Below is our recent interview with Stephan de Haas, Chief Executive Officer at Haasonline Software:

Q: Could you provide our readers with a brief introduction to Haasonline Software?

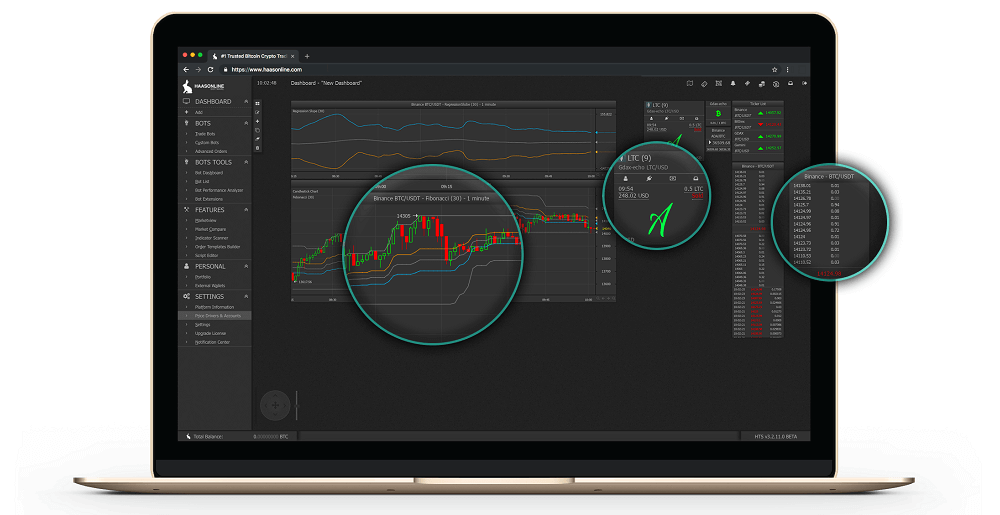

A: I officially launched HaasOnline Software in 2014 and released the first documented Bitcoin trading bot. Since then our company has grown tremendously from our humble beginnings to have served over 35,000 crypto traders. We have continued developing our flagship product, HaasOnline Trading Server (HTS), which has transformed into a full automated cryptocurrency trading platform. HTS is designed to allow crypto traders the ability to automate a wide array of trading strategies that range from scalping and arbitraging to custom proprietary strategies that are executed across multiple exchanges.

Q: How did you come up with the idea for HaasBot?

A: It all started about six years ago when I first started to come across articles that were talking about how revolutionary Bitcoin was. My background is in software engineering so naturally I started digging into what Bitcoin was all about and immediately saw an opportunity with trading on cryptocurrency exchanges (very few choices back then). I created a very simple Bitcoin trading bot and posted it for sale on a popular Bitcoin forum and began to work on HaasBot full-time.

Q: Can you give us insights into your features?

A: The primary function of HTS is to automate trading strategies and to do this we provide two options for our users. The first is using one of the dozen pre-built trading bots that will execute strategies like inter-exchange arbitraging, which is when you buy low on one exchange and selling for profit on another. Another is our crypto index trading bot which allows traders to run their own crypto index funds. One of our most popular trade bots is the Flash Crash trade bot, which is similar to a spread order strategy in that it capitalizes on micro flashes (noise, wicks, etc.) that occur during a trading period. The second option gives experienced traders granular control by allowing them to replicate and automate their manual trading strategy by using technical indicators, safeties, and insurances. Advanced users also have the ability to script their own technical indicators using our developer API.

Other notable features that make up the HTS include the ability to monitor assets, research market trends, and test potential strategies without leaving our platform.

• Crypto Trading Bots & Manual Trading

• Charting & Technical Analysis

• Highly Customizable Dashboards

• Backtesting & Simulation

• Exchange Integrations

• Third Party Alerts

• Asset & Portfolio Management

• Developer API

Recommended: Konversai – The World’s First One-Stop Shop For Any And All Personal Human Knowledge

Recommended: Konversai – The World’s First One-Stop Shop For Any And All Personal Human Knowledge

Q: What makes your trading bot stand out from its competition?

A: HaasOnline Software has been around since the early days and we’ve seen a lot of unscrupulous companies come and go, while we continue to stand the test of time. We’ve been dedicated to honest and transparent business practices to ensure that false or exaggerated promises are not made regarding potential trading performance.

With the recent crypto boom and down turn we’ve seen an increase in low quality trading bots that have saturated the market. We strive to continue to be the most feature rich platform on the market and we believe we have continued to do so since our initial release back in 2014.

Q: Which exchanges are supported?

A: Our product currently supports over 22 different spot, margin, and leverage trading exchanges. We continually evaluate and add new exchanges as they meet or exceed our integration requirements. Our growing list of supported integrations includes major spot trading exchanges like Binance, Kraken, Bittrex, KuCoin, Coinbase Pro, and Gemini. For our advanced users we support exchanges that offer margin or leverage trading like Deribit, BitMEX, and Kraken Futures. For exchanges that we don’t officially support, advanced users are able to use our scripted driver to craft custom integration with any exchange that offers a public API.

Q: What are your plans for the future?

A: Our company continues to be at the forefront of innovation when it comes to automation in the cryptocurrency industry and you will see traces of our innovations and concepts throughout the current competitor landscape. We’ve been focusing on increasing the stability of our current application release (3.x), improving our documentation for the platform and developer api, forging new relationships with exchanges, exploring new opportunities, and continuing research & development of new products that will benefit the entire crypto ecosystem.

You can stay up to date with our company news and product releases by subscribing to our newsletter, official blog, Twitter, Discord, or Facebook.

Activate Social Media: