Below is our recent interview with Richard Allin, Chief Revenue Officer at Assentis, who is responsible for developing the overall go-to-market plan and growth strategy for the Americas:

Q: Could you provide our readers with a brief introduction to Assentis?

A: We here at Assentis like to say our core business is “Visualizing Data/Content”

What that really boils down to is that we are focused on transforming the way financial firms communicate with their clients. We are looking to elevate the customer experience and turn “one-way outbound communication” channels into “two-way bi-directional conversations”.

We allow firms within the Banking, Financial Services, Insurance (BFSI) industry to create better experiences for their customers by providing business users the tools they need to easily create personalized, multilingual, compliant, multichannel, customer-centric communications. This allows firms to stay on-brand, reduce their risk, empower their business users and elevate the customer experience, while reducing costs and increasing efficiencies.

Everything I mentioned thus far helps the firm focus on their real end-goal, which is, or should be, elevating the customer experience (CX), with the expectation that this builds trust, credibility and a stronger, more profitable relationship over the long run.

Assentis solutions are in use by more than 110 organizations, including many of the top 10 banks, across the US, Europe & Asia, producing more than 5 billion multilingual documents annually worldwide. We are a technology company who understands that people and relationships matter, which is one of the main reasons why we have a 93% retention rate since our inception 17 years ago.

Assentis was founded in 2002 and is headquartered in Switzerland with offices in America, Europe and Asia.

Recommended: RapidValue Solutions: A Peek Into A Decade Of Driving Digital Excellence Powered By Mobile And Cloud

Recommended: RapidValue Solutions: A Peek Into A Decade Of Driving Digital Excellence Powered By Mobile And Cloud

Q: Can you give us insights into your services?

A: We are technology company who truly believes in putting the customer first. We provide consistent customer focused service with a dedicated team comprising of sales, pre-sales, professional services & management who works closely with our customers throughout their relationship with Assentis.

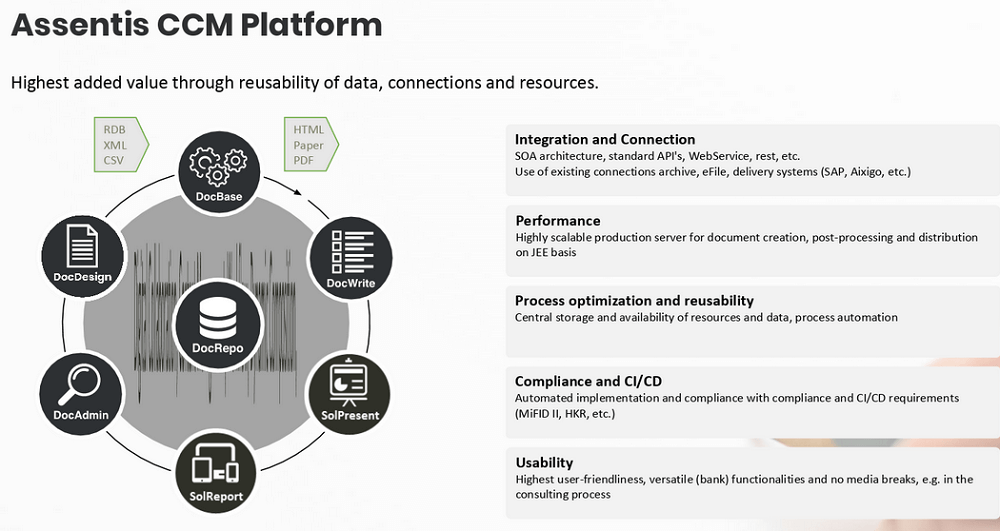

Our DocFamily Product Suite makes use of a modular open architecture, which enables us to meet our clients’ unique requirements, wherever the client is in their digital transformation journey. Installations can be on-premises or in the cloud and can easily be integrated via APIs into existing customer platforms.

Our professional services team starts the process by working collaboratively with the client to understand their goals and requirements in order to recommend solution options with a Proof of Concept, which allows the customer to interact and see the solution in action. Our team makes sure our clients maximize their investment in the solution.

We provide as much training and in whatever manner best suits our clients’ needs, and this is not a one-time training session, but something that continues throughout the relationship. We are working as partners in this endeavor, and not in silos.

Our product management team continually reviews client feedback and discusses their wish lists for inclusion in our product roadmap. This is how many of our solutions actually came about.

Q: You’ve recently announced expansion into US markets; could you tell us something more?

A: Well, we already had quite a few customers here in the states when we made the decision to grow the team in the region. As Assentis started to become known a little bit more in the US, we experienced a rapidly growing interest in our solutions, thus we decided it was best to have a team of people on the ground locally to handle this increased demand for our services.

Additionally, we wanted to make sure we nurtured our existing relationships and provided the high level of customer support we deliver elsewhere in the world, by servicing our clients locally.

Q: What makes Assentis unique?

A: One of the unique things about us is that we focus solely on delivering Customer Communication solutions to the BFSI community. By doing this we can provide the high level of experience and expertise that this industry demands.

The way we separate layout and content is quite a unique feature as well. This allows the business owners to gain independence from their IT department, empowering them to manage their own content (presentations, reporting, etc.) and create personalized & individualized communications, without relying on any help from their IT department. Furthermore, due to our business rules and permission-based access, management and users can be confident that the output is legally compliant and available only to restricted users, stays on brand, meets corporate image/design guidelines and is error free.

Q: Can you talk us about the various business use cases which your clients use your solution for?

A: We typically highlight a few business use cases which we see come up over and over again, but aren’t limited to those shown below:

Client Reporting, Investment Proposals, Pitchbooks & Presentations, Fund Fact Sheets, Customer Correspondence, On-Demand Communications and Automated Advices & Notifications.

We are always happy to elaborate on these further and share success stories we have encountered along the way.

Q: What makes Assentis a hot solution for customer experience?

A: Although many will say this isn’t sexy, we feel that the data output management piece is at the very heart of the CCM experience, which is why we choose to focus on this aspect of the business. We have some sophisticated front-end tools, but what goes on behind the scenes is our big differentiator and where we do things better than any other firm I know. It goes back to the separation of layout and content, which I mentioned earlier.

While many firms are looking to deliver AI, RPA, etc., we have found that a lot of the firms coming to us aren’t yet ready for such technologies. They are taking a step back and taking a long in-depth look at their core customer communication solution. They are coming to grips with the fact that they are trying to build cutting-edge solutions on top of a weak foundation and are realizing in many cases it makes sense to go back and firm up that foundation. This is one of the many reason’s firms choose our solution. We give them the strong foundation they are looking for, plus the ability to add new technologies as they arise and as the firm feels ready to implement such technologies.

Additionally, what makes us hot is that our team has extensive background in the BFSI space, so they are very well versed in what is the latest and greatest, and how to deliver the solution that best meets our customers’ needs today, and for tomorrow.

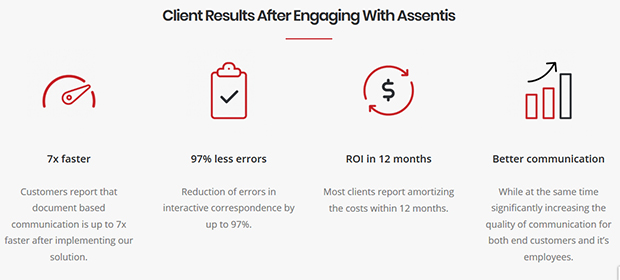

Some “hot” results our clients are experiencing after implementing Assentis solutions are: on an average they deliver their document-based communications seven times quicker, experience a 97% reduction in errors and see a total return on their investment in less than a year!

Q: Can you share some success stories with our readers?

A: We have stories from all across the globe, but one of the stories I like best is that of a large multinational bank who approached us with a particular pain point, which was to help them provide very high-end personalized reporting to their UHNW customers. We worked closely with them to provide a solution that met their demanding clients’ needs, while also providing them with the assurance that they were delivering a premium customer experience; one that would lead to better customer loyalty/retention and additional sales. Now that same firm has expanded their usage of our CCM platform and produces 1 billion pages annually covering 100 document types, which service multiple areas of the bank (credit, mortgage, savings, onboarding, etc.)

Recommended: Private Eyes Delivers Employment Security Solutions For Businesses Seeking To Reduce Liability Risk In Their Hiring Procedures

Recommended: Private Eyes Delivers Employment Security Solutions For Businesses Seeking To Reduce Liability Risk In Their Hiring Procedures

Q: Can you tell us why you have such a high retention rate amongst your customers?

A: People, product & process, in short.

Our people are the best in the industry! Our solutions team is extremely strong, working very closely with our customers and forging solid relationships We have found that many companies test the waters with us by starting with one business use case and then are so impressed with the results that they ask us to work with them to deliver solutions that address the additional pains they encounter.

Our products and solutions are robust, are ever-evolving and are designed for industry specific business use cases. We help financial firms create outbound documents in batch, ad-hoc or interactive mode. Our smart form and ePDF technology enable bi-directional communications, capturing in-bound content including attachments, and allowing automated relevant responses.

Our processes allow firms to streamline their operations and experience a much lower incidence of errors while elevating the customer experience. These processes empower businesses owners & increase process efficiencies through automation.

Q: What are your plans for the future?

A: Right now, one of key areas of focus is continuing our expansion in the Americas. As we do so, we are partnering with some of our key clients to develop new functionality like interactive client reporting and cloud solutions. Whilst we are always looking to develop solutions that are modular and fit in with current clients’ needs, so as to stay in the forefront of the space, we strongly believe our core expertise of document creation is critical to a firm’s success in their digital transformation journey. As stated earlier, we feel firms need to lay a strong foundation before they start to look too far forward, innovating technology they aren’t yet ready for just yet.

We aim to be the leader in the CCM space for financial institutions across the globe, as we are in Europe today, and are working hard to make that become a reality!

Activate Social Media: