Below is our recent interview with Peter Kent, from Koyo:

Q: For those who haven’t heard of it, what is the best way to describe Koyo?

A: Koyo is the UKs first open banking powered lender. Open Banking is the secure way to give lenders or financial providers like us, access to transactional banking data. Open Banking technology is sparking disruption in the financial services sector that will benefit millions of customers in the UK. Unlike other lenders who use credit agency data (which people new to credit, or the country won’t have), our innovative approach enables us to offer competitively priced loans, to an otherwise poorly served segment of the market.

Recommended: Lumegent Is Driven To Revitalize Physical Marketing In A Digital Age

Recommended: Lumegent Is Driven To Revitalize Physical Marketing In A Digital Age

Q: Why do we need a solution like Koyo these days?

A: Koyo was founded in 2018, on the principle that people who are new to credit, or the country, should be treated fairly when it comes to finance. There are over 6 million of these people in the UK alone. In the past, those seeking credit would be charged excessive fees for borrowing that caused financial problems, rather than solved them. We’re changing all that.

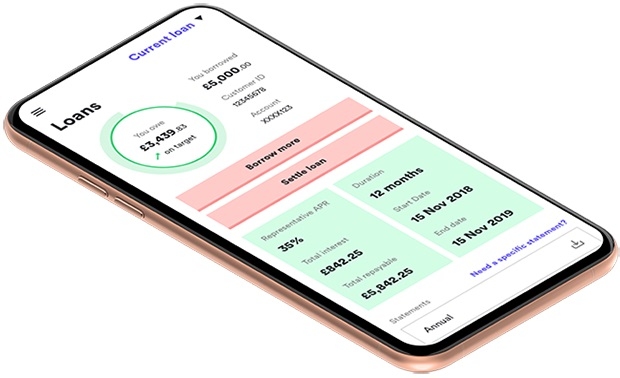

Q: How exactly are you able to offer competitively priced credit, without the use of guarantors or hidden fees?

A: When Koyo launches later this year it will be the only lender that requires all customers to complete an open banking process as part of the application. This enables Koyo to offer competitively priced credit, without the use of guarantors or hidden fees. Koyo is on a mission to provide loans that are personal and transparent, to those who have little or no options through no fault of their own.

Recommended: Meet Silvercrest – A Technology Company That Delivers Sophisticated Marketing And Media Solutions For Brands

Recommended: Meet Silvercrest – A Technology Company That Delivers Sophisticated Marketing And Media Solutions For Brands

Q: You’ve recently raised $4.9M in Seed round; could you tell us something more?

A: Koyo has closed a funding round led by Forward Partners with participation from Seedcamp. Co-investors include Christian Faes (Founder & CEO of LendInvest), and Charlie Delingpole (Founder & CEO of ComplyAdvantage).

Q: What can we expect from Koyo in the future?

A: Thomas (CEO) was quoted, “While Koyo is based in London, we have global ambitions. Our aim is to expand our product offering in the UK and explore other markets where thin file customers are underserved”.

Last Updated on December 1, 2019

Activate Social Media: