8vdX revolutionizes the startup investment landscape with its AI-powered tools, streamlining deal pipeline management and offering comprehensive insights for investors and venture capitalists. The platform facilitates efficient fund and LP management and provides tailored solutions like VentureInsights for angel investors and VentureInsights Plus for VCs. It stands as a paradigm shift in investment strategies, where AI-driven decision-making enhances the synergy between startups and investors.

8vdX and AI in Investment

In the dynamic realm of startup financing and venture capitalism, 8vdX emerges as a beacon of innovation. This platform is not just a tool; it’s a harbinger of a new age in investment strategies, where artificial intelligence (AI) is no longer a futuristic concept but a present-day reality. The integration of AI in investment isn’t just about automation; it’s about enhancing human decision-making with insights derived from data that’s both vast and intricate. 8vdX stands at the forefront of this revolution, wielding AI to demystify the complexities of investment and fundraising.

The Startup Challenge: Fundraising and Investment Hurdles

Startups are often ensnared in a web of challenges, with securing adequate funding being paramount. The journey from an innovative idea to a profitable business is fraught with uncertainties. Investors, on the other hand, navigate a labyrinth of options, seeking startups that promise not just returns, but revolutionary ideas and sustainable business models. The conundrum lies in matching these two worlds effectively. This is where 8vdX, with its AI-driven approach, steps in to bridge this gap.

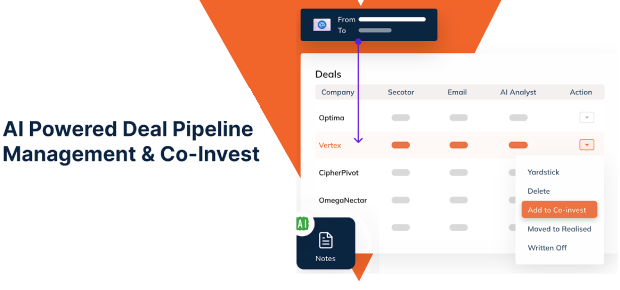

AI-Powered Deal Pipeline Management

The traditional methods of managing a deal funnel can be cumbersome, often inundated with a deluge of emails and pitches. 8vdX redefines this process through its AI-powered platform, enabling investors to manage their entire deal funnel with unprecedented ease. The platform is adept at sifting through inbound communication, ensuring that promising opportunities are highlighted. Moreover, the Co-invest tool on 8vdX facilitates a collaborative investment approach, allowing Limited Partners (LPs) to co-invest, thus democratizing the investment process.

Insightful Yardsticks for Investors

In a terrain as volatile as venture capital, the ability to benchmark and monitor portfolio companies is invaluable. 8vdX introduces ‘Yardstick’, a tool that empowers investors to generate insights that are at the forefront of the industry. With Yardstick, investors are equipped to stay ahead of the curve, making informed decisions with data-driven confidence. This tool is more than a mere analytical instrument; it’s a compass that guides investors through the ever-shifting landscape of startup investments, ensuring they remain informed and ahead in their strategic decisions.

Standardized Smart Investor Updates

The necessity for consistent and insightful reporting is paramount in the investment realm. 8vdX responds to this need with its capability to generate standardized, insightful reports from portfolio companies. This feature transcends the mere provision of data; it equips investors with the analytical prowess to discern trends and make pivotal decisions. The seamless feedback mechanism embedded in the platform further strengthens the bond between investors and founders, fostering a symbiotic relationship conducive to growth and innovation.

Recommended: The Q&A With Trevor Blyth, The President At Kamut International

Comprehensive Fund and LP Management Solutions

8vdX transcends the traditional boundaries of fund management by offering an all-encompassing solution for fund activity management. This facet of the platform caters to the intricate needs of managing documents such as Net Asset Value (NAV) reports, Tax Statements, and Audited Accounts. The process of onboarding investors, often a labyrinthine task, is simplified and streamlined. This holistic approach ensures that the operational aspects of fund management are as advanced and efficient as the investment decisions themselves.

VentureInsights: A Special Focus on Angel Investors and VCs

VentureInsights, a cornerstone feature of 8vdX, is tailored to meet the unique demands of angel investors and venture capitalists. For angel investors, the platform provides an AI-Powered Deal Management and Evaluation tool, streamlining the investment process. Venture capitalists and family offices benefit from VentureInsights Plus, an extensive AI-Powered Investing and LP Management Platform. These tailored solutions underscore 8vdX’s commitment to catering to the diverse needs of the investment community, ensuring that each user finds the tools and insights most relevant to their investment journey.

In sum, 8vdX stands as a paragon of innovation in the world of startup fundraising and investment. Its suite of AI-powered tools does not merely automate processes; it revolutionizes them, infusing a level of insight and efficiency previously unattainable. As we advance further into an era where data reigns supreme, platforms like 8vdX are not just advantageous; they are indispensable. They mark a new epoch in investment strategies, one where data-driven decisions become the cornerstone of successful investments. The future of startup investment and fundraising, as embodied by 8vdX, is not just about connecting money with ideas; it’s about fostering a symbiotic ecosystem where startups and investors thrive together, guided by the unparalleled insights that only AI can provide.

Please email us your feedback and news tips at hello(at)superbcrew.com

Activate Social Media: