Below is our recent interview with Nadine Lucas from Bankingblocks:

Q: Could you provide our readers with a brief introduction to Bankingblocks?

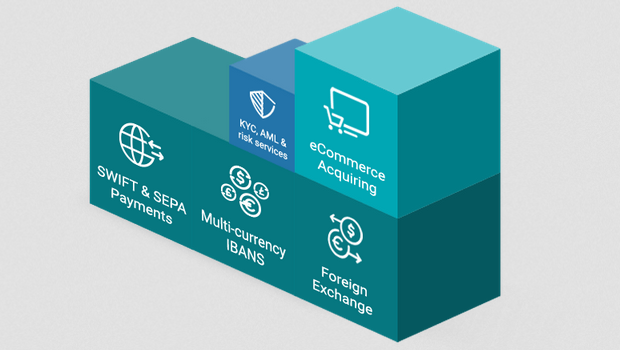

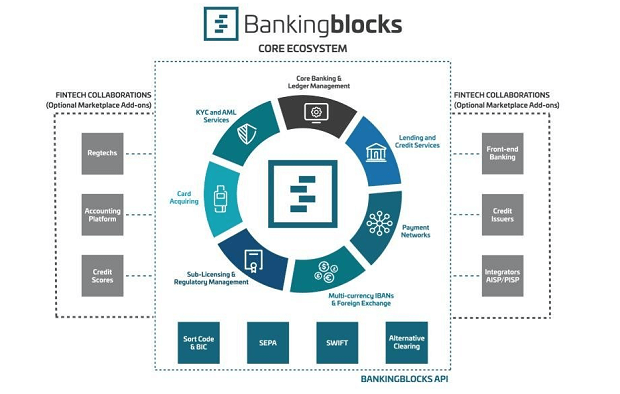

A: Bankingblocks offers purpose-built financial solutions for fintech and payment companies, which they, in turn, can offer to their customers. Bankingblocks is not a retail banking solution, but a true banking-as-a-service provider that has been tailored to suit the needs of modern, growing fintechs. Our services range from acquiring and banking (IBANs) to forex, SEPA / SWIFT payments, clearing, card issuing and more.

Bankingblocks offers “blocks” that their clients can select, arrange and connect to, in whatever

configuration they need. Bankingblocks has combined the traditional European PI, agency banking and acquiring licenses groups to create a stand-alone modular banking service for the fintech industry – driven by licensed banking products, not just technology.

Recommended: System Surveyor Changes How Systems Projects Are Being Planned And Managed

Recommended: System Surveyor Changes How Systems Projects Are Being Planned And Managed

Q: Can you tell us something more about your financial products (blocks)?

A: One of the industry’s main challenge is the lack of flexibility from traditional financial institutions. Bankingblocks offers modular banking and payments to fintechs allowing them to access the products they need – easier, faster and cheaper. One of our main blocks are real multi-currency (up to 28 end-to-end currencies) IBAN accounts, SEPA / SWIFT payments and direct Acquiring. With the financial products as these, fintechs can offer truly cross-border solutions to their customers in a fraction of time.

Through one simple connection, partners can gain wholesale access to the following financial products:

• Dedicated, multicurrency IBANS (per customer)

• Swift and Sepa clearing

• Visa, Mastercard, Cartes Bancaire, AMEX and JCB card acquiring services

• Debit and Prepaid card issuing

• Escrow and segregated account services

• Foreign exchange

• And many more

Our main blocks are supported by Compliance and Technology add-ons. Bankingblocks offers PI sub-license and white-label programs for licensed institutions as well as transaction screening, KYC,KYB and AML checks and Risk Management. Every block is also directly connected to our core banking platform. Fintechs can integrate their technology to the platform and get their own dedicated access.

All of the blocks are available through one contract allowing easy launch for our partners.

Q: What will be the next big industry trend?

A: When it comes to exciting industries, Fintech is about as good as it gets. The constant shift of consumer needs is the main driver of innovation. We will see a revolution turn into an evolution of strategic collaborations between the newcomers and traditional banks. Fintech companies turn technology into faster, smarter and more customer focussed financial solutions and services. The fintech ecosystem will continue to mature with interesting developments ranging from the rise of open banking, increasing regulatory requirements and maturation of regtech and insurtech. There is also expected to be a growing emphasis on consolidation, particularly in the payments area as companies look to grow globally.

I think the next big industry trend will be solidification of backend banking services. Fintech has been booming and their purpose is proven – customers need and want access to modern banking services, and convenience is king. Front-end development has been sky-rocketing, and I think that the next trend will be banking product development – or more specifically, the seeking and connecting of industry standard banking products, behind the great utility that Fintechs have already built.

Q: Why is now the time for a fintech solution like Bankingblocks?

A: Fintechs create the essential and innovative technical platforms that modern customers demand and need, but they are not receiving the support from traditional banks to deliver these. Whether it’s poor connectivity, concerns about market competition or a general disinterest and inability to help, fintech businesses are being increasingly impeded by traditional banks. Although there is widespread acceptance that fintechs will soon take over the customer-facing finance market, incumbent banks are still unequipped and unwilling to provide them the services they need to grow. Bankingblocks understands this and has built a fully integrated wholesale banking service, dedicated for Fintechs. This means Fintechs get instant access to industry leading banking and payment services, and can focus on what they do best (innovation and customer acquisition), and stop having to look for alternative banking providers or go as far as considering their own banking license applications.

Bankingblocks was created to solve this problem and power the future of fintechs: allowing these businesses to launch, grow and build, block by block.

Recommended: An Interview With Co-Founder And CEO Of Activus Connect, Felix Serrano

Recommended: An Interview With Co-Founder And CEO Of Activus Connect, Felix Serrano

Q: Bankingblocks CEO, Daria Rippingale, won the Emerging FinTech/Payment Leader Award 2019, congratulations! How exciting is that?

A: Yes, it’s extremely exciting. We were quite pumped when she was shortlisted but now that she won we are excited and proud. It is Bankingblocks’ corporate responsibility to support women in the industry on their way to the top. At Bankingblocks we’ve made it our corporate responsibility to become equality ambassadors and empower women in any professional environment.

Q: As a closing note, can you tell us what are Bankingblocks’ plans for the future?

A: Throughout 2019, Bankingblocks will keep expanding its suite of financial products with new quarterly rollouts, adding additional card issuing, UK Instant Payments, BACS, CHAPS and more to the existing product suite. Along with the new product additions, we expect a considerable growth of our team, especially in Compliance and Product departments.

Activate Social Media: