Prove Identity’s Journey and Valuation

Prove Identity, a smartphone-based identity verification startup, has successfully secured $40 million in funding. This startup, which was formerly known as Payfone, underwent a rebranding in 2020. The recent funding has catapulted its valuation beyond the $1 billion mark, although the exact figure remains undisclosed. The company’s growth has been significant, with a 40% increase in its international business over the past year.

Innovative Authentication Technology

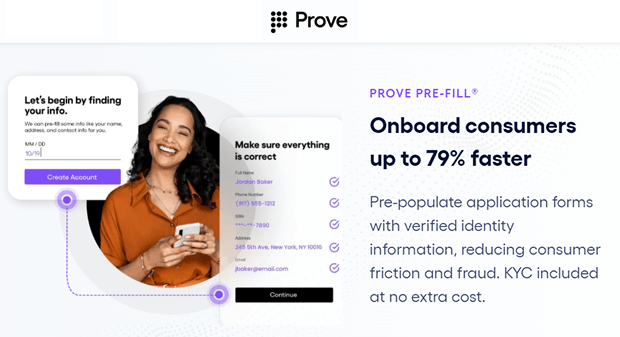

The core of Prove’s technology revolves around utilizing data from a phone’s SIM card, which serves as a privacy-centric proxy for digital identities. This data is then combined with smartphone features like facial recognition to authenticate users. Such authentication can lead to various actions, including pre-filling of information and password-free authentication. With the newly acquired funds, Prove aims to develop more tools for digital payments, commerce, and fraud detection.

Investors and Market Landscape

The funding round witnessed participation from strategic backers such as MassMutual and Capital One. The digital identity realm continues to gain traction, making it a focal point for investors. Prove’s previous funding round had secured $100 million just days before its rebranding. The company’s CEO, Rodger Desai, had then revealed its profitability, with a post-money valuation of $549 million.

Competition and Future Prospects

The digital identity verification space is bustling with competitors. While older startups like Jumio are still in the game, newer entrants like ThetaRay and Fourthline are leveraging AI-based approaches. The market also sees significant interest from private equity firms aiming for consolidation. Another notable mention is Worldcoin, co-founded by OpenAI’s Sam Altman, which is introducing a novel concept of scanning irises to establish a network of digital IDs.

Expanding Customer Base

Prove’s clientele has grown beyond just commerce. It now boasts partnerships with 9 of the top 10 U.S. banks, major global cryptocurrency exchanges, leading U.S. retailers, healthcare companies, and insurance firms. Some of its renowned customers include Experian, Visa, Starbucks, BlueCross BlueShield, and DocuSign.

Origins and Market Potential

Founded around 2008, Prove initially aimed to simplify e-commerce transactions by leveraging the ubiquity of smartphones. The company claims that its current tools facilitate faster onboarding, reduce abandonment rates, and significantly cut down on fraud. The market for identity and access management was valued at nearly $16 billion in 2022, indicating a promising future for companies like Prove.

Charles Svirk, a partner at MassMutual Ventures, expressed his enthusiasm for Prove’s potential, emphasizing its role in redefining digital identity. With this investment, Svirk will be joining Prove’s board of directors.

Please email us your feedback and news tips at hello(at)superbcrew.com

Activate Social Media: