IncomeClub is an online investment advisor with a focus on bond investing. The company is continuously working on new innovative features such as: mobile applications, smart saving add-on, simplified account opening etc. Below is our interview with Sergey Sanko, President & CEO at IncomeClub:

Q: How would you describe IncomeClub in your own words?

A: IncomeClub is an SEC-registered online financial advisor with a focus on individual bond investing.

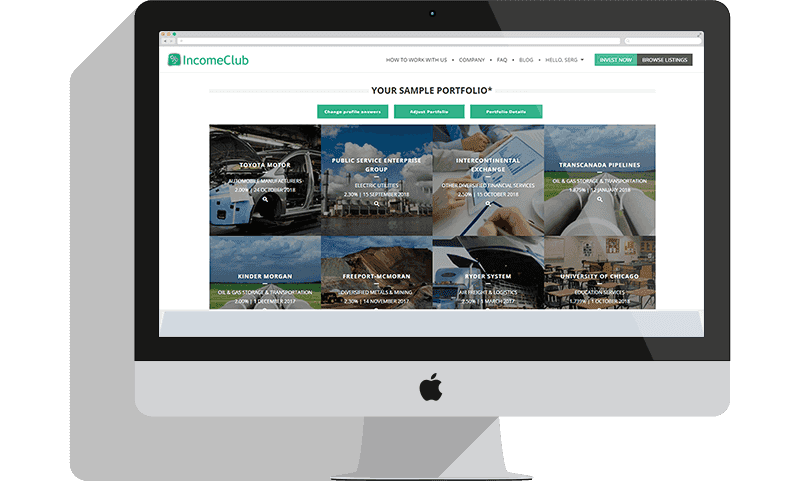

Our new FinTech company provides cost-effective investment solution with online convenience. IncomeClub’s platform serves investors who seek conservative investment strategies, with low fees and transaction costs. User-defined time horizons in combination with predictable returns are our main differentiation points.

Recommended: Mobile Dealer Data Enables Dealerships To Save And Make Money

Recommended: Mobile Dealer Data Enables Dealerships To Save And Make Money

Q: What makes IncomeClub a good choice?

A: Allocating assets into investment portfolio is a complex and time-consuming task. Many parameters come into play: willingness and ability to take a risk, your financial goals and time when you need to withdraw your money, diversification among industries and ratings just to name a few. This complexity requires a lot of effort, and these efforts are well rewarded.

Our automated algorithms resolve this complexity and compose tailored bond-based portfolio matching client’s criteria. We are doing this for a fraction of the fee that traditional advisors charge.

Moreover, you can try our platform with “accounts under 20K managed for free” promotion to make sure that you are comfortable with IncomeClub’s services.

Q: Could you explain IncomeClub’s Dedicated Asset Allocation approach?

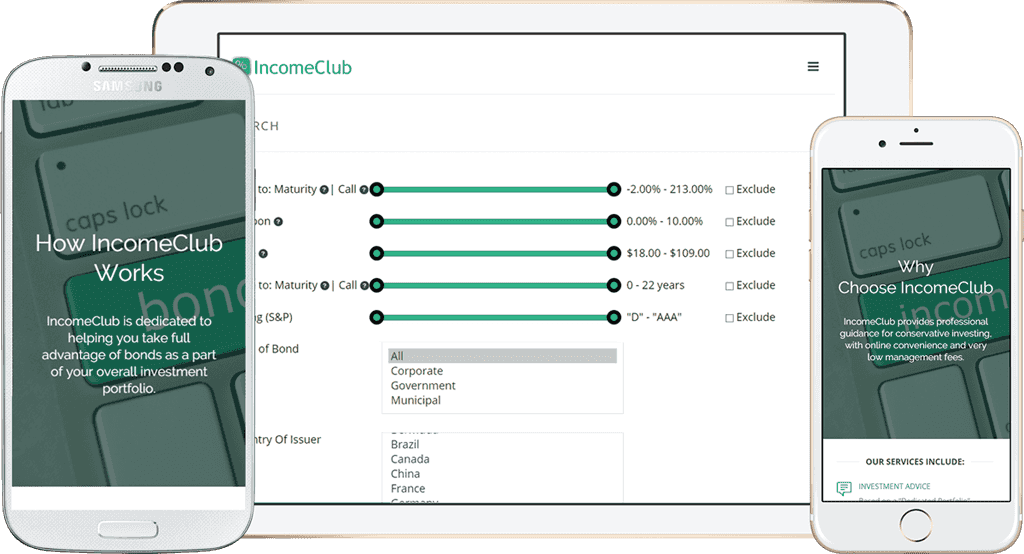

A: Our automated portfolio creation uses the Dedicated Asset Allocation approach. This is one of the simplest yet effective ways of protecting your assets in the rising interest rates situation or when there is a widening of credit spreads. In the “bear market” dropping bond prices are no longer the problem, if holdings are kept till maturity.

IncomeClub’s platform is built on dedicated portfolio theory. The theory defines investment portfolio attributes and features for generating a predictable string of future cash inflows. The investor’s goal is achieved by buying government and corporate bonds. Keeping these securities until maturity targets receiving a face value back following withdrawal or reinvesting.

Recommended: Why Hire Internal Recruiters Or Agencies? – My Recruiting Team Offers End-To-End Recruitment Services

Recommended: Why Hire Internal Recruiters Or Agencies? – My Recruiting Team Offers End-To-End Recruitment Services

Q: What is the company’s long-term potential?

A: Our long-term goal is to eliminate the complexity in individual bonds investing and make it the best saving and investing tool for a large number of people in the USA and internationally. Individual bonds have advantages of predictable returns compared to ETF, and we enable this advantage via our platform.

We hope to work 75 million of Digitally savvy investors in the USA. This group is expanding by millennials, who are grown up with software and demand for online services.

Q: What are your plans for next 6 months?

A: We are continuously working on the future platform features:

– mobile applications (getting our first basic version in June)

– simplified account opening with our custodian Interactive Brokers

– e-commerce style service for our hands-on investors

– smart saving add-on;

Recommended: Showpad Raises $50 Million To Accelerate Growth Of Its Sales And Marketing Teams Globally

Q: Do you have any plans to establish IncomeClub’s B2B services?

A: The complexity of the bond market is not only a headache for individual investors, but also the same problem for traditional financial advisors. They are spending hours and days allocating clients’ assets into individual bonds. As a logical choice, they settle for working with ETFs instead . We believe that IncomeClub PRO platform will make investment advisors” life much easier when dealing with individual bonds portfolio. We plan to help them in providing the best level of fiduciary duty to their clients.

Activate Social Media: