Below is our recent interview with Colin Hayward, CEO at Chinsay:

Q: Could you provide our readers with a brief introduction to Chinsay?

A: Since 2000, Chinsay has been innovating the capture and digitalisation of commodity and freight industry contract data. Our global customer network includes many of the biggest companies in those industries, such as Arcelor Mittal, Rio Tinto, and EDF.

Q: You’ve recently announced a major step forward for the commodities industry; could you tell us more?

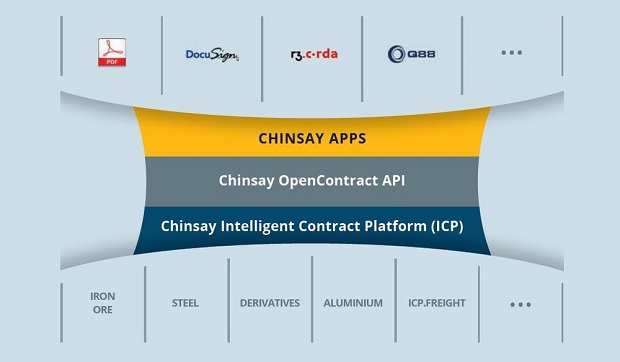

A: We just announced our new state-of-the-art Intelligent Contract Platform (ICP), a cloud-based SaaS service that integrates the workflow that generates contract data with key technologies such as CTRM, blockchain, and machine learning to create a major step forward in terms of technology, efficiencies and risk management for the industry.

In most companies, contracts are managed through manual siloed processes and unconnected software, involving repeated manual data inputs, copying data from email into Microsoft tools and then again into downstream software, resulting in fragmented data and a lack of transparency.

Using ICP, data is created, abstracted and flows seamlessly across clients’ technology stack, providing an informed view of business operations that leads to more informed decisions within the organisation.

Behavioural data can be used to identify inefficiencies in organisational performance and structure, whilst commercial data flows effortlessly into other operational systems, such as ERP, CTRM, blockchain-based trade financing systems, and enterprise data lakes for detailed analysis.

With ICP, the industry can finally digitalise the fundamental trade process early in the deal lifecycle, creating a strongly-typed and richly-structured contract dataset that links front, middle and back office functions, making global supply chains more efficient and transparent and benefiting all stakeholders.

Recommended: From Start-Up To Scale-Up: LC GLOBAL Leads Companies Through Their Next Growth And Innovation Stages

Recommended: From Start-Up To Scale-Up: LC GLOBAL Leads Companies Through Their Next Growth And Innovation Stages

Q: Why Chinsay? What makes you the best choice?

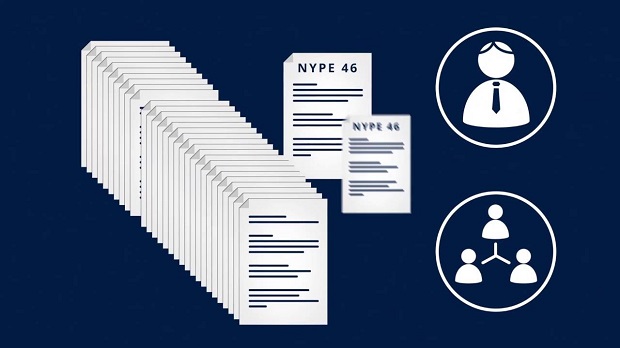

A: Contracts in the Commodity and Freight industries have unique complexities, and often involve far more stakeholders and participants than standard contracts. The average international trade operation involves between 20 and 30 parties, meaning that hundreds of people and emails can be involved in the creation, negotiation and execution of a single contract. The sheer volume of the data, negotiation, and risks encountered by every party involved requires a tailor-made solution.

Q: How do you transform contract data into actionable information?

A: Traditionally, contracts have been static reference documents, consulted only when problems or opportunities arise. By digitalising the contract at the outset, we capture strongly-typed and richly-structured data that is always available for reference, integration, learning, and analysis.

Q: How do you transform contract data into actionable information?

A: Traditionally, contracts have been static reference documents, consulted only when problems or opportunities arise. By digitalising the contract at the outset, we capture strongly-typed and richly-structured data that is always available for reference, integration, learning, and analysis.

Q: What are your plans for the future?

A: Our goal is to empower our clients with digitalised ecosystems integrated through ICP to leverage their data to eliminate the inefficiencies that make trading slower and costlier than necessary. We are rapidly rolling out comprehensive solutions for diverse commodity sectors, from Iron Ore and Steel to Agriculture, Concentrates, and Freight. Of course, our technology can also be applied to other industries with similar needs.

Q: Why does the industry need digitalisation?

A: Technology offers all industries increased efficiency, but the commodity industry, with its largely paper-based processes, lags behind the adoption curve. Nonetheless, margins are just as tight, and commodities companies suffer the same pressure to manage risks and costs. The resulting need for greater scale, speed and efficiency in this very complex market drove our development of ICP. Digitalisation solves these issues, making businesses more efficient while providing access to transformative new technologies such as e-documentation, blockchain and machine learning.

Q: Are there any tangible benefits that clients have seen since using ICP?

A: With ICP, data is captured early in the trade lifecycle to enable pre-trade risk assessment and make it very easy to provide valuable and usable data to associated processes, systems and stakeholders.

Allowing multi-national companies to standardise across their businesses means an increase in efficiency, control, and visibility. On an industry level, standardisation and a centralised collaborative platform help organisations trade with more certainty, while reducing both the cost and risks of trade. Some of our clients have commented that with ICP they save 40-70% of their time in document preparation.

Our clients advise that delay to and non-production of contracts expose them to unnecessary risks daily. One client says that 1 in 20 charter parties are never created and regularly those that are come after a voyage has been completed. Chinsay enables businesses to have the right information at the right time. This information can be anything from relevant market information and customer information to experience of previous deals, risk assessment on clauses, and more.

Q: What prompted Chinsay to develop ICP?

A: ICP was built on our deep experience in the freight contract management industry with our Recap Manager product. RM offered great benefits to the freight divisions of some of the world’s largest commodities trading companies. These clients asked us to deliver the same benefits to their commodities trading divisions too. ICP delivers those benefits and more.

Q: What do you see as fundamentally complex within commodity contracts?

A: Taking a holistic view, there are many complexities to untangle and address. The contracts often involve detailed options, obligations, commitments, material specifications, timetables, delivery instructions, and other terms and conditions. Properly digitalising the contract involves not just loading in a big spreadsheet, but rather capturing the hierarchical and interconnected relationships between the various datapoints, and then modelling of the risks inherent in the contract. Then the process complexity needs to be addressed. Before ICP, market players did not have access to a platform that could take data from manual systems to digital processes and share data across the enterprise, resulting in highly siloed information and increased reliance on manual processes. This can lead to human error and challenges in achieving scale and flexibility as well as the impossibility of having a central repository of business intelligence.

Recommended: The SSL Store Provides A Variety Of Digital Security Solutions For SMBs And Large Enterprises

Recommended: The SSL Store Provides A Variety Of Digital Security Solutions For SMBs And Large Enterprises

Q: Why can’t companies move directly from manual to blockchain? What would the risks be?

A: There is no direct path. Blockchain smart contracts don’t work on Word documents. Blockchain is a back-end technology, like a database. When was the last time you used a database directly? To deliver value, blockchain systems need structured data and a defined process. In this way, you might think of ICP as a user interface for blockchain.

Q: What problems does siloed data create for both contracts and the business?

A: Siloed data makes broad risk management exceptionally difficult, as there is no overall view of an organisation’s exposure to a number of operational risks; it also prevents the sharing of knowledge (and company learning) and standardisation. Businesses cannot gain insight into how their real-life performance compares to the contractual obligations which define the health, efficiency and effectiveness of their business and the decisions made around it.

If we imagine a process which involves hundreds of emails, all with contractual changes, and a team trying to keep up with these without errors, while creating a central document, we can get an idea of just how difficult it is working manually and dealing with siloed data.

Q: How does ICP change the way commodity and freight markets use technology?

A: At the moment, technology is used to enable certain processes without having a complete view of the trade lifecycle and organisation. With Chinsay’s solution, an organisation is able to link data extracted in ICP with other software, discovering the full potential of business operations and becoming Blockchain- and AI-ready.

The response we have received after launching ICP makes it clear the industry needs the platform. We are engaged with more than 40 potential new clients in a range of commodity markets today.

Activate Social Media: