FundPaaS helps businesses meet their working capital requirements by converting customers into investors through equity and debt crowdfunding. FundPaaS’s financial product and business model represent a new solution to help small and midsize businesses raise capital. Here is our interview with Amilcar Chavarria, Co-Founder and CEO of FundPaaS:

Q: What is FundPaaS?

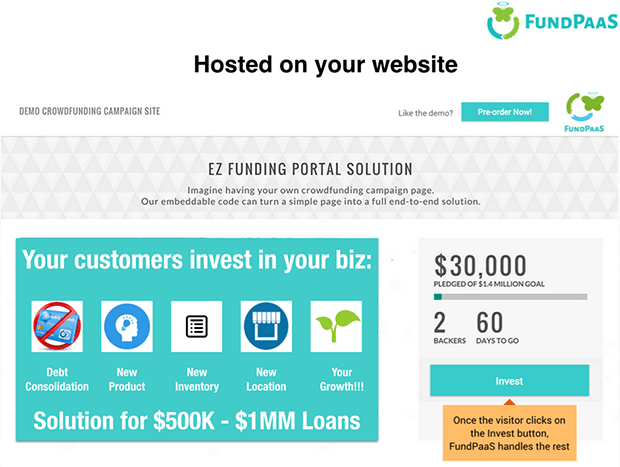

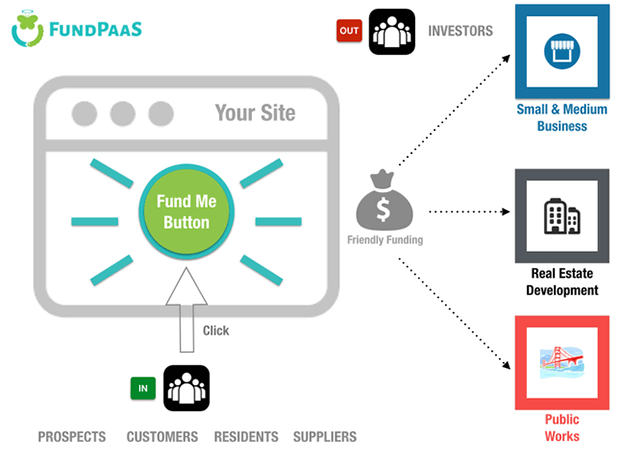

A: FundPaaS stands for Funding Platform as a Service. The best way to think about it is as a web plug-in or button that any business can embed into an existing website to raise capital by converting customers into investors without leaving the site.

Q: What’s your Mission?

A: Our mission is to help American businesses meet their working capital requirements by converting customers into investors through equity and debt crowdfunding. We seek a quadruple bottom-line in what we do. To us, well capitalized SMBs, lead to new jobs and new jobs lead to food on the table and discretionary spending which constitutes 70% of our GDP. If that in turn leads to a healthier economy we’ve created social wealth and our mission is accomplished.

Q: What’s the problem you are solving?

A: For the 28MM SMBs out there, borrowing via Banks, SBA or Alternative Lending Sites tends to be:

1) Expensive: Average 15% APR

2) Time consuming: lots of applications get denied and finding investors is time consuming

3) Limited in terms of capital: most platforms lend up to $500K and banks have a hard-time underwriting loans under $1MM

4) Complex if you do it alone: requiring finance, legal and technology know how

Related: New York BizLab Helps Tech Companies Grow Smart And Grow Fast

Related: New York BizLab Helps Tech Companies Grow Smart And Grow Fast

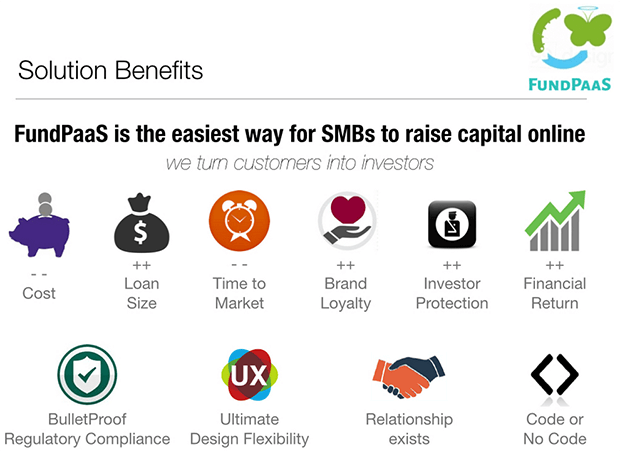

Q: Why does your solution work?

A: The main reason is that when businesses borrow from the same people they love and serve best, it makes the relationship stickier. From a customer loyalty perspective, it becomes harder for those customers to leave that business since their switching costs went up as a result of an investment. More importantly, these same customers turn into free marketers, mentors and evangelists for your brand. Oh and let’s not forget, we make it extremely easy for businesses to register and copy and paste their own “Fund Me” button into their sites.

Related: Angel Capital Group Helps Innovative Startups Fund Their Future

Related: Angel Capital Group Helps Innovative Startups Fund Their Future

Q: Why do you feel that your team is qualified to win in this space?

A: Our competitors include regional banks, agencies (e.g. SBA) and new online lending alternatives. Our team members have helped the launch of over 150 crowdfunding portals since the passing of Title II in September of 2013 (i.e. the birth of crowdfunding for equity) and collectively have 40+ years of FinTech, Regulatory Compliance and Securities Laws expertise, which are areas that most of our competitors lack or don’t get. From extensive research and hands-on experience in crowdfunding and digital wealth management (i.e. 5 startups collectively), we understand better than most of our competitors how difficult it is for consumers to invest online.

Q: What’s new about what you’re making? What substitutes do people resort to because it doesn’t exist yet?

A: Our one-click “Fund Me” button, financial product and business model represent a new solution to help SMBs raise capital by turning their customers into investors during checkout for example. Otherwise, they’d resort to banks, alternative lenders or crowdfunding portals for loans which are hard to get, expensive, time-consuming and insufficient. Under Reg A+, SMBs can borrow up to $50MM vs. a typical maximum of $250K online. In most states that have approved intrastate crowdfunding, businesses can borrow up to $2MM per year.

Because of recent laws, FundPaaS is a viable alternative vs. gaining the trust of a new investor and paying 5 – 9% to a crowdfunding portal like Indiegogo. FundPaaS fees are only a fraction of what you’d pay there. Using partnerships with banks and money managers, we’ll also bring additional funding sources and investors to your site. You can get a quick sense of the product here.

Related: Fintech Sandbox – Helps FinTech Startups Build Great Products And Apps

Related: Fintech Sandbox – Helps FinTech Startups Build Great Products And Apps

Q: Why did you pick this idea to work on?

A: Our basis for selecting this idea is:

Big Market: a 1% shift of the $30 trillion held in long-term assets to small businesses would amount to $300Bn as the estimated market for business crowdfunding (Locavesting).

Hyper-growth: crowdfunding is expected to hit $40Bn in raised capital this year alone

Regulatory Changes: new intrastate exemptions in 21 states and federal rules (i.e. Reg A+) make it possible for everyone to invest in SMBs.

Domain Expertise & Social Impact: Our team has deep expertise in FinTech, CrowdFunding, Regulatory Compliance & Securities Laws.

Q: Could you tell us more about your team?

A: FundPaaS’s founding team of five brings many years of Entrepreneurship, FinTech, Legal and Compliance expertise and collectively; they’ve started eight companies and two non-profits prior to FundPaaS, hold five engineering degrees, a juris doctor degree and three business & liberal arts degrees including an MBA from a top institution like Wharton.

Q: How do we get a hold of you?

A: On our site there’s a quick contact form.

Q: What’s the next product for you guys?

A: We are rolling out a Social Media Application that can help any business raise capital on Facebook. Now that’s something I “Like“.

Activate Social Media: