Dispatch, a rebranded wealthtech platform formerly known as OneAdvisory, has successfully raised $8 million in seed funding, signaling strong investor confidence. The platform revolutionizes wealth management by utilizing optical character recognition (OCR) technology for efficient client data management. This innovative approach positions Dispatch to significantly impact the wealth management sector, setting new standards in data integration and management.

Introduction: The Dawn of a New Era in Wealth Management

The wealth management sector is witnessing a transformative era, marked by rapid technological advancements and innovative solutions. At the forefront of this change is Dispatch, a platform that has recently garnered significant attention with its $8 million seed funding. This investment signals a strong market confidence in Dispatch’s unique approach to wealth tech, setting the stage for a deeper exploration of its impact and potential.

From OneAdvisory to Dispatch: A Story of Transformation

Originally known as OneAdvisory, the company’s journey to becoming Dispatch is a tale of strategic evolution. Recognizing the need for a more descriptive and impactful brand, the decision to rebrand reflects a commitment to their core mission: to streamline and enhance wealth management through superior technology. This transformation is not just a change in name but a reaffirmation of the company’s dedication to innovation in the wealth tech space.

Unpacking the $8 Million Seed: Investors Bet Big on Dispatch

The recent infusion of $8 million in seed capital into Dispatch is a testament to the confidence investors have in its potential. This funding round, led by global venture capital firm F-Prime Capital and supported by existing and new investors including Ritholtz Wealth Management, underscores the belief in Dispatch’s vision. The investment is more than just financial backing; it’s a strong endorsement of Dispatch’s approach to reshaping the wealth management industry.

Dispatch’s Secret Sauce: What Sets It Apart in Wealth Tech?

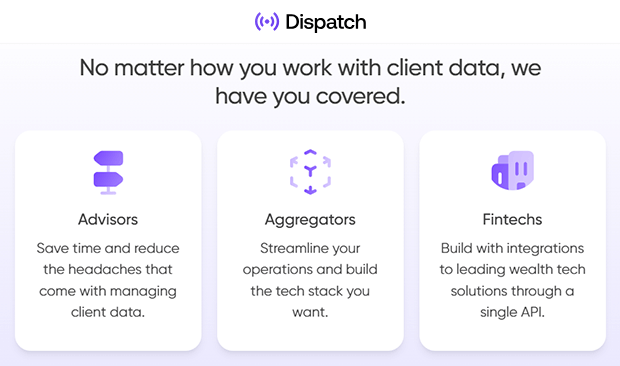

Dispatch distinguishes itself through its innovative approach to data management. Unlike traditional platforms, Dispatch focuses on seamless integration and efficient data handling. This approach addresses a critical pain point in wealth management: the need for a unified system that can effectively manage and synchronize client data across various platforms. Dispatch’s solution offers a unique blend of simplicity, efficiency, and technological sophistication, setting a new standard in the industry.

The OCR Edge: Simplifying Client Data Like Never Before

One of Dispatch’s standout features is its use of optical character recognition (OCR) technology. This technology enables the platform to extract and utilize data from a wide range of documents, such as tax returns and brokerage statements. The OCR capability not only enhances data accuracy but also significantly reduces the time and effort required for data entry. This feature exemplifies Dispatch’s commitment to leveraging cutting-edge technology to simplify and improve the wealth management process.

Recommended: Vidiofy’s Breakthrough: Crafting Dynamic Reels With Generative AI Technology

Beyond the Tech: Dispatch’s Vision for the Future of Wealth Management

Dispatch’s ambitions extend far beyond its current technological offerings. The company envisions a future where wealth management is not only more efficient but also more accessible. This vision includes expanding the platform’s capabilities to cater to a broader range of financial advisors, regardless of their firm’s size. Dispatch aims to democratize high-end wealth management technology, making it a standard tool in every financial advisor’s arsenal.

The Ripple Effect: How Dispatch’s Rise Influences the Wealth Management Sector

The emergence of Dispatch is reshaping the landscape of the wealth management sector. Its innovative approach is setting new benchmarks for data management and client service, compelling other players in the industry to elevate their technological standards. Dispatch’s success is creating a ripple effect, encouraging innovation and improvement across the sector. This dynamic shift is not only beneficial for wealth management firms but also for their clients, who stand to gain from more efficient and accurate financial services.

Dispatch in Action: Case Studies and Success Stories

Dispatch’s effectiveness is best illustrated through its real-world applications. Several wealth management firms have already integrated Dispatch into their operations, witnessing substantial improvements in data management and client service. For example, a mid-sized firm reported a 30% reduction in time spent on data entry and a significant increase in data accuracy. These success stories underscore Dispatch’s practical value and its ability to deliver on its promises.

The Road Ahead: Challenges and Opportunities for Dispatch

Despite its early success, Dispatch faces challenges and opportunities as it navigates the wealth tech landscape. The company must continuously innovate to stay ahead of rapidly evolving technology trends and growing competition. Additionally, Dispatch needs to expand its market reach and adapt to the diverse needs of various financial advisors. However, these challenges also present opportunities for growth and further innovation, positioning Dispatch to potentially lead the next wave of advancements in wealth management technology.

Wrapping Up: Dispatch’s Journey to Reshape Wealth Tech

In conclusion, Dispatch’s journey from OneAdvisory to a trailblazer in wealth tech is a compelling narrative of innovation, strategic rebranding, and market impact. With its recent $8 million funding, Dispatch is well-positioned to continue its trajectory of growth and influence in the wealth management sector. As the company moves forward, it carries the potential to redefine how financial advisors manage and utilize client data, ultimately benefiting the entire industry.

Please email us your feedback and news tips at hello(at)superbcrew.com

Activate Social Media: