* – This article has been archived and is no longer updated by our editorial team –

Morgan Hill Partners, with six offices across the US, provides technology and tech-enabled companies around the world with an exclusive network of senior executives and a proven Path to Value playbook to innovate, build and accelerate growth, from startup to scale-up. With more than 35 years of advisory, operations and investment experience, Morgan Hill Partners fundamentally changes the way consulting services are delivered, investing a portion of the firm’s fees, aligning firm performance with client outcomes.

To find out more about how they are reinventing the consulting experience we sat down with Jim Barnish, Co-Founder and General Partner at Morgan Hill Partners:

Q: How would you describe Morgan Hill Partners in your own words?

A: Morgan Hill is an innovative business partner for technology and tech-enabled companies, from startup to scale-up. Our experience executives, capital efficient process, and proven methodologies are deployed only as needed, aligning company and investor interests.

We provide innovative solutions to solve challenges that have continually plagued tech and tech-enabled businesses. Our Path to Value playbook and domain expertise help companies achieve their full potential, fundamentally changing the way consulting services are delivered. We deliver the right expertise and playbook, at the right time, for the right outcomes.

Q: Who are the primary clients of Morgan Hill Partners and what are some of the key challenges you are helping them solve?

A: Today, investors are more sophisticated and require companies develop a data-driven strategy, scalable product, and excellence across the board. Unfortunately, most companies lack the process, playbook, executive expertise, and capital to excel in every discipline. This drives inefficiencies and gaps that affect execution and performance, causing investors to pass on 99% of the deals they see.

We understand that these technology and tech-enabled companies face a challenging and ultra-competitive environment with limited (and expensive) access to top executives, because we’ve been there too. Now, Morgan Hill delivers. We work with companies, from pre-revenue startups to venture-backed firms looking to innovate, scale, and optimize performance.

Based on defined methodologies, the Morgan Hill Partners Path to Value playbook is applied to companies from startup to scale-up to ensure optimal client outcomes. The Path to Value playbook is the only Management Consultancy as a Service (MCaaS) product available to clients using a structure that is customized to their companies.

You can contact us for more info on our Path to Value playbook or read our case studies.

Q: Tell us more about your services.

A: Morgan Hill Partners offers Path to Value consulting services, including product & go-to-market strategy, investment facilitation, exec & board advisory, process improvement, offering productization, and direct & channel sales.

We assist clients in selecting the right expertise and solutions that support their unique business needs, at the right time.

We manage the complete client lifecycle, from strategy and planning to execution and support, extending technology investments through value-added products and services.

Morgan Hill offers the right expertise and playbook (solutions) for software, hardware, and technology-enabled companies in nearly every industry.

Q: You keep saying “playbook”. What do you mean by Path to Value playbook?

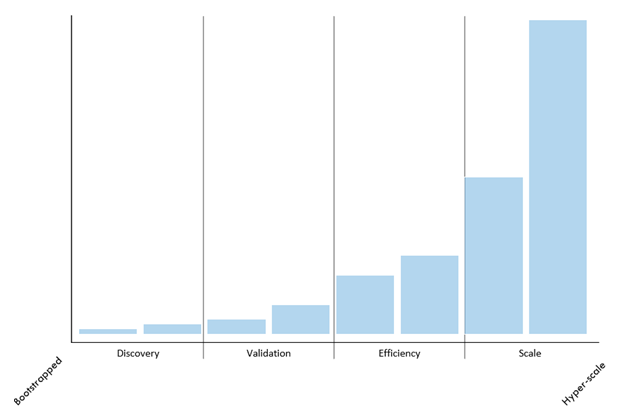

A: It’s simple, really. A company’s growth can be broken into stages.

Recommended: Intetics Launches The Innovative Software Product Assessment Service

Recommended: Intetics Launches The Innovative Software Product Assessment Service

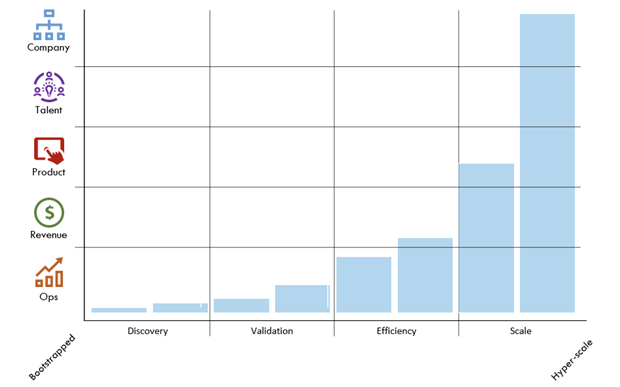

A company’s maturity can be mapped along several disciplines.

Recommended: The World’s First, All-In-One Camera Equipped Smart-Lock Gate Raises $5M Series B Funding

Recommended: The World’s First, All-In-One Camera Equipped Smart-Lock Gate Raises $5M Series B Funding

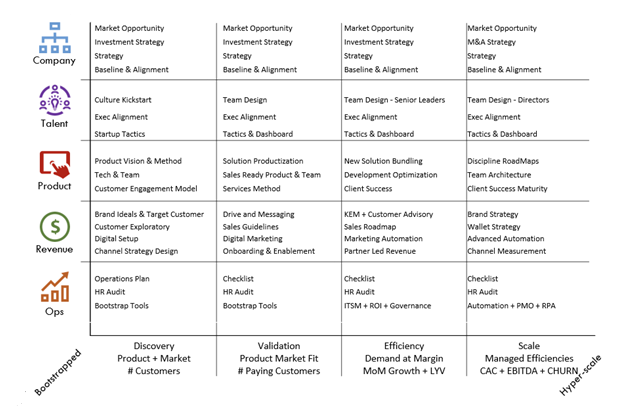

Our Path to Value playbook covers every discipline, at every stage.

Recommended: Mobile Semiconductor Announces Two Significant New Products To Support The Exploding IoT Market

Recommended: Mobile Semiconductor Announces Two Significant New Products To Support The Exploding IoT Market

Q: What’s so different about your approach?

A: We’re very selective & only work with companies we believe in. We’re relentless in our focus on our clients’ success, aligning our outcomes. So much so, that we typically invest a portion of our fees back in your company. This approach means we consider ourselves an extension of your team and are personally invested in your organization’s success.

We are rich in experience where executive teams have gaps. Our proven methodologies deliver repeatable results. Our curated network ensures clients receive elite expertise.

Our Path to Value playbook allows us to do more than simply present a PowerPoint deck and exit. We help you develop and execute a data-driven plan.

Q: You’ve recently completed your acquisition of Opmetrics, can you tell us something more?

A: Fractional CXO services are critical to the alignment and execution of a company’s vision. We’ve seen companies of all sizes struggle to translate their plan into commercial successes. By combining the capabilities of Morgan Hill’s strategic planning, product excellence, and revenue creation solutions with Opmetrics’ fractional CXO services, we can now help companies better innovate, build, and execute on a data-driven plan.

Recommended: Q&A With Toronto’s Bo Zou: How Brands Can Stand Out In A Competitive Environment

Recommended: Q&A With Toronto’s Bo Zou: How Brands Can Stand Out In A Competitive Environment

Q: What are your plans for the future?

A: In the near future, we have very strong growth plans. We plan to expand our geographic reach, operational capabilities, and consulting services via both organic and M&A activity.

In general, we’re always interested in talking with institutional investors, bankers, and others to:

1. Discuss the companies (deals) that you loved but didn’t invest in.

2. Share regular updates of what we’re both seeing in the market.

3. Review the gems we’re building. We’ll pass investment leads as soon as they’re ready.