonomous vehicles are the norm and not the exception. We’re already seeing semi-autonomous vehicles on the road, and there are a number of applications where self-driving machines are being used successfully, but for now, at least, these instances are either limited to highly specific purposes and routes, or they’re still in the early testing stages.

That said, I do think insurers and the automotive industry in general need to be on top of the changes that are definitely coming in the future. Even though fully self-driving vehicles aren’t likely to be around for some time, vehicle systems that take over some aspects of driving, adaptive cruise-control for example, are quickly being adopted by consumers. This has an impact on driver safety and therefore, it is critical to understand this data as it becomes available and we need to be in front of this emerging trend.

Q: What is the roadmap for The Floow going forward?

A: The Floow product roadmap include 6 major development items:

1. Mobile first: We feel smartphones are central to our roadmap given their nature as the primary interface for user experience and their ability to provide high-quality mobility data at a low cost. We are working on improving the efficacy of smartphones through the use of IoT wireless peripherals, such as tags and cameras, to mitigate some of weaknesses intrinsic to the nomadic nature of smartphones.

2. Risk model sophistication: We help insurance partners eliminate the need to only use traditional rating variables and class-plan data by generating accurate premiums directly derived from behavioral-based driving data collected from mobility sensors. Also, we are engaged in Research and Development programs to offer partners unique access to next-generation risk models designed to predict claim for Level 3 (and above) autonomous vehicles.

3. Behavioral modifications: We continue to research, develop and expand the reach of our successful FloowCoach program with the integration of chatbots.

4. Collaboration with OEMs: We continue to expand existing partnerships with major OEMs as well as establish new partnerships to allow for the collection of data from OEM platforms. We are working to integrate with OEMs’ data access points, qualify the data quality for creation of insurance-grade scores, and negotiate sensible data acquisition costs for our partners.

5. Claims automation: we have automated crash detection capabilities that support FNOL, accident reconstruction and roadside assistance. Our roadmap includes integrating across more stages of the claim’s lifecycle beyond crash detection in pursuit touch-less, pass-through claims handling.

6. Mobility Services: We are also piloting our GoWithFloow peer-to-peer car sharing platform. GoWithFloow will allow drivers to quickly match with car-owners near their location, enabling them to borrow a car quickly and conveniently.

Activate Social Media: