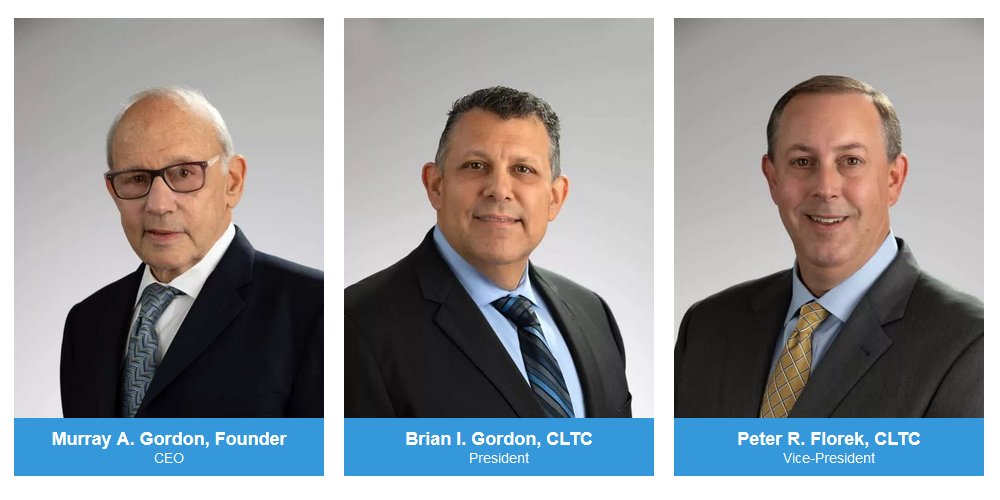

MAGA Ltd., also known as Murray A. Gordon and Associates, was founded in 1975 by Murray A. Gordon. Below is our recent interview with Brian Gordon, President of MAGA Ltd. Long Term Care Planning.

Q: For those unfamiliar with MAGA Ltd. can you provide a description of what your company does?

A: We are a family run business, which includes Murray, his son Brian Gordon and his son-in law, Peter Florek. MAGA specializes in Long Term Care planning and we are considered experts in our field. Working only with top-rated insurance carriers, MAGA tailors Long Term Care solutions to each person’s individual needs. MAGA focuses on LTC education for clients, financial advisors and other professionals, strives for exceptional customer service and is available to assist clients from start to finish (purchasing a policy to filing a claim decades later). MAGA represents all of the best Long Term Care insurance carriers and is licensed nationally.

Recommended: Otodata – A Key Player In The Tank Monitoring Industry

Recommended: Otodata – A Key Player In The Tank Monitoring Industry

Q: What are the key facts to know about Long Term Care Insurance?

A: Long Term Care planning education is the key to our 45 years in the LTCI industry. We want our clients and financial advisors to be familiar with all the available options to make an educated decision and plan successfully for retirement. We also focus on communicating to consumers and financial advisors the consequences of a LTC event and how it would affect a retirement portfolio and other assets without a plan in place. Purchasing a LTCI policy provides asset protection, guaranteed benefits no matter what is happening in the economy and peace of mind for the entire family when care is needed in the future.

LTCI provides coverage for a person who has a chronic problem and needs help with their activities of daily living (ADL’s – bathing, dressing, toileting, transferring, continence and eating) or has a cognitive impairment, such as Alzheimer’s or Dementia. Health Insurance and Medicare will not pay for chronic care. Long Term Care policies help cover the cost of Home Health Care, Assisted Living facilities, Skilled Nursing facilities and Adult Day Care. It also provides other benefits such as Respite care, Geriatric Care Management services and more. At MAGA Ltd. we educate our clients and advisors on both Stand-Alone “Traditional” LTCI and Hybrid Life/LTCI or Annuity/LTCI because we don’t believe one-size fits all when it comes to Long Term Care Insurance.

Q: Isn’t Long Term Care covered under Medicare and Medicaid?

A: Unfortunately, no, Long Term Care coverage under government plans is very limited and carries stringent requirements. That is why the government created tax incentives to encourage people to purchase their own LTCI plan. Medicare does not cover Long Term Care expenses and instead covers short term acute care that a person will typically recover from.

Medicare Requirements for a Nursing Home Stay

• You must be admitted to a hospital for at least three (3) days

• You must enter a Medicare approved nursing facility

• You must be in a Medicare approved bed within the approved facility

• You must be receiving skilled care on a daily basis

If an applicant meets all the Medicare requirements, Medicare will pay 100% eligible expenses for the first 20 days. For days 21-100, Medicare will pay only after a daily co-payment of $176 (for 2020) has been met. This is usually paid by a Medicare supplement plan, if you have one, or else you must pay it out of pocket. After the 100th day, neither Medicare nor a Medicare supplement will pay for nursing home care. At that point, you are on your own. That is not the case when you have LTCI!

Keep in mind, too, in order to be eligible for Long Term Care benefits under Medicaid, you have to “spend down” (i.e., exhaust) most of your assets first. There is a lookback period for 60 months in order to qualify for Medicaid. For more information you can visit our website for details and to download the 2020 Medicare Parts A and B information summary.

Recommended: FluxCredit Helps Indebt Americans Resolve Their Financial Woes

Recommended: FluxCredit Helps Indebt Americans Resolve Their Financial Woes

Q: Does everyone need Long Term Care Insurance? What are the pros and cons?

A: Not everyone needs or can afford a Long Term Care insurance policy, however, everyone does need a Long Term Care strategy. Long Term Care insurance allows you and your loved ones to execute a plan designed to protect retirement funds and assets. Family members will not need to worry about being a burden to other family members. It helps remove the questions and guilt that family members can experience over the care of a loved one. LTCI also helps relieve the financial burden of the growing cost of care. A disadvantage of Long Term Care insurance is that premiums can be expensive. If a person purchases a Stand-Alone “Traditional” LTC policy, the premiums may go up during the lifetime of the policy because the premiums are not guaranteed and are subject to future rate increases (side note, Hybrid Asset-Based Life/LTCI policies provide guaranteed premiums). If you never use your Stand-Alone LTCI policy after paying premiums for years or decades, some consider this to be a con. We disagree though because not using your policy means a chronic condition was not present at the end of a life. As the Founder/CEO of MAGA always says “it’s better to have it and not need it, then need it and not have it.”

Q: What are the company’s plans or goals for the future?

A: MAGA Ltd. will continue to deliver the best Long Term Care solutions for our future clients and provide top notch service for our existing clients. We have been specializing in LTCI for 45 years and have assisted our clients in collecting tens of millions of dollars in benefits over the years. We plan to expand further into our claims consultation program for policyholders who have agents that do not or cannot assist them any longer. We will remain committed to creating new and innovative solutions for financial professionals, corporations (employer/group LTCI), medical professionals and consumers. Most importantly, we will promote and assist in LTCI education whenever possible and continue to help our clients in any way we can.

Activate Social Media: