Below is our recent interview with Jordan Trimble, President and CEO at Skyharbour Resources:

Q: Could you provide our readers with a brief introduction to Skyharbour Resources?

A: Skyharbour Resources is a preeminent uranium exploration company with projects in the prolific Athabasca Basin of Saskatchewan in Canada, which was ranked as the second best mining jurisdiction to work in globally by the Fraser Institute in 2018. The Company has been acquiring top-tier exploration projects at attractive valuations culminating in six uranium properties totaling over 200,000 hectares throughout the Basin. Skyharbour’s goal is to maximize shareholder value through new mineral discoveries, committed long-term partnerships, and the advancement of exploration projects in geopolitically favourable jurisdictions.

Q: You’ve recently announced the completion of an Unmanned Aerial Vehicle Magnetometer survey; could you tell us something more?

A: We recently completed an Unmanned Aerial Vehicle Magnetometer Survey on our 35,705-hectare Moore Uranium Project. The project is located approx. 15 km east of Denison Mine’s Wheeler River project on the southeast side of the Athabasca Basin, Saskatchewan. Denison is a large strategic shareholder of Skyharbour. The survey conducted successfully identified high-priority, cross-cutting features and structures along the Maverick zone. The identification of these features has helped refine and identify current and additional drill targets for the upcoming winter diamond drilling program at Moore. Only 2 km of the total 4 km long Maverick structural corridor have been systematically drill tested leaving robust discovery potential along strike as well as at depth in the underlying basement rocks which have seen limited drill testing. With this survey, we continue to unlock the discovery potential at Moore through value-add, systematic and cutting-edge exploration techniques.

Recommended: Peerless Network – Cutting-Edge Provider Of Telecommunications Services And A Global Disruptor In The Telecom Industry

Recommended: Peerless Network – Cutting-Edge Provider Of Telecommunications Services And A Global Disruptor In The Telecom Industry

Q: What projects is the company involved with?

A: Skyharbour owns 100% of its flagship 35,705 hectare Moore Uranium Project located 42 kilometres northeast of the Key Lake mill, approx. 15 kilometres east of Denison’s Wheeler River project, and 39 kilometres south of Cameco’s McArthur River mine. Skyharbour has carried out several drill programs with multiple holes intersecting high grade uranium mineralization over the 4km long Maverick corridor. Drill results include 20.8% U3O8 over 1.5m at 264m depth in hole ML-199, 9.12% U3O8 over 1.4m at 278m in hole ML-202 and 5.29% over 2.5m U3O8 at 279m depth in hole ML-200.

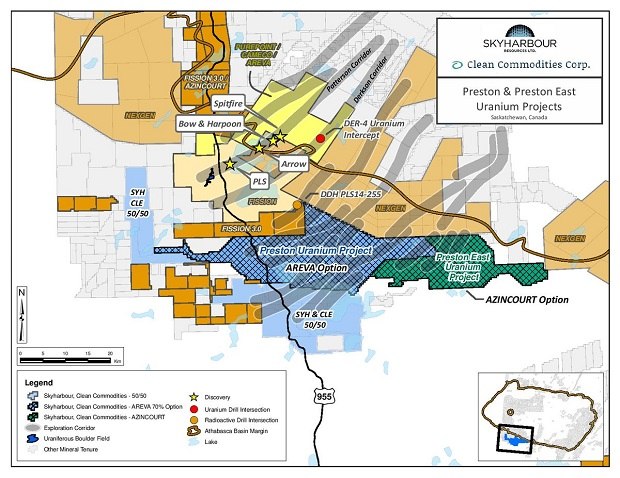

The Company’s Preston Project is a large land position totaling 74,965 hectares strategically located proximal to NexGen Energy’s (TSX-V: NXE) high grade Arrow uranium deposit and Fission Uranium’s (TSX: FCU) Patterson Lake South Triple R deposit. In March 2017, Skyharbour signed two separate option agreements, one with Orano Canada Inc. (France’s largest uranium mining and nuclear company) and one with Azincourt Energy, to option up to 70% of the project for $11,500,000 in total project consideration ($9,800,000 in exploration and $1,700,000 in cash payments over six years) as well as shares of Azincourt.

Skyharbour also owns 100% interests in the Falcon Point and Yurchison Uranium Projects totaling 84,710 hectares on the east side of the Basin. The Falcon Point property hosts an NI 43-101 mineral resource of 7.0 million pounds U3O8 inferred at an average grade of 0.03% U3O8 and 5.3 million pounds ThO2 inferred at an average grade of 0.023% ThO2 within 10.4 million tonnes using a cutoff grade of 0.01% U3O8.

Lastly, the Company has a 100% interest in the Mann Lake Uranium Project located on the east side of the Basin 25 km SW of Cameco´s McArthur River Mine. The project boasts highly prospective geology and geochemistry, and a robust discovery potential as identified by the historic work consisting of over $5 million in exploration including drilling.

Q: Can you provide some commentary on the current state of the uranium market?

A: The uranium market is showing signs of recovery and analysts that cover the sector have stated that there could be a sustained upswing as they are currently seeing some of the best fundamentals since pre-Fukushima. This should be supportive of higher uranium prices as a major supply-side response is playing out while the sticky demand-side continues to improve. Primary uranium production declined to approx. 138 million lbs U3O8 in 2018 with recent closures and project deferrals while demand continues to rise and is expected to be approx. 196 million lbs as per UxC in 2019. The spot uranium price is just under $25 / lb U3O8 which is still well below the average all-in global cost of production and significant price appreciation is needed to justify this production as well as developing new mines to ensure sustainable and secure supply to meet growing global demand.

Major production cuts and depleting mine reserves appear to be working their way into the uranium market and driving prices higher. The two largest producers, Cameco and KazAtomProm, have announced large supply cuts in 2017 and 2018 including Cameco’s suspension of operations at the world’s largest uranium mine, McArthur River. Additionally, several new uranium holding companies and funds have emerged to purchase physical material effectively taking further spot supply from circulation. Lastly, Cameco has commenced and will continue to buy millions of pounds of uranium directly in the spot market in 2019 and 2020 to fulfill their contracts.

On the demand side, there are 447 operating nuclear reactors and 55 new reactors under construction globally with hundreds more that have been ordered, planned and proposed. China continues to be at the forefront of demand growth and has the largest reactor pipeline including 46 operating reactors, 12 under construction and another 213 planned, ordered or proposed, making up a significant portion of the global pipeline of non-operating units. Additionally, India recently announced that the country has approved the construction of 12 new nuclear reactors to generate base-load, clean, reliable electricity.

Q: What are the company’s plans and goals for the future?

A: Skyharbour is planning a 2,500 metre diamond drilling program slated to commence later in the year / early next year. This drill program will test both unconformity and basement targets along the high grade Maverick structural corridor, as well as prospective regional targets identified by Skyharbour’s technical team. Of particular interest are potential underlying basement feeder zones to the unconformity-hosted high grade uranium present along the Maverick corridor. These targets have seen limited historical drill testing. Additional drilling will also be undertaken, dependent on local field conditions, on the landward portions of the recently discovered Otter Zone targets along strike of hole ML19-04. Furthermore, Skyharbour’s partner companies Orano and Azincourt are both planning exploration and drill programs at Skyharbour’s Preston and East Preston projects in the next several months which will provide additional news flow, discovery potential and share price catalysts for the company in the near term.

Recommended: California Company Revolutionizes How Traffic Tickets Are Contested

Recommended: California Company Revolutionizes How Traffic Tickets Are Contested

Q: Can you tell us about your background and the other people on Skyharbour’s board and management?

A: I started running Skyharbour about 6 years ago when it was a small public shell company. I’m an entrepreneur and have worked in the resource industry with numerous companies specializing in management, corporate finance and strategy, shareholder communications, deal structuring and capital raising. Previously, I was the Corporate Development Manager for Bayfield Ventures, a gold company with projects in Ontario which was successfully acquired by New Gold (TSX: NGD) in 2014. Through my career, I have founded and helped manage several public and private companies and have been instrumental in raising substantial amounts of capital for resource companies. I am a frequent speaker at resource and mining conferences globally and I have appeared on various media outlets including BNN and the Financial Post. I hold a Bachelor of Science Degree with a Minor in Commerce from the University of British Columbia and I am CFA® Charterholder currently serving as a Director of the CFA Society Vancouver.

Rick Kusmirski, P.Geo, M.Sc., is the Company’s Head Geologist. He has over 40 years of exploration experience in North America and overseas, and has actively participated in the discovery of a number of uranium, gold and base metal deposits. For several years, in his capacity as Exploration Manager, he directed Cameco Corporation’s (TSX: CCO) uranium exploration projects in the Athabasca Basin. In 1999, Rick joined JNR Resources becoming Vice President of Exploration in 2000. Subsequently, he directed the exploration program that led to the discovery of the Maverick Zone on the Moore Lake uranium joint venture in the Athabasca Basin in Saskatchewan with partner Kennecott Canada. Rick became JNR’s President and CEO in January of 2001. In February of 2013, Denison Mines Corp. (TSX: DML) successfully acquired all of the outstanding shares of JNR by way of a friendly all-share take-over bid.

David Cates, CPA, MAcc, is a Director of Skyharbour. David Cates, CPA, MAcc, is a Director of Skyharbour. He is the President and CEO of Denison Mines (TSX: DML) and Uranium Participation Corp (TSX: U). Prior to being appointed the President and CEO position Mr. Cates served as Denison’s Vice President Finance, Tax and Chief Financial Officer. As Chief Financial Officer, Mr. Cates played a key role in the Company’s mergers and acquisitions activities – leading the acquisition of Rockgate Capital Corp. and International Enexco Ltd. Mr. Cates joined Denison in 2008 and held the position of Director, Taxation prior to his appointment as Chief Financial Officer. Prior to joining the Company, Mr. Cates held positions at Kinross Gold Corp. and PwC LLP with a focus on the resource industry.

Paul Matysek, M.Sc., P.Geo, is a Strategic Advisor for Skyharbour and is a mining entrepreneur, professional geochemist and geologist with over 35 years of experience in the mining industry. He was the Founder, President and CEO of Energy Metals Corporation (“EMC”), a premier uranium company that traded on the New York and Toronto Stock Exchanges. Mr. Matysek led EMC as one of the fastest growing Canadian companies in recent years, increasing its market capitalization from $10 million in 2004 to approximately $1.8 billion when it was acquired by a larger uranium producer, Uranium One Inc., in 2007. In December of 2017, Mr. Matysek was involved of the sale of Lithium X Energy corp. for $265M to NextView New Enenergy. Mr. Matysek was the President and CEO of Goldrock Mines Corp. which on June 7th, 2016 announced it had entered into a definitive agreement to be acquired by Fortuna Silver Mines (NYSE:FSM) (TSX:FVI) for $129 million on a fully-diluted in-the-money basis. Previously, Mr. Matysek was the President and CEO of Lithium One Inc., which developed a high quality lithium project in northern Argentina. In July 2012, Lithium One and Galaxy Resources merged with a $112 million plan to create a fully integrated lithium company. Prior to Lithium One, Mr. Matysek was the President and CEO of Potash One Inc. where he was the architect of the $434 million friendly takeover of Potash One by K+S Ag, which closed in early 2011.

Activate Social Media: