YayPay is focused on bringing modern order-to-cash software to mid-sized enterprises. YayPay’s powerful back-office SaaS applies process automation, machine learning, and AI to accounts receivables operations to accelerate collections, boost worker productivity, improve customer relationship management, and predict cash flow with greater accuracy. Below is our recent interview with Anthony Venus, CEO and Co-founder of YayPay:

Q: You’ve recently announced $5.3m in venture funding; could you tell us something more?

A: Sure. With modern software powered by machine learning, we aim to turn finance teams into super-efficient revenue heroes by giving them workflow tools that finally match in robustness those used by their sales and marketing departments.

The funding puts YayPay at a major inflection point in which we can now recruit more great talent, roll out a full suite of intelligent order-to-cash automation software, and accelerate sales activities

The funding is led by QED Investors along with co-investors Birchmere and Fifth Third Capital, the direct equity investment subsidiary of Fifth Third Bancorp, with support from 500 Fintech Fund, Aspect Ventures, Gaingels, Techstars, and Zelkova.

Recommended: Timesheet Mobile Maximizes Collaboration And Productivity With Its Workforce Management Solution

Recommended: Timesheet Mobile Maximizes Collaboration And Productivity With Its Workforce Management Solution

Q: Could you provide our readers with a brief introduction to YayPay?

A: YayPay is finally bringing modern software to mid-market finance teams. YayPay released its first software module in January and has collected over $100 million in receivables, and processed more than 150,000 invoices.

Companies that use YayPay have reduced Days Sales Outstanding (DSO) by up to 25% while dramatically improving A/R productivity because collections teams can more accurately monitor cash inflow and proactively work with slow-paying clients. Finance staff typically report 3x more efficiency and can accelerate cash flow by 10 to 25%, which means millions of dollars more in free cash flow, and massive savings.

Q: What kind of features are you offering to your clients?

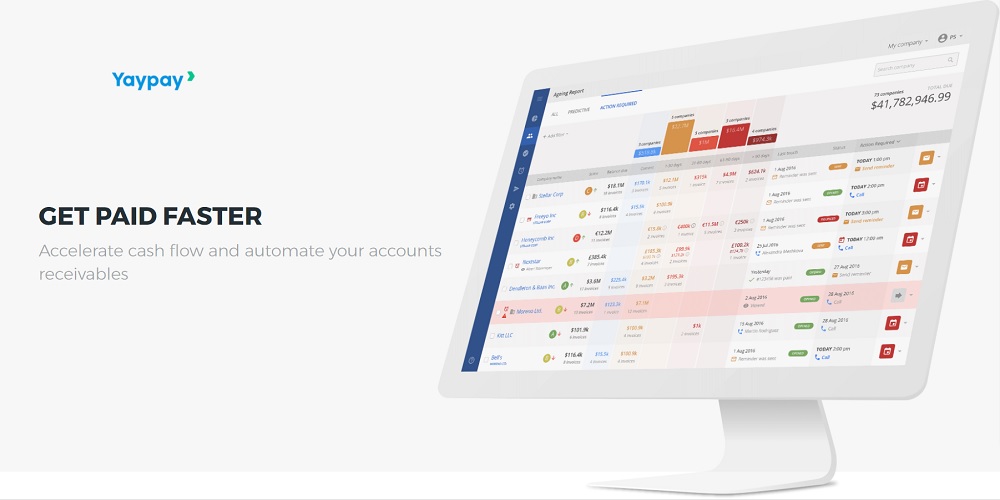

A: The YayPay A/R solution has five fundamental features for enabling finance teams to do their work.

The first is real time analytics cash forecasts that offer unparalleled visibility into A/R health on one page. Second, dynamic A/R aging reports so teams no longer need to spend hours scrolling through spreadsheets. The software lets them know exactly what customers they need to follow-up with, and when.

Third is a single point of record that consolidates ERP, CRM, email and much more. YayPay automatically syncs contact information and communication history so finance teams have easy access at all times. Fourth is CRM for A/R that enables teams to log calls, make notes, and track activity. This means fewer emails, more time for productive work, and faster collections.

Lastly, is complete communication history. The YayPay platform allows users to capture and track communications. Tracked communications make it easier for users to monitor and follow up on outstanding receivables.

Recommended: Paloozoo Gives Users Control Over Their Social Media Experience

Recommended: Paloozoo Gives Users Control Over Their Social Media Experience

Q: Why is now the time for a technology solution like YayPay?

A: Particularly for small and mid-sized business, understanding cash flow is crucial, but the A/R workflow lags business processes such as payroll, sales, and marketing in technical innovation. It’s a tedious, manual process that’s critical to any company’s bottom line, but up to now it’s been difficult to automate.

However, with advances in AI and machine learning, the A/R process can finally be modernized.

Q: What are your plans for the future?

A: With our funding round complete, we can now build up our resources so that we can continue our product development and roll out a full order-to-cash, automated and intelligent, suite of software that complements our current popular product that focuses on collections management and cash prediction.

We will also be able to increase sales activities so that we can add to our current base of customers. As I said earlier, this is a major inflection point for YayPay and you should expect to hear more from us as we accelerate our growth.

Last Updated on October 10, 2017

Activate Social Media: