Below is our recent interview with Issac Hwang, CEO of Cali Finance Group:

Q: Issac, can you briefly walk us through your story – how you started and how you got to where you are today?

A: Numerous factors led to the creation of Cali Finance Group but the deciding factor that led me to create Cali Finance was the lack of financial resources available to the general populace.

The general populace often has no clue on how to make good financial decisions. Most people learn through trial and error that can lead to unwanted territories of consequences. Everyone knows that finance is a vital part of our livelihood but is rarely talked about in public spheres. Finance is a seldom talked about topic despite being a subject that dictate our everyday lives.

Along with personal finance, I saw how corporations and wealthy individuals were able to stay ahead of the economy by utilizing consultations. For example, the “Big Three” (McKinsey & Company, Boston Consulting Group, and Bain & Company) and the “Big Four” (PriceWaterhouseCoopers (PwC), Ernst & Young (E&Y), Deloitte, and KPMG) are the consulting firms commonly used by corporations and the elite. For multi-billion dollar companies and high net worth individuals, they were able to afford the high fees that comes with using such prestigious consulting firms. Furthermore, they were able to stay ahead of the curve and sustain themselves against the majority of obstacles that came their way.

I saw that the people who needed guidance the most were not mega corporations or high net worth individuals. Instead, Cali Finance believed consultations were most vital to small businesses and the general populace – the backbone of our economy.

With those reasons in mind, I created Cali Finance to provide both the general populace and small businesses with affordable financial services.

Recommended: An Interview With Veronica Wheat, CEO And The Founder At Chef V

Recommended: An Interview With Veronica Wheat, CEO And The Founder At Chef V

Q: Can you give us insights into your services?

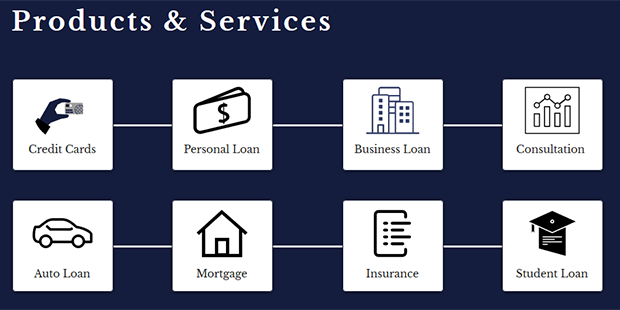

A: In short, Cali Finance Group is a professional services network (consulting firm) and loan brokerage company that caters to small businesses and individuals.

Cali Finance helps our clients obtain favorable loan terms. The several types of loans offered are personal/installment, auto, business, mortgage, student, and more.

For the general populace, they might have no clue why consultations are important. To answer, I would like to ask a question.

Q: Simply, wouldn’t anybody and everybody benefit from having an expert at their corner?

A: An expert that helps with financial-related inquiries, business questions, and other areas of someone’s life can add tremendous value. With their experience, an expert can guide and warn any individual about common troubles faced in entrepreneurship, personal finance, and other areas of his or her life. Essentially, consultations offer you not only mentoring but also resolutions to problems that you may have never thought of.

Q: What sets you apart from your competition? How are you unique?

A: Unlike our competitors, Cali Finance offers affordable consultations with our financial services.

We see every aspect of our client’s finances. Each part of a person’s finance interplay with one another.

Example:

A real estate agent will only help their clients to purchase a home. After the home purchase, the real estate agent’s job stops there. However, the aftermath of purchasing a home is where the true responsibilities lie. The purchase of a home comes with tax, legal, insurance, and other liabilities. The responsibilities do not stop there.

On the basis of this example,

Cali Finance helps not only helps with the home purchase but also with all the responsibilities that come with owning a home.

In essence, Cali Finance acts as your financial advisor but with more areas of expertise.

Q: What advice do you have for early entrepreneurs who hope to scale up as quickly and successfully as you have?

A: You need to be your company’s greatest asset. As an entrepreneur, you need to not only wear many hats but also persist in learning new “skills” and know-how to help your company. As an entrepreneur, you should know that no one can replace the essence of your company. In order for your company to strive, you need to strive and escalate first. Your company is only as good as your decision and mindset.

I recommend entrepreneurs to avoid the pitfall of early success. Success takes time. I know the advice from a 25-year-old might appear hypocritical. However, how many hours do you think I had to put in to become the entrepreneur I am today? As in everything in life, everyone needs to walk the rite of passage.

Success will follow once you are focused on your purpose and value rather than the ideals of success.

After all, shouldn’t a person be in the right mindset to handle success?

Recommended: 8topuz Delivers Unique AI Based Risk-Managed Trading Software

Recommended: 8topuz Delivers Unique AI Based Risk-Managed Trading Software

Q: When you’re not working, what do you enjoy doing in your spare time?

A: I enjoy quality time with my friends and family.

Q: What are your plans for the future?

A: My plan is to continue my self-improvement and improving my entrepreneurship.

Activate Social Media: