Railsbank is the leading global Banking-as-a-Service (BaaS) platform. It enables banks, businesses and brands to define the future of consumer and SME finance. Below is our recent interview with Nigel Verdon, CEO and Co-founder of Railsbank:

Q: Could you provide our readers with a brief introduction to Railsbank?

A: Marketers, product managers, developers, CEOs and founders are able to take their financial product vision and rapidly prototype, launch and scale using Railsbank’s open finance platform which consists of operations, regulatory licensing and a rich set of APIs.

It was founded by serial entrepreneurs and fintech veterans Nigel Verdon and Clive Mitchell in 2016.

Q: Can you give us more insights into your platform?

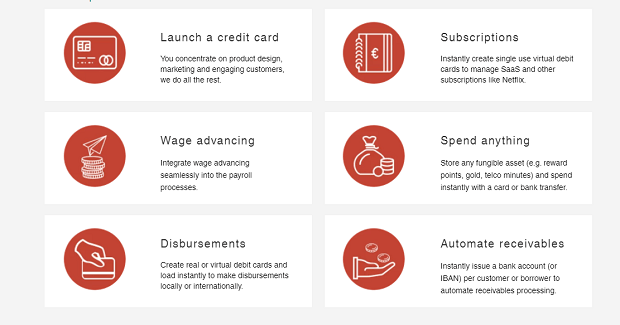

A: The Railsbank core finance platform currently consists of Banking-as-a-Service, Cards-as-a-Service, Compliance-as-a-Service, Insights-as-a-Service and Credit-as-a-Service.

As part of this product line-up, Railsbank is also launching in the US the first of its kind Credit Card as a Service, developed for fintechs, enterprise companies and consumer brands. In less than 12 weeks, Railsbank can deliver a credit card in the customer’s brand along with a user journey seamlessly embedded into the customer’s existing user experience.

Q: What’s the best thing about Railsbank that people might not know about?

A: Railsbank is a facilitator and enabler, and is not consumer facing. It works in the background to enable other fintechs and brands to develop financial products that will excite the financial consumer over the coming decades.

It has also created one of the most experienced and talented teams to work in the financial services industry, over 200 people who share common goals and values, and who are determined to work together to shape the future of the industry.

Q: You’ve recently raised $37,000,000 in funding; can you tell us something more?

A: The new investment will enable Railsbank to continue to expand its global footprint, further strengthen its core product proposition, launch Credit Cards as a Service and help increase its lead in embedded finance as the world’s pre-eminent BaaS platform, enabling start-ups and established brands to prototype, launch and scale financial products within their own customer experience.

Recommended: Meet Kegg – A 2-In-1 Fertility Tracker Built To Detect A Woman’s Fertile Window

Recommended: Meet Kegg – A 2-In-1 Fertility Tracker Built To Detect A Woman’s Fertile Window

Q: What are your plans and goals for the future?

A: Support the launch of the Credit-Cards-as-a-Service proposition in the US to encourage increased competition and innovation within the country’s USD4 trillion credit card market.

Invest in extending the product suite to launch Credit as a Service in the US and across the UK and Europe in 2021.

Continue to expand product in APAC, including into the Philippines, Indonesia, Malaysia, Australia and Japan, and further strengthen our business in the UK and Europe.

Invest in strengthening the team to be the best and highest performing pool of talent in the industry and able to operate on a global scale.

Continue to consider strategic investments, such as our acquisitions of Wirecard Card Solutions.

And broadly, Railsbank is on a mission to help to deliver financial inclusivity, via its customers products, to as many people as possible throughout the world. We believe that financial services are a human right and not a privilege.

Last Updated on December 25, 2020

Activate Social Media:

Recommended:

Recommended: