Wynnchurch Capital recently closed its sixth private equity fund at $3.5 billion, surpassing its initial target and marking a significant achievement in the middle market segment. This milestone reflects the firm’s strategic investment approach and commitment to operational excellence. The closure of Fund VI positions Wynnchurch for future growth and continued influence in the private equity landscape.

A New Peak in Private Equity

Wynnchurch Capital, a renowned name in the realm of private equity, recently announced a landmark achievement with the closure of its sixth private equity fund, Wynnchurch Capital Partners VI, L.P., amassing a staggering $3.5 billion. This event not only underscores Wynnchurch’s prowess in the financial sector but also sets a new benchmark in the private equity landscape, particularly in the middle market segment.

The Journey to $3.5 Billion: How Wynnchurch Capital Made It Happen

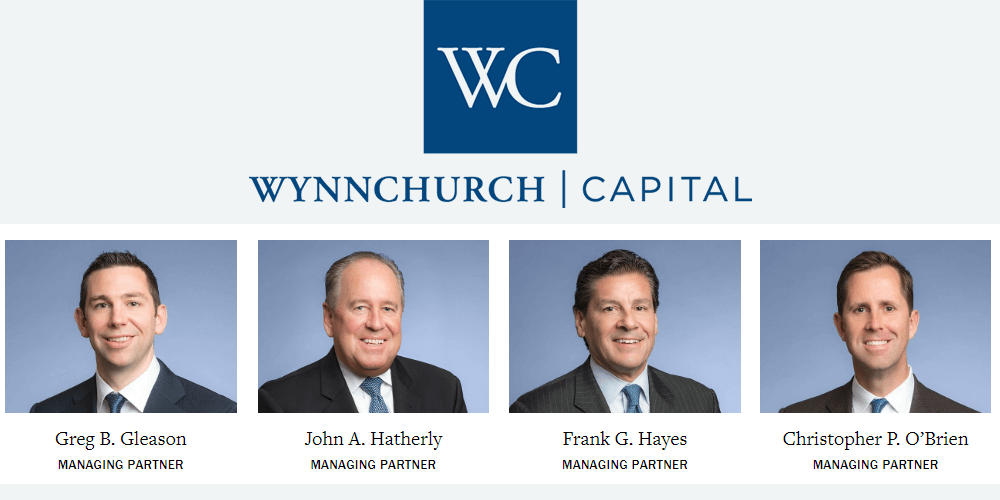

The path to this remarkable accomplishment was paved with strategic foresight and adept financial maneuvering. Wynnchurch Capital’s approach, characterized by a keen eye for potential and a steadfast commitment to value creation, played a pivotal role in attracting substantial investments. The firm’s leadership, including notable figures like Chris O’Brien and John Hatherly, steered the fund towards this success through their profound understanding of market dynamics and investor expectations.

Breaking Down the Numbers: What $3.5 Billion Means for Investors

The closure of Fund VI at $3.5 billion is not just a numerical milestone; it holds profound implications for investors and the broader market. This substantial capital infusion is poised to catalyze a series of investments, potentially leading to significant returns. For the investors, this development represents not only a vote of confidence in Wynnchurch Capital’s capabilities but also an opportunity to partake in a diverse array of promising investment ventures.

Wynnchurch’s Winning Formula: A Closer Look at Their Investment Approach

Wynnchurch Capital’s investment strategy is a blend of meticulous market analysis, focused sector expertise, and a partnership-driven approach. This formula has consistently yielded positive outcomes, as evidenced by the firm’s track record over the past 25 years. By prioritizing operational excellence and strategic growth, Wynnchurch has carved out a niche for itself in the private equity sector, particularly in the middle market.

Recommended: How Ask Viable Is Changing The Game In Qualitative Data Interpretation

Recommended: How Ask Viable Is Changing The Game In Qualitative Data Interpretation

The Ripple Effect: Wynnchurch Capital’s Influence on the Middle Market

Wynnchurch Capital’s influence extends far beyond the immediate sphere of its investments. The firm’s activities have a significant ripple effect on the middle market, often serving as a catalyst for growth and innovation. By injecting substantial capital into this market segment, Wynnchurch not only bolsters the financial health of its portfolio companies but also contributes to the broader economic ecosystem. This infusion of funds often leads to job creation, technological advancements, and enhanced competitive dynamics within various industries.

Beyond the Numbers: Wynnchurch’s Commitment to Operational Excellence

While the financial aspects are critical, Wynnchurch Capital’s commitment to operational excellence is a cornerstone of its philosophy. The firm doesn’t merely inject capital into its investments; it actively works with management teams to drive value creation. This approach involves a deep dive into operational efficiencies, market positioning, and strategic growth initiatives. The managing partners’ statements reflect a clear focus on not just financial gains but also on sustainable, long-term growth for their portfolio companies.

The Road Ahead: Future Prospects for Wynnchurch Capital and Its Investors

With the successful closure of Fund VI, the future looks promising for Wynnchurch Capital and its stakeholders. The firm is well-positioned to leverage its accumulated expertise and financial resources to explore new investment frontiers. Potential areas of growth could include emerging technologies, sustainable business practices, and international expansion. For investors, this represents an opportunity to be part of a forward-thinking and dynamically evolving portfolio.

“A New Chapter in Private Equity”: Wrapping Up Wynnchurch’s Monumental Achievement

In conclusion, the successful closure of Wynnchurch Capital Partners VI, L.P. at $3.5 billion is more than just a financial milestone; it’s a testament to the firm’s enduring commitment to excellence, strategic foresight, and operational acumen. This achievement not only reinforces Wynnchurch’s position in the private equity landscape but also sets the stage for future growth and innovation. As Wynnchurch Capital embarks on this new chapter, it continues to shape the contours of the middle market, promising exciting prospects for its investors and the broader economic landscape.

Please email us your feedback and news tips at hello(at)superbcrew.com

Activate Social Media: