Money laundering and terrorism financing are global concerns that all international financial centres must take seriously as the consequences of such illicit activities are severe and will adversely impact the integrity of the financial market.

As a leading international financial and business hub, Singapore enjoys a stellar reputation as a clean and trusted financial centre because of the zero-tolerance policy and strong AML/CFT regime. Today, we speak to 3E Accounting General Manager Chan Mee Chi, who shares about her firm’s strict controls on Anti Money Laundering and Countering the Financing of Terrorism, and how these controls helped 3E Accounting achieve full compliance in the Compliance Review conducted by external assessors appointed by the Accounting and Corporate Regulatory Authority (ACRA).

Q: What is 3E Accounting’s view regarding the risk that money laundering and terrorist financing have on our economy?

Mee Chi: Terrorism affects everyone in this age of global inter-connectivity. The impact of terrorism attacks such as 9-11 and the Mumbai attacks goes beyond the countries where these attacks took place, and they shook the confidence of the global economy. Anyone could be the target of any terrorist attacks or be involved in money laundering cases, hence the need for all of us to remain vigilant. By combating money laundering and terrorist financing, it helps to cut the flow of illicit funds and mitigate the adverse effects of criminal economic activity, and promote integrity and stability in financial markets.

Q: ACRA requires registered filing agents to comply with the Anti-Money Laundering and Counter Terrorism Financing Guidelines for Registered Filing Agents. How did 3E Accounting ensure compliance with the Guidelines?

Mee Chi: The requirements as per the Guidelines are part of our global effort to combat money laundering and terrorism financing, boost professional standards in the industry as well as to maintain Singapore’s reputation as an international financial and business hub. As ACRA’s registered filing agent, 3E Accounting is committed to carrying out its duty conscientiously and diligently for all its clients while maintaining the highest level of care and compliance on due diligence review aligned with ACRA’s Guidelines. 3E Accounting will conduct a strict due diligence review as appropriate when onboarding clients. 3E Accounting will also perform relevant periodic and on-going monitoring due diligence review.

Q: Is there anything that 3E Accounting does differently to maintain a strict due diligence review? Why is it important??

Mee Chi: 3E Accounting will not hesitate to reject or terminate a client if thorough due diligence according to 3E Accounting’s risk assessment policy on a client is unable to be completed.

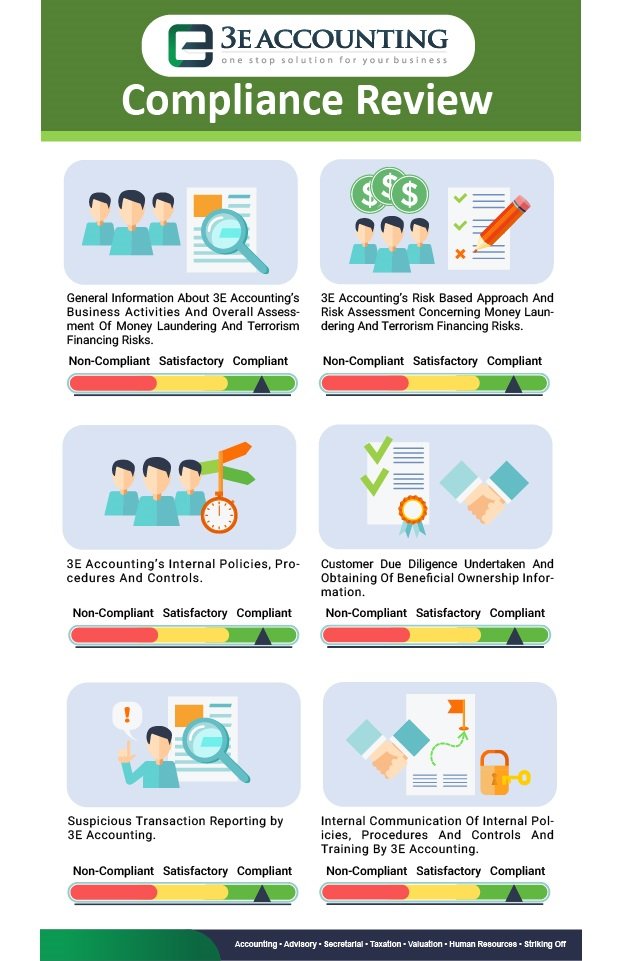

The scope of the Compliance Review covers the firm’s internal processes, whether the firm has an effective risk-based assessment and approach, conducts customer due diligence and obtains beneficial ownership information and has internal controls in place as well as provisions for suspicious transaction reporting.

Q: I understand that 3E Accounting is fully “Compliant” in adhering to ACRA’s Guidelines for Filing Agents. What does this mean for 3E Accounting’s professional standing?

Mee Chi: Yes, 3E Accounting is fully “Compliant” and this achievement demonstrates that 3E Accounting has strong internal policies, procedures, and controls in place to mitigate the risks of money laundering and terrorism financing. What’s more, this means that 3E Accounting is fully complying with prevailing ACRA and relevant Singapore’s regulatory requirements. This shows our professionalism and commitment to help maintain Singapore’s reputation as an international financial and business hub. It also guarantees our quality of services as we always uphold the value of integrity.

To conclude, an effective anti-money laundering and countering terrorism financing regime is crucial to safeguard market integrity. 3E Accounting is committed to support the global effort and we are confident that we will continue to meet our obligations to the AML/CFT regulatory framework.