Vance Street Capital recently closed its Fund IV, at a substantial $775 million, surpassing its initial target due to high investor demand. The firm continues its strategic focus on sectors like aerospace, and industrial technology, leveraging its expertise to enhance operational efficiencies and market competitiveness. This achievement underscores Vance Street’s robust position in the private equity market and its commitment to driving transformative growth within its portfolio companies.

Overview of Vance Street Capital’s Fund IV Milestone

Vance Street Capital, a Los Angeles-based private equity firm, recently announced the closure of its fourth fund at $775 million, reaching its hard cap significantly ahead of schedule. The firm, known for its targeted investments in North America, set an initial target of $550 million in January 2024 but saw overwhelming investor interest. This achievement not only underscores the firm’s robust standing in the market but also reflects a strong endorsement of its strategic vision amid fluctuating economic conditions.

Strategic Focus of Fund IV

Fund IV continues Vance Street Capital’s commitment to industries where technical precision and advanced engineering are paramount. The fund targets sectors such as medical devices, life sciences, industrial technology, and aerospace & defense. Each of these areas is recognized for its high barrier to entry and the critical nature of its products and services, which align with the firm’s expertise in fostering operational excellence and innovation.

Investment Philosophy and Approach

At the heart of Vance Street Capital’s strategy is a deep-seated partnership model with founder-owned firms, family-run businesses, and divisions spun off from larger corporations. This approach not only provides the capital necessary for these businesses to expand but also injects a level of operational acumen and industry knowledge that is tailored to enhance growth and market competitiveness. The firm leverages its extensive network of industry veterans and operational experts to elevate its portfolio companies to new heights of operational efficiency and market leadership.

Impact of Oversubscription on Fund IV’s Strategy

The oversubscription of Fund IV suggests a robust confidence among investors in Vance Street Capital’s strategic direction and management acumen. This excess funding may allow the firm to broaden its investment scope or increase stake sizes in target companies, potentially leading to greater influence and more significant transformative impacts within their industries. The additional capital also provides the firm with greater flexibility in navigating market uncertainties, ensuring sustained growth and innovation in its portfolio companies.

Recommended: ThreatLocker Secures $115M In Series D Funding To Enhance Zero Trust Security

Role of Partners and Investors

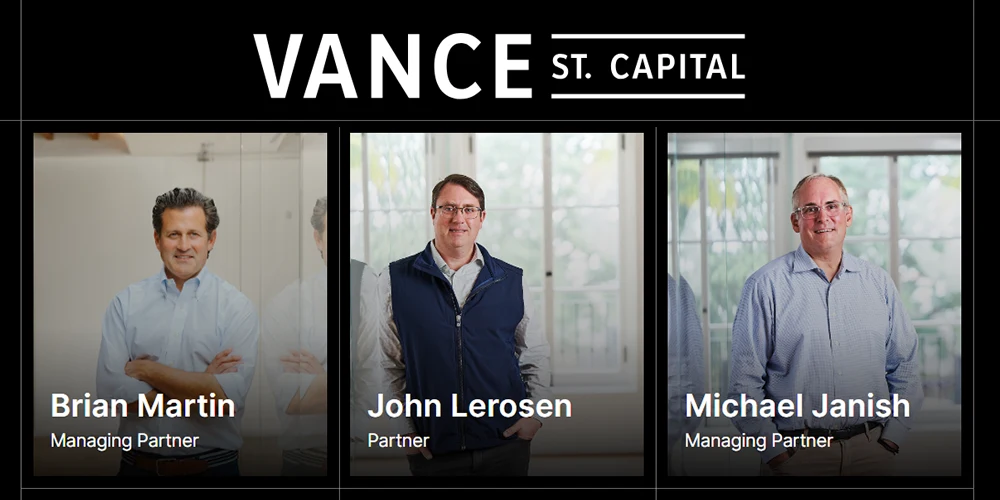

Vance Street Capital attributes much of its success to the strong relationships cultivated with both new and returning investors. These partners range from institutional backers to individual investors seeking to allocate funds in a firm with a proven track record. Their substantial commitments in the latest funding round exemplify trust in Vance Street’s ability to manage and grow strategic assets effectively. Managing Partner Brian Martin often highlights the importance of these relationships, emphasizing that the collaborative efforts with investors significantly contribute to the fund’s robust fundraising outcomes and strategic pursuits.

Historical Performance and Track Record

Over the past two decades, Vance Street Capital has consistently demonstrated its ability to identify and nurture potential within niche markets, resulting in substantial returns for its stakeholders. The firm’s history is marked by successful engagements where operational improvements and strategic initiatives have translated into increased revenues and market expansion for the companies involved. A glance at previous funds reveals a pattern of strategic exits and lucrative returns, showcasing the effectiveness of Vance Street’s hands-on investment approach and its keen eye for transformative opportunities.

Future Outlook and Strategic Goals

Looking forward, Vance Street Capital plans to continue leveraging its industry expertise and operational strategy to explore new opportunities in its core markets. The additional capital from Fund IV will likely fuel expansions into new geographical territories and perhaps even adjacent industries where the firm can apply its model of transformational growth. Such strategic expansions are carefully aligned with the firm’s long-term goals of fostering sustainable growth and maintaining a leading edge in the competitive landscape of private equity.

Securing a Sustainable Future

As Vance Street Capital looks to the future, its management team remains focused on the dual objectives of market expansion and sustainable growth. The successful close of Fund IV is more than a financial milestone; it is a testament to the firm’s resilient strategy and the trust it has cultivated among its investment community. The ongoing partnerships with founders and business owners are central to this strategy, ensuring that each investment not only contributes to financial success but also aligns with broader economic benefits and advancements within critical industries.

Please email us your feedback and news tips at hello(at)superbcrew.com

Activate Social Media: