CredHub reports rental payments to the major credit bureaus on behalf of property managers and their tenants. This provides an enormous amenity for renters who now receive credit for their largest monthly payment, when they pay on time. Below is our recent interview with Steve Jarvis, CEO at CredHub:

Q: What is unique about CredHub?

A: Unique to CredHub is our ability to also pull and report delinquent (late and skipped) payments to the bureaus. When property managers implement CredHub, and tenants know that late and skipped payments will affect their credit score, delinquent payments plummet.

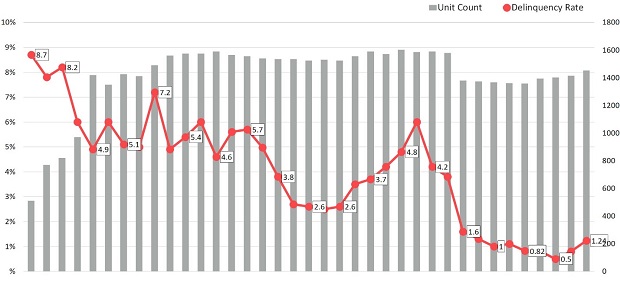

Here is the experience one CredHub property management client had after implementing the program. Delinquency rate dropped from 9% to 1%. This client was chasing 130 tenants a month to pay their rent, and now they are working with 10-15 tenants on the problem.

Recommended: An Interview With Eddie Rowland – CEO At Nexbelt

Recommended: An Interview With Eddie Rowland – CEO At Nexbelt

Credentialed with Equifax and TransUnion, the CredHub platform also gives the property manager visibility and control to payment reporting. We work with every major property management technology and are easy to implement. In addition, our pass-through revenue model provides a markup opportunity for clients to earn an incremental $5 dollars or more per tenant just by signing up.

With CredHub, property managers can provide a vital financial benefit to responsible tenants, decrease their time and frustration chasing delinquent payments, and increase their revenue per door. The program is a win for all parties involved, except those tenants who are planning to not pay their rent on time.

Q: What is your backstory? How did your company come into being?

A: The major credit bureaus finally started accepted rent as a reportable payment a few years ago. At that time the original Company, named Rental Payment Reporting, started manually pulling and reporting rental payments. Two years ago, the Company re-capitalized and renamed to CredHub. We used the new capital to build an automated and scalable solution for the problem of reporting positive (on-time) and negative (late and skipped) payments.

The platform was completed last summer and provides a simple, flexible, and scalable solution for property managers. We also built a property manager portal that provides clients transparency to payments and flexibility to control their reporting.

Q: Can you give us insights into your products?

A: Our flagship product is RentCred, a rental payment data analytics and reporting platform for property managers and landlords. The platform provides a simple flexible, and scalable solution for reporting all rental payments, on-time and delinquent, to the major credit bureaus.

RentCred also comes with an ID Theft Protection service for all tenants. This service includes dark web monitoring, credit alerts, lost wallet protection, highly trained resolution and recovery experts, and 24/7 US based customer care.

Q: What are the benefits to tenants?

A: Our primary client is the property manager or landlord who sees higher retention by including this tenant amenity, a reduction in painful payment delinquency, and an added revenue stream.

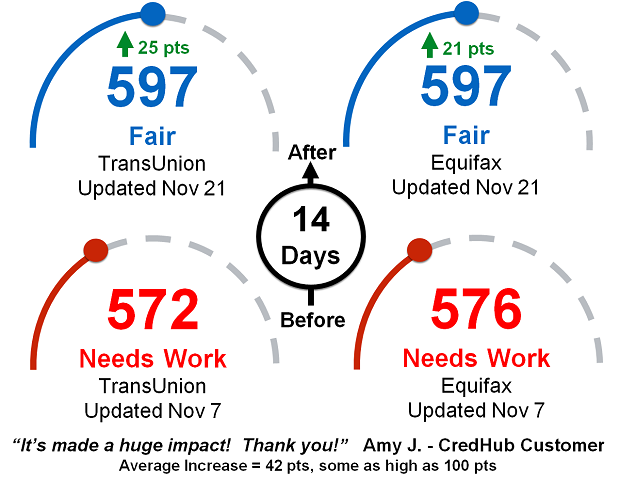

We also provide a key benefit to responsible on-time paying tenants, who see credit score increases from their largest monthly payment being reported to the major credit bureaus. Our tag line is “giving credit where credit is due”, and happy residents have contacted us to thank us for providing this benefit. Increased credit scores improve their financial health, and can help them save money on a car loan, or allow them to buy a house.

Here is the credit score impact one of our customers saw in just two weeks with the CredHub service.

Recommended: RapidX Delivers Products Ranging From High-Speed Car Chargers, To Safe And Convenient Charging Solutions For Home

Recommended: RapidX Delivers Products Ranging From High-Speed Car Chargers, To Safe And Convenient Charging Solutions For Home

Q: What are the company’s plans and goals for the future?

A: Our current plan is to grow our base or property management clients over the coming year. We are seeing great traction in the market since launching the platform last year, and great feedback from our clients on the impact of the service.

As we speak, our country is amidst a global pandemic and related economic downturn. CredHub is the most valuable in a down and uncertain economy. Residents need credit score benefit now more than ever, and property managers are facing a crisis in rental revenue reduction. On client recently told me: “Your timing is great as a significant part of the country is going to be figuring out which bills to pay.”

Our platform is flexible and scalable enough to provide reporting for other large monthly payments in the future such as mortgages or utilities. For now, however, the enormous domestic rental market has all of our attention.

Activate Social Media: