Below is our recent interview with Pamela Rodriguez, Marketing Director at Renew Financial:

Q: Could you provide our readers with a brief introduction to Renew Financial?

A: Absolutely! Renew Financial was founded in 2008, and is one of the leading, and the most experienced, Property Assessed Clean Energy (PACE) financing companies in the nation. Actually, Renew Financial is the company that brought PACE financing to life. Cisco Devries, one of our co-founders, did not believe that it was fair or right that only those homeowners that had a lot of money in the bank could put improvements on their home that made them safer, and that saved energy.

Our company and the PACE program were created to bring to market an affordable home improvement financing option that allowed all homeowners, even those who did not fit in the box for traditional financing options such as a cash-out refinance; home equity line of credit; home equity loan; personal loan; or credit cards, to have access to the funds they needed to make their eligible home improvement projects a reality.

We currently provide PACE financing to homeowners located in participating communities in California and Florida, and we’re actively working towards expanding our program to more communities within the two states as well as beyond these.

Q: What is your mission and vision?

A: Our mission is to be the nation’s leading and most trusted provider of financing for sustainable building improvement projects. These projects strengthen communities by making our customers’ homes and businesses safe, energy efficient, and more valuable. Our vision is to create financial access to a safe, healthy, and sustainable world.

Q: Can you give us more insights into your product?

A: Unlike traditional forms of financing, PACE is secured by the property itself via a voluntary tax assessment and it is paid as an addition to the property tax bill. A lien is recorded against the property and it stays in place until the financing agreement is paid back in full.

Contrary to public belief, PACE is not a new financing mechanism. Homeowners have actually been paying non-voluntary assessments through their local property taxes for projects that benefited individuals and their communities, such as sewer systems, streetlights, and utility lines. These assessments are known as the “land- secured financing district financing model” and have been around for 100 years, PACE financing is an extension of this financing model.

With PACE financing homeowners can make eligible home improvements without having to pay upfront costs, and because the assessment is property-based the homeowner does not need to meet a minimum credit score requirement to qualify. Plus, the program offers 100% financing, competitive fixed interest rates, and payment terms of up to 30-yrs. depending on the expected useful life of the product(s) being installed.

It is important to note that PACE financing is not a government subsidy, it is private financing that must be repaid in full. Like other types of financing, it is also subject to approval, and underwriting requirements and restrictions apply. Homeowners should perform their due diligence when selecting a contractor, and read their financing documents carefully to avoid misunderstandings.

Q: What makes your product unique compared to traditional forms of financing?

A: Over the years the PACE program has significantly evolved, and today it has some of the most comprehensive consumer protections compared to other forms of home improvement financing in the market. For example, in order for a contractor to be able to offer our PACE financing they must first pass a due-diligence review and maintain a satisfactory standing.

Homeowners are provided with numerous disclosures, a confirmation of terms call, and a commitment that funds will not be disbursed to the contractor until a certificate of completion is signed by the homeowner indicating the job has been completed to their satisfaction. Other forms of home improvement financing traditionally come with far fewer consumer protections and valuable safeguards than PACE financing.

Q: What kind of home improvement projects can one finance though PACE?

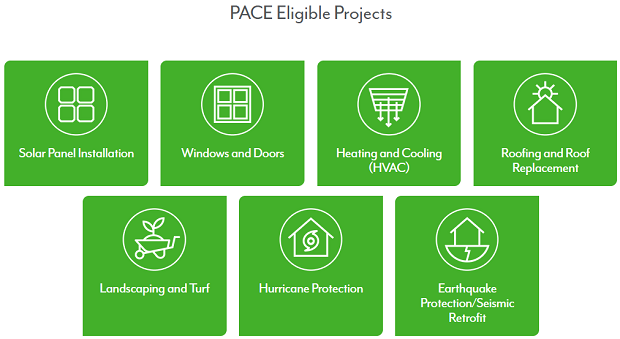

A: There are hundreds of eligible projects and products that one can finance through PACE, but the most popular ones include solar panels, roof replacement, Heating and Ventilation Air Conditioner (HVAC) systems, impact resistant and energy efficient windows and doors, siding, and more.

Recommended: Meet Airbase – The Only Truly Comprehensive Spend Management Platform For Small And Midsize Companies

Recommended: Meet Airbase – The Only Truly Comprehensive Spend Management Platform For Small And Midsize Companies

Q: What can we expect from Renew Financial in next 6 months? What are your plans?

A: We are growing and have big plans to support our growth. While I’m not at liberty to share details, I can tell you that we are here for the long run. We are more committed than ever before to make PACE financing accessible to homeowners nationwide, and support our growing network of contractors with best in class service, tools, and technology.

Q: What is the best thing about Renew Financial that homeowners and contractors might not know about?

A: The best thing about Renew Financial is its people. We are passionate about the work we do and why we do it. We deeply care about the homeowners and the contractors we serve, improving the environment, and strengthening communities. I’ll share a story with you to put things into perspective as to how incredibly powerful the work we do through PACE financing can be.

I’ll try to be as brief as possible. This is the story of Helen from Port Charlotte, FL. Helen had gone through a financial hardship after losing her husband, and then her job. Even though she had been working hard to bring her finances back on track, her credit score was still too low for any lending institution to lend her money with terms she could afford, and her income was too high to qualify for any sort of financial assistance. Helen desperately needed a new roof and a new air conditioner.

Helen was ready to make the painful decision to sell the home in which she had many wonderful memories of her late husband, but she then learned about PACE from Renew and her life took an unexpected turn.

Helen was able to afford the upgrades she needed to stay in her home, in her own words “Thanks to Renew, I am able to stay in the home that my husband and I lived in. To me what Renew has done for me has been a God’s send, an absolute God’s send. There aren’t enough words for me to describe the fact that I can stay in my home. I am so grateful to Renew that I can stay in my home and I don’t have to worry about my ceiling coming down or my AC not working when I need it most.”

You see the impact of PACE financing goes beyond upgrading a home. We are talking about changing lives . The beauty of the program is that we can generally help homeowners from one end of the spectrum to the other solve what can feel as unsolvable. Plus, PACE home improvements can have positive economic and environmental impacts which benefits us all – it’s a win-win.

Activate Social Media:

Recommended:

Recommended: