Nirvana Insurance, a groundbreaking startup, is revolutionizing the commercial trucking insurance sector. By harnessing the power of artificial intelligence, telematics, and internet-of-things technology, the company is leveraging 15 billion miles of trucking data to craft precise risk models.

Securing $57 Million in Series B Funding

Recently, Nirvana secured an impressive $57 million in an all-equity Series B funding round. This capital injection will be instrumental in further expanding their big data platform, bolstering their team, and scaling their business operations. Notably, since its inception in 2022, the company has witnessed a staggering 30-fold growth. Esteemed investors such as Lightspeed Venture Partners, General Catalyst, and Valor Equity Partners have shown their confidence in Nirvana’s vision, effectively doubling the company’s valuation to over $350 million post-money.

Addressing the Challenges of the Trucking Industry

The trucking industry, predominantly comprised of small businesses, operates on razor-thin margins. With 90% of fleets owning fewer than 50 trucks and grappling with escalating fuel costs, many are struggling to stay afloat. Traditional insurance, which can cost between $15,000 to $20,000 annually per vehicle, further strains these businesses. Moreover, the lengthy processes involved in obtaining quotes, finalizing policies, and settling claims can be cumbersome and time-consuming.

Nirvana’s Cutting-Edge Solution

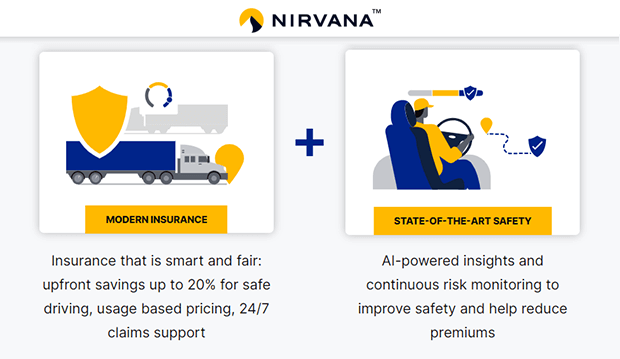

Nirvana’s innovative solution promises to streamline these processes. By tapping into the plethora of sensors embedded in trucks, the company can gather vast amounts of data to devise new pricing models. As CEO Rushil Goel points out, no other company is leveraging billions of data points from truck sensors in this manner. Furthermore, with the federal mandate in 2017 requiring all trucks to be equipped with electronic logging devices, the potential data pool is vast and growing. Nirvana’s tools also enable customers to swiftly file and process claims using dashboard camera footage and other data.

Safety Incentives and the Future of Fleet Insurance

One of the standout features of Nirvana’s approach is its ability to reward safe driving. By analyzing data from truck sensors and cameras, the company’s AI can determine driving patterns and behaviors. Safe drivers can benefit from discounts of up to 20% on their premiums. Raviraj Jain, a partner at Lightspeed Venture Partners, lauds Nirvana’s efforts, emphasizing the company’s role in modernizing insurance and promoting safety.

Nirvana Insurance is at the forefront of a transformative shift in the commercial trucking insurance landscape. By seamlessly integrating AI, IoT, and big data analytics, the company is setting new standards in risk assessment and customer service. As the IoT fleet management market continues to grow, Nirvana’s innovative solutions are poised to lead the way.

Please email us your feedback and news tips at hello(at)superbcrew.com

Activate Social Media: