AlleyCorp recently announced a significant expansion in its investment strategy with a new $250 million fund, which includes external investors for the first time. This fund is set to bolster early-stage startups in technology, healthcare, and other sectors, providing not just capital but strategic support to foster innovation and growth. Through this initiative, AlleyCorp enhances its role in shaping the tech ecosystem, underpinning the development of transformative companies and technologies.

AlleyCorp’s Strategic Move

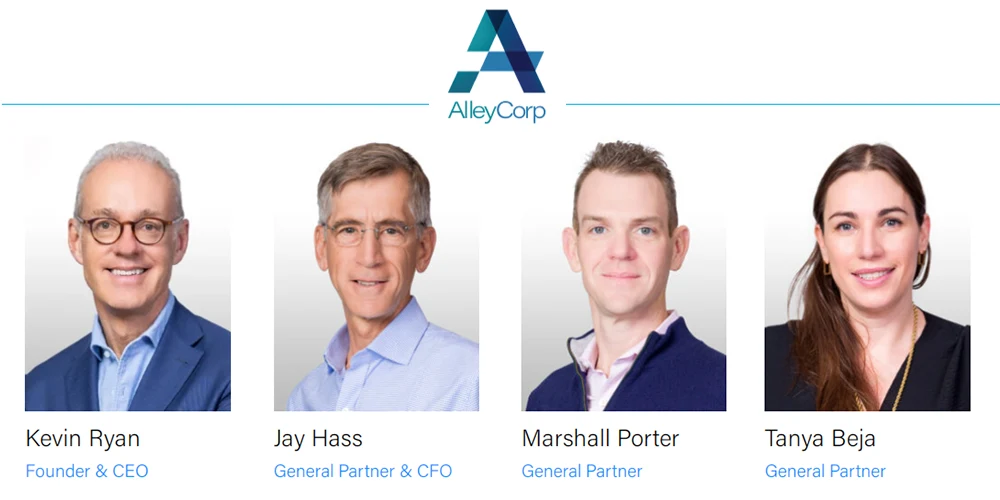

AlleyCorp, established by prolific New York internet entrepreneur Kevin Ryan, recently unveiled a significant expansion in its investment activities with the introduction of a new $250 million fund. This move is not merely a routine financial venture but a strategic initiative marking a pivotal moment in the firm’s history. By incorporating external investors for the first time, AlleyCorp is broadening its operational framework and setting the stage for enhanced impact on technological innovations and the entrepreneurial landscape in New York and beyond.

Analysis of the $250M Fund

This new $250 million fund distinguishes itself by welcoming external investors, a departure from AlleyCorp’s traditional funding practices. The fund aims to sustain AlleyCorp’s robust investment pace, which historically injects approximately $100 million annually into nascent tech enterprises. This strategic shift not only diversifies the financial base supporting these ventures but also enriches the ecosystem with a broader range of insights and expertise. The engagement of select limited partners (LPs) who share a vision for deep collaboration reflects a thoughtful expansion of AlleyCorp’s investment philosophy.

AlleyCorp’s Investment Philosophy and Focus

AlleyCorp maintains a clear focus on fostering innovation within key sectors such as consumer technology, enterprise solutions, robotics, healthcare, and social impact initiatives. The firm’s approach combines a rigorous research-driven methodology with a hands-on investment style, ensuring that financial support is coupled with strategic guidance. The consistency in this strategy enables AlleyCorp to not just fund but also actively contribute to the foundational stages of company development, enhancing their potential for success and sustainability.

Implications for Early-Stage Startups

The injection of $250 million into the venture ecosystem is a boon for early-stage startups, particularly in AlleyCorp’s active domains. This fund is likely to catalyze the growth of emerging companies by providing not only capital but also strategic mentorship. AlleyCorp’s history of being often the first to write checks in seed rounds demonstrates its commitment to nurturing startups from the ground up. This has profound implications for entrepreneurs seeking both financial backing and a collaborative partner to navigate the complex terrain of scaling innovative technologies.

Recommended: Grafine Partners Secures $600 Million For Innovative Private Equity Strategy

AlleyCorp’s Role in the Broader Tech Ecosystem

AlleyCorp’s influence extends far beyond the realm of financial investment. As a prominent incubator and investor, the firm plays a critical role in shaping the technological landscape, not only by funding but also by actively participating in the development of companies. This involvement includes originating ideas, assembling teams, and providing ongoing leadership and support through various growth stages. This integrative approach helps cultivate a vibrant tech ecosystem, fostering an environment where innovation thrives and entrepreneurial endeavors receive the support necessary to evolve from nascent startups to established entities.

Key Ventures and Innovations Funded by AlleyCorp

Throughout its history, AlleyCorp has been instrumental in the rise of several significant tech enterprises. Noteworthy examples include:

- MongoDB: A leader in modern, general-purpose database platforms.

- Zola: Innovating within the wedding registry and planning market.

- Nomad Health: Revolutionizing healthcare staffing with a tech-driven approach. With the new fund, AlleyCorp continues to invest in groundbreaking projects such as:

- Radical AI: Transforming material science with AI-driven autonomous labs.

- Conduce Health: Pioneering a marketplace model for specialty care in healthcare, enhancing value-based care delivery.

Future Outlook and the Impact on Tech Entrepreneurship

AlleyCorp is poised to continue its role as a key supporter of innovative ventures, focusing on AI, technology, and sustainable practices to foster industry growth. With the new $250 million fund, the firm aims to drive significant technological advancements, reinforcing its influence in the venture capital landscape. This commitment supports the next generation of tech pioneers, catalyzing the development of solutions that address complex challenges and enhance both economic and social value.

Please email us your feedback and news tips at hello(at)superbcrew.com

Activate Social Media: