Francisco Partners’ acquisition of Jama Software for $1.2 billion underscores a strategic move in the tech investment landscape, heralding a new direction for Jama Software and potential shifts within the tech industry. This deal highlights the importance of requirements management and traceability solutions in driving innovation and efficiency in product development. Industry experts view this acquisition as a significant marker of future trends in technology investments and corporate strategies.

The Billion-Dollar Handshake

The tech industry recently witnessed a landmark deal with Francisco Partners announcing its acquisition of Jama Software for a whopping $1.2 billion. This significant move not only underscores the value of Jama Software in the realm of requirements management and traceability solutions but also highlights Francisco Partners’ ambition to further solidify its position in the technology sector. Here, we dissect the elements that make this transaction a pivotal moment for both entities and the technology landscape at large.

The Titans at Play: Francisco Partners & Jama Software Unveiled

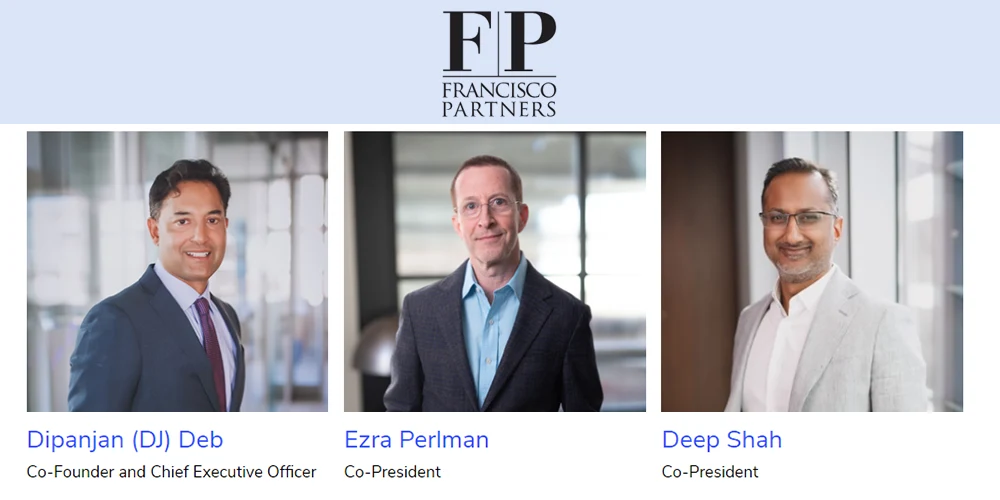

Francisco Partners, a global investment firm, has been a prominent player in the technology sector for nearly a quarter-century. With an investment portfolio that boasts over 400 technology companies and approximately $45 billion in raised capital, the firm’s strategic acquisitions reflect a deep understanding of the tech industry’s evolving dynamics.

Jama Software, on the other hand, has established itself as a leader in engineering and product development software solutions. Its flagship product, Jama Connect, enables companies to optimize product development processes, thereby reducing risks and costs associated with complex projects. This section delves into the histories and achievements of both companies, shedding light on their paths to this monumental deal.

Behind the Scenes: The Making of a Mega Deal

The acquisition did not happen overnight but was the culmination of strategic planning, negotiation, and foresight. This segment explores the timeline and key negotiations that paved the way for this historic acquisition, highlighting the motivations that drove Francisco Partners to invest in Jama Software. Insights into the negotiation process and the strategic alignment between the two companies provide a behind-the-scenes look at how such deals are orchestrated.

The Price Tag of Innovation: Analyzing the $1.2 Billion Valuation

The valuation of $1.2 billion for Jama Software signifies a landmark moment, not just for the company but for the industry at large. This section offers a financial analysis of the deal, placing it in context with other similar transactions within the tech sector. It explores:

- The rationale behind the valuation

- Comparative analysis with similar acquisitions

- The implications for Francisco Partners’ investment strategy

By examining these aspects, readers gain a comprehensive understanding of the financial underpinnings of this acquisition and its significance in the broader context of tech industry investments.

What This Means for Jama Software: A New Direction

With Francisco Partners at the helm, Jama Software is poised for a strategic pivot that may reshape its future trajectory. While the core mission of providing top-tier requirements management solutions remains unchanged, the acquisition is likely to introduce new avenues for innovation, expansion, and leadership. Jama Software’s CEO, Marc Osofsky, who will continue to lead the company, plays a crucial role in this new chapter, ensuring a seamless transition while pursuing aggressive growth strategies. This section explores potential shifts in Jama Software’s operational, strategic, and leadership domains, forecasting a bright yet challenging road ahead.

Recommended: 1836 Property Management Sets New Standards In Real Estate Services

The Ripple Effect: Implications for the Tech Industry

The acquisition of Jama Software by Francisco Partners does not exist in a vacuum; it sends ripples across the tech landscape, influencing competitors, partners, and the market at large. This segment examines the broader implications of the deal, including:

- Shifts in the competitive dynamics within the requirements management and traceability sectors.

- Potential strategic adjustments by rival firms aiming to maintain or improve their market standing.

- Forecasting future consolidation trends within the tech industry, spurred by this significant acquisition.

By assessing these factors, readers can appreciate the far-reaching impact of the Francisco Partners and Jama Software deal beyond the immediate parties involved.

Voices from the Field: Industry Experts Weigh In

To provide a multi-faceted view of the acquisition, this section collates insights from various industry analysts, tech executives, and thought leaders. Their perspectives shed light on the deal’s strategic importance, potential challenges, and the anticipated effects on the tech industry’s landscape. Through expert commentary, the article enriches its analysis, offering readers a diverse array of viewpoints on the implications of this significant acquisition.

Navigating the Future: Opportunities and Challenges Ahead

As Francisco Partners and Jama Software embark on this joint venture, they face a landscape brimming with opportunities and fraught with challenges. This final segment outlines the potential paths forward, highlighting:

- Opportunities for market expansion, product innovation, and customer engagement that the acquisition presents.

- Challenges in integrating operations, cultures, and strategies between Francisco Partners and Jama Software.

- The broader impact of this acquisition on innovation, competition, and market dynamics within the tech sector.

This comprehensive analysis aims to provide readers with an understanding of the strategic considerations underlying the acquisition and its possible repercussions for the involved entities and the industry as a whole.

The Final Verdict: What Lies Beyond the Billion-Dollar Acquisition

In closing, the acquisition of Jama Software by Francisco Partners marks a milestone in the technology investment landscape, signaling a period of accelerated growth and heightened competition. As both entities navigate this new phase, the tech industry watches closely, anticipating the transformative effects of this partnership. This article, through its detailed exploration and expert insights, offers a thorough examination of one of the year’s most significant tech acquisitions, framing it as a bellwether for future trends in technology investments and corporate strategy.

Please email us your feedback and news tips at hello(at)superbcrew.com

Activate Social Media: