Westbound Equity Partners recently closed its second fund at $100 million, focusing on empowering underrepresented founders in the tech industry. The firm extends beyond financial investments, providing mentorship, networking opportunities, and access to the Westbound Network to ensure the success of its portfolio companies. This initiative marks a significant step towards inclusivity in venture capital, setting a precedent for future investments in diverse entrepreneurship.

A New Chapter for Diversity and Inclusion in Venture Capital

Westbound Equity Partners, previously known as Concrete Rose, has recently announced the close of its second fund at a monumental $100 million. This move not only solidifies Westbound’s position in the venture capital ecosystem but also marks a significant step towards addressing the historical underrepresentation of certain demographics in the tech industry. The establishment of Fund II aims to bridge the gap, providing not just financial but also structural support to startups led by diverse founders.

Breaking the Mold: Westbound’s Bold Vision for Fund II

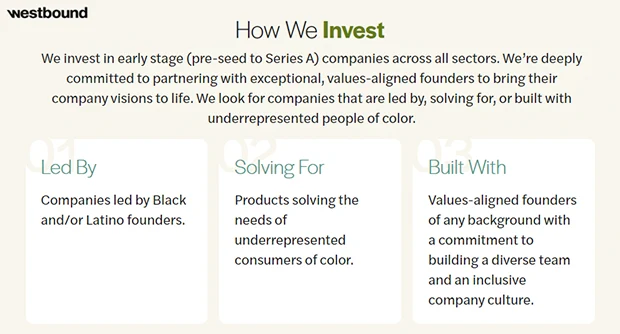

The inception of Fund II embodies a radical departure from conventional venture capital approaches, deliberately focusing on startups serving underrepresented markets or led by diverse teams. The initiative reflects a growing recognition within the industry of the untapped potential residing in these communities. Westbound’s strategic investment in these areas serves as a beacon for change, demonstrating a commitment to altering the status quo and fostering an environment where diverse perspectives thrive.

The Westbound Way: Pioneering Change in Silicon Valley

Tracing its roots back to its initial days as Concrete Rose, Westbound Equity Partners has undergone a significant transformation, symbolized by its rebranding and renewed mission. The firm’s evolution is indicative of its foundational belief in the power of diversity and inclusion as catalysts for innovation. Westbound’s unique approach to venture capital, prioritizing social and financial capital for its portfolio companies, sets a new benchmark for the industry, encouraging other firms to follow suit.

From Vision to Reality: The Impact of $100M on Underrepresented Entrepreneurs

The allocation of $100 million towards nurturing startups led by underrepresented founders signifies a monumental shift in the allocation of resources and opportunities. The fund’s impact is twofold: it not only provides essential capital to startups at critical stages of their development but also sends a powerful message to the broader industry about the value and necessity of diversity in tech. By spotlighting success stories from its portfolio, Westbound underscores the tangible benefits of its investment philosophy, demonstrating that supporting diverse founders is not only a moral imperative but also a smart business strategy.

Beyond the Check: How Westbound Nurtures Its Investments

The essence of Westbound’s approach extends well beyond the initial investment. The firm is deeply invested in the holistic success of its portfolio companies, offering a suite of support services that underscore its commitment to building enduring relationships. This includes:

- Mentorship and Guidance: Experienced industry leaders provide strategic advice and operational support to help startups navigate the challenges of growth.

- Networking Opportunities: Access to a wide network of potential partners, customers, and investors can be pivotal for early-stage companies.

- The Westbound Network: An ecosystem of advisors, LPs, and fellow entrepreneurs fosters a sense of community and collaboration, enabling founders to leverage collective knowledge and resources.

This multifaceted approach to venture capital investment illustrates Westbound’s understanding that financial capital alone is insufficient for ensuring the long-term success of its portfolio companies. By integrating these support mechanisms, Westbound positions itself as a partner in the truest sense, invested in the comprehensive success of the entrepreneurs it backs.

Recommended: Figure Secures $675M At $2.6B Valuation, Eyes New Horizons In Humanoid Robotics

Looking Ahead: The Future Landscape of Inclusive Investing

The strategic moves by Westbound Equity Partners with Fund II are not occurring in isolation but are part of a broader shift towards inclusivity in the venture capital sector. This trend reflects a growing awareness of the economic and social benefits of diverse entrepreneurship. The ripple effects of Westbound’s investment strategy are expected to encourage other venture capital firms to adopt similar approaches, thereby expanding the ecosystem of support for underrepresented founders. This evolving landscape signifies a potential future where access to capital and resources is more equitably distributed, enabling a wider array of innovations to flourish.

Empowering the Next Generation: Westbound’s Commitment to Closing the Gap

Westbound Equity Partners stands at the forefront of a movement aimed at transforming the venture capital industry from within. The firm’s commitment to fostering a more inclusive and equitable tech ecosystem goes beyond mere financial investments; it’s about building a foundation for generational prosperity among underrepresented communities. This dedication to closing the racial wealth gap and creating opportunities for those historically sidelined in tech entrepreneurship embodies Westbound’s visionary approach to venture capital.

Joining Forces: How You Can Be Part of the Movement

The journey towards a more diverse and inclusive venture capital industry requires collective effort and participation from all corners of the ecosystem. Westbound Equity Partners invites founders, investors, and industry stakeholders to contribute to this transformative mission. Engagement opportunities include:

- Founders seeking capital and support for ventures that cater to or are led by underrepresented individuals are encouraged to reach out.

- Investors interested in diversifying their portfolios and supporting impactful businesses can consider partnering with or investing in Westbound Equity Partners.

- Industry Stakeholders can amplify the mission by fostering conversations around diversity and inclusion, advocating for policy changes, and providing mentorship to emerging entrepreneurs.

This collective action is essential for sustaining momentum and ensuring the long-term success of initiatives aimed at making the tech industry more reflective of society’s diversity.

A Bold Step Forward: Charting the Path for a More Inclusive Industry

The establishment of Westbound Equity Partners’ $100M Fund II is more than a financial milestone; it’s a clarion call to the venture capital industry at large. By prioritizing investments in underrepresented founders and startups, Westbound not only champions diversity and inclusion but also highlights the untapped potential residing in these communities. The success of Fund II will likely serve as a blueprint for how venture capital can be leveraged as a tool for societal change, offering insights into the benefits of broadening the scope of investment to include a more diverse range of entrepreneurs.

As the tech industry continues to evolve, the role of venture capital in shaping its direction cannot be understated. Firms like Westbound Equity Partners play a pivotal role in this process, guiding the industry towards a future where innovation is driven by a multitude of perspectives, experiences, and ideas. In doing so, they not only contribute to the growth of the tech sector but also to the creation of a more inclusive and equitable society.

Please email us your feedback and news tips at hello(at)superbcrew.com

Activate Social Media: